Five years after exiting China, Google is back knocking on its door. Several reports have hit domestic media claiming the search giant is negotiating deals with Chinese phone makers to get the Google Play app store pre-installed onto devices. One local outlet added that the company was paying device makers as much as $1 for each phone (link in Chinese) that gets stamped with its app store.

Google declined to comment on the rumors, but the latest reports follow a steady stream of rumblings regarding Google Play in China. The Information reported that the company initiated talks with Beijing officials about a possible return as far back as 2013. Late last year, Google then made inroads with Chinese banks to help local developers profit from their apps—though only from sales outside of China, since Google Play is inaccessible domestically.

Senior vice president Sundar Pichai also hinted at these plans last month, telling Yahoo Finance, “We would love to serve Chinese users better, so we’re constantly looking for more ways to do that. You know we are thinking about things like how do we bring Google Play in China, and so we are constantly looking for opportunities.”

Google isn’t a complete non-entity in China. It has offices in Beijing and Shanghai with hundreds of employees, most of whom are engineers or help Chinese companies sell ads that reach foreign Google users.

But Google is a ghost on most other fronts in China, as a result of its unceremonious pullout in 2010 after a censorship dispute. Despite Android phones occupying about 75% of China’s mobile market, Google makes little money there. Its apps and services also don’t come pre-installed on devices, and Chinese looking to test drive Google Search or Gmail face spotty connectivity or outright blocks.

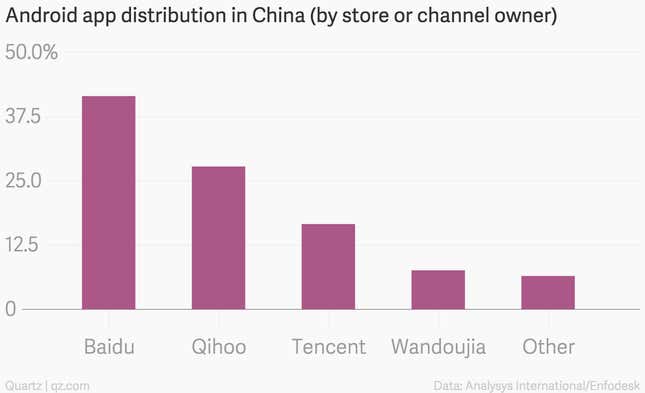

As a result, other players have filled Google’s shoes in its absence, most notably Baidu. Indeed, even before Google bowed out of China, the Chinese search giant was already ahead of it.

If Google is committed to app distribution in China, it will face an extremely fragmented market (link in Chinese), wherein search engines, messaging apps, and telcos each compete to win over developers and users.

Even if a censored, localized version of Google Play hits Chinese smartphones with full connectivity, its impact on Google’s bottom line might be minimal. According to its earnings report last quarter, Google derived 90% of its revenues from products like its search engine and YouTube (both monetize with ads). Google Play and other Android-centric revenues made up the remaining 10%. Access to China’s massive consumer mobile market can help grow that segment. But consumers and developers there are already loyal to incumbents.