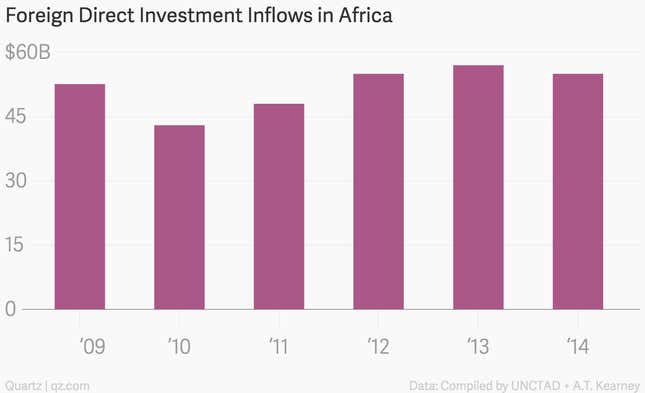

Conventional wisdom has it that Africa is the next frontier of the global economy. This narrative of “Africa Rising” is reflected in part by the growing rate of foreign direct investment (FDI) into the continent.

According to the United Nations Conference on Trade and Development’s World Investment Report, 2013 alone saw FDI rise 4% to $57 billion. This growth reflects a three-year trend driven by interest from investors in oil and gas, infrastructure, transport services, and industrial production.

This shift has led to some analysts dubbing the continent the second most attractive investment destination, tied with Asia.

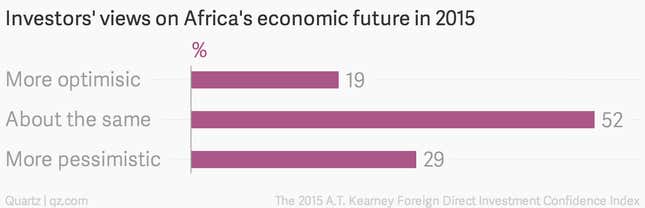

However, a new report by the consulting firm A.T. Kearney suggests that some investors are still nervous about doing business on the continent. Asked how optimistic they are when it comes to the future health of Africa’s economies, this was their response:

This nagging uncertainty about the region contributed to a 3% drop in FDI inflows last year, according to the report. The Ebola crisis in West Africa was cited by the business executives surveyed as one such factor in the decrease in confidence.

“3% is a very small decline and is not statistically significant to read one way or the other,” Paul Laudicina, chairman of A.T. Kearney’s Global Business Policy Council, told Quartz via email. Hence the positive outlook of 71% of those surveyed, who feel that Africa still remains an attractive investment destination.

Nevertheless, the fact that close to one-third retain a pessimistic view goes to show just how fragile that perception is. The 29% who are more pessimistic about Africa than the year before is the highest of any region surveyed.

“It is at a premium for countries to demonstrate to investors that they are a smart bet in an environment of many complex, overlapping risks,” says Mr. Laudicina. “Many African countries with their large, emerging consumer markets certainly have that potential. But they will need to compete globally for investor confidence.”

But some analysts suggest investors who are established on the continent tend to be more bullish about its economic future. A 2014 survey by Ernst & Young showed that 73% of established investors believed that Africa had improved its attractiveness compared to the year before, while only 39% of non-established investors felt the same.

“This view is often based on perceptions that are 20 to 30 years out of date… Africa is an inherently challenging place to do business, but many companies pursuing a long-term African strategy have generated excellent returns from their investments,” the report said.