Germany thanks you for keeping its gold, but it would very much like to have it back now.

According to Handelsblatt (in German), the German Bundesbank will suspend its gold reserves in Paris and move them to Frankfurt. Gold reserves in New York will also be reduced. And the bank will present a new plan this week describing the future handling of Germany’s gold assets and where they will be stored.

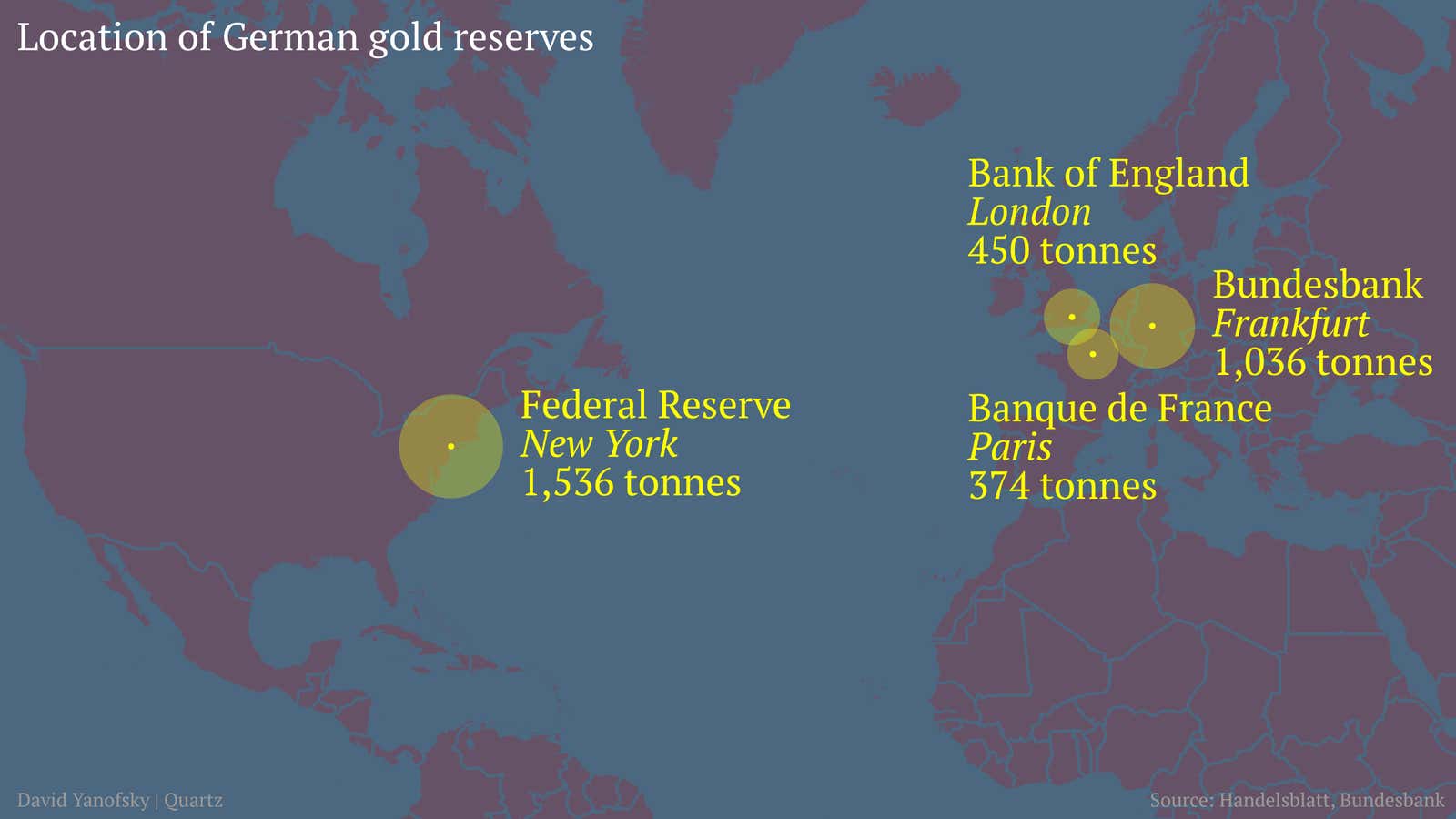

German plans to repatriate gold have been in the works for a while. Bundesbank board member Carl-Ludwig Thiele said last autumn that the bank will bring back and inspect 150 tonnes (165 US tons) of gold from New York to Germany over the next three years. Last autumn the Bundesrechnungshof, the German court of audit, criticized the Bundesbank because, with the exception of a perfunctory examination in 2011, it has never itself checked the quality and weight of the 1,536 tonnes of gold stored in New York (as it has for other holdings, by melting down some of the gold bars to test their purity).

While it is freighted with symbolic meaning, gold plays a minor role in the world financial system at the moment. So why do central banks even have it? Well, until 1971 foreign governments or central banks could show up at the “gold window” of the Federal Reserve and convert dollars into gold. Much of the German gold at the Fed was amassed during that era. Today central banks keep it as a kind of insurance policy against currency collapse. If a country’s money all of the sudden becomes worthless, the central bank could sell some of its gold reserves to buy the foreign currency the country needs to pay the nation’s bills.

Those bills would most likely be owed to a nation’s largest trading partners, which is why gold reserves are often kept abroad. If the euro ever collapsed and Germany wanted to buy a lot of US dollars, it would be easier and faster to use the gold stored in New York to buy it, rather than get a freighter to ship loads of the metal out of Hamburg to lower Manhattan.

But looking at the map above, you can also see there is an important symbolic value to where a nation keeps its gold. You tend not to entrust billions of dollars worth of precious metals to the care of unfriendly states. For that reason it’s also a symbol of political and military alliances. During the cold war, for example, Germany also took to storing gold in New York as a way of protecting from any potential Soviet invasion.

From that perspective, Germany’s decision to start toting gold back to Frankfurt speaks volumes about the corrosion of trust between partners in the global financial system. It’s yet another symptom of how the global financial crisis—and the European government debt crisis that followed—has altered the international ties that served as the foundation of the global economy for decades.