The top app publisher in the world is Facebook. Second is Google. Third is the Chinese utility app maker Cheetah Mobile.

Clean Master, an app that purports to remove unwanted junk files from your phone and is made by Cheetah Mobile, is the sixth-most downloaded app in the world (pdf, p.15), after only Facebook Messenger, Facebook, WhatsApp, Instagram, and Skype.

Just as Facebook and Google are yearning for access to the lucrative China market, Chinese internet companies are looking to reach the billions of smartphone owners outside China. But the window has closed for startups to build the next Facebook, Google, or Amazon. So Chinese companies are crossing the border with utility apps—browsers, battery boosters, and junk-file cleaners.

Few people will fall in love with these apps the way they do with Facebook or Google. And it is very likely these apps will never make it to the West, where iPhones rule and even Android devices tend to be high-spec. But for the Indonesian guy who just bought a phone for $50, they can be very attractive.

Balancing expensive data plans, lousy batteries, and crappy internet speeds, owners of budget handsets in emerging markets are skilled at getting the most out of their machines, installing apps like “Clean Master” or “Apus Booster+” to make batteries last longer and data load faster.

Cheetah Mobile is the most successful of the lot. Other Chinese companies have reached similar scale with utility apps. Beijing’s APUS claims to have 120 million users on APUS Launcher, an app that re-skins your home screen, giving you a new look and rearranging icons while promising to boost your phone’s speed and conserve power. UC Web, which Alibaba acquired in 2014 for more than $1.9 billion claims to have 100 million daily active users on its mobile browser UC Browser.

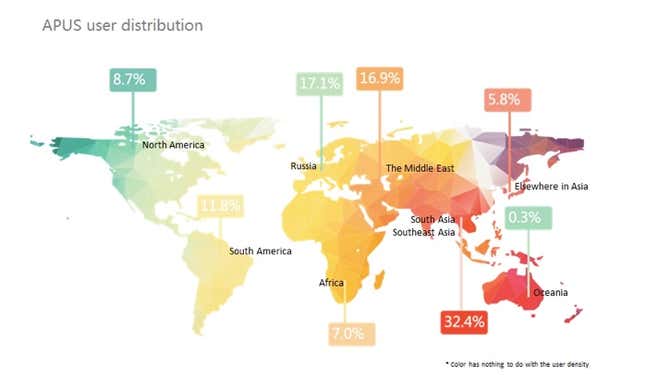

Baidu and Qihoo 360 Technology, two firms with roots in China’s pre-mobile internet, also have found traction abroad with utility apps. Baidu’s battery booster and Qihoo’s security software both count downloads in the tens or hundreds millions. And these firms have found their biggest fans in developing countries. APUS, for example, despite residing in Beijing, has a minimal presence in China. Most of its users are concentrated in India, Southeast Asia, and Latin America, where cheap Android phones reign supreme.

A smartphone real estate bubble

These apps are free, which explains some of their success. Their business models are based on advertising: speed boosters and browsers are the sort of apps that users touch on a daily basis, and they also collect data on the apps installed on one’s phone, the websites that one visits, and even who users contact. The Chinese utility companies hope this will make their users attractive to advertisers.

Cheetah Mobile leads the pack on this front. The company has invested in or acquired three ad networks—Hong Kong-based Zoom Interactive, Paris-based MobPartner, and Boston-based Nanigans. The catch, of course, is that user acquisition costs money. Few of these firms will openly admit to buying users, but it’s no secret that these companies are spending millions on marketing, in the form of Facebook ads, banner ads, or pre-install deals with device manufacturers.

While no data is available that reveals how much these companies spend on ads themselves, Chinese ad network Papaya Mobile estimates that 60% of global mobile ad spending is going into utility apps. But it’s not clear if that spending will offset the costs required to market the utility apps to begin with. If developers find that ad space on a battery booster indeed drives installations, companies like Cheetah Mobile will hit the jackpot. But if users press the boost button and promptly exit the app, then utility app real estate isn’t that valuable at all.