It was a good year to be in the central banking business.

The US Federal Reserve forked over some $89 billion in profits to the US Treasury in 2012. By law, the central bank must give the exchequer any profits it makes, which it does chiefly by buying bonds and earning interest on them.

And thanks to the bond-buying sprees it has undertaken to boost the economy, the Fed’s profits have surged handsomely. Apple and Exxon combined only made a bit more than $82 billion in profits during their most recent full reporting years.

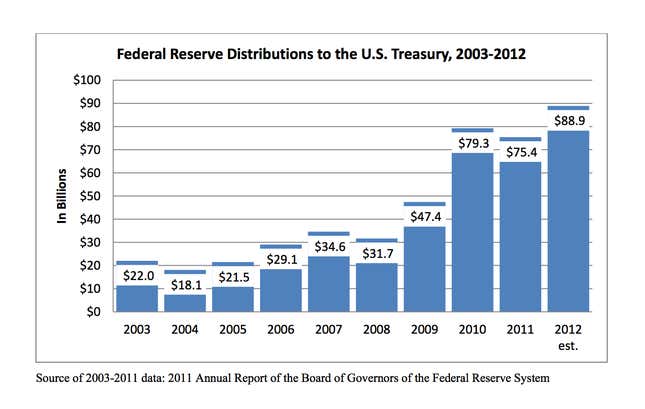

In fact, it was the best year ever for the Federal Reserve, profit-wise. Check it out:

You can see profits surged in the aftermath of the financial crisis. That’s when the Fed started various programs to create new money and use it each month to buy billions of dollars of bonds issued by government-backed entities. Those bonds earn interest income, totaling about $81 billion in 2012.

Other sources of Federal Reserve profits include sales of some of the once-rotten financial assets—such as these—that it bought from banks during the financial crisis (netting $6.1 billion last year) and sales of some Treasury bonds ($13.3 billion), including those sold as part of its “Operation Twist” program.

But this can make your head spin. It seems weird enough that the central bank makes a profit on programs it’s using to try to stave off a recession. Why does the Fed then turn around and give those profits to the US Treasury? The short version is, that’s what the law says it has to do. But the annual report on the Fed’s profits also offer a chance to think about some of the truly strange arrangements the Fed, a sort of quasi-governmental entity, and Treasury Department, a full arm of the government, have had to work out since the birth of the Federal Reserve system back in 1913.

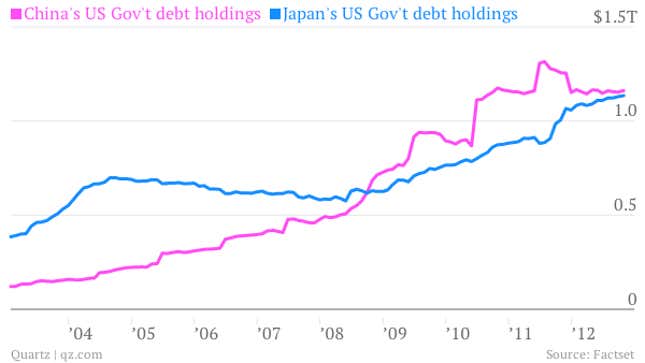

For instance, under Section 14 of the Federal Reserve Act, the Fed cannot buy government bonds directly from the Treasury. In other words, it can’t directly fund the operations of the US government. It can, however, promise to buy US government bonds at a premium from the guys in the private sector that buy them directly from the Treasury. And the Fed has been doing a ton of that. In fact, the Fed is now the largest single holder of US government debt—bigger than China and Japan. Seriously, look. China and Japan both own more than a trillion…

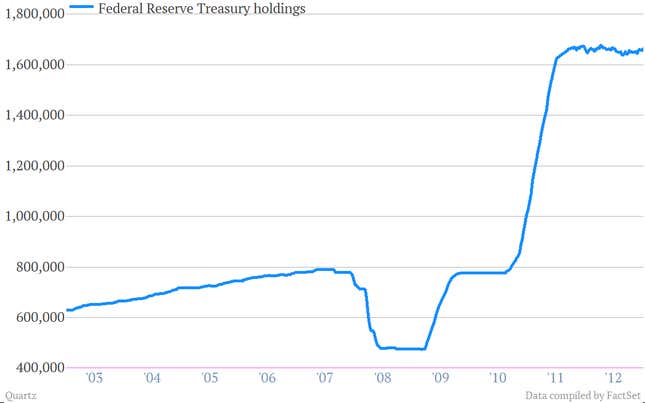

…but the Fed owns more than $1.6 trillion of US debt:

In short, the Fed buys US government bonds, the US government pays the Fed tens of billions of dollars in interest payments, and the Fed then turns around and pays that money back to the Treasury. Weird, but true.