China essentially closed its IPO market, amid an effort to keep a stock market rout from turning into an out-and-out crash.

Last night China’s state-run Xinhua reported that some 28 companies had decided en masse to put their public offerings on hold. While there was no mention of a state decision to cease public offerings, the measure was widely interpreted as an effort by authorities to stem sharp losses in Chinese equities. The state-controlled Securities Association of China separately said that 21 large Chinese brokerage firms were setting up a fund with roughly $19 billion to buy shares and prop up the market. China’s central bank also will reportedly be providing liquidity needed to keep declines from snowballing.

Since June 12, China’s Shanghai Composite and Shenzhen index are down 29% and 33% respectively. That decline comes after a remarkable surge that put those very same indices up more than 60% and 120% at their highest points this year. And despite the sell-off, the Shanghai index remains up 79% over the last year. The Shenzhen is up 89% over the same period.

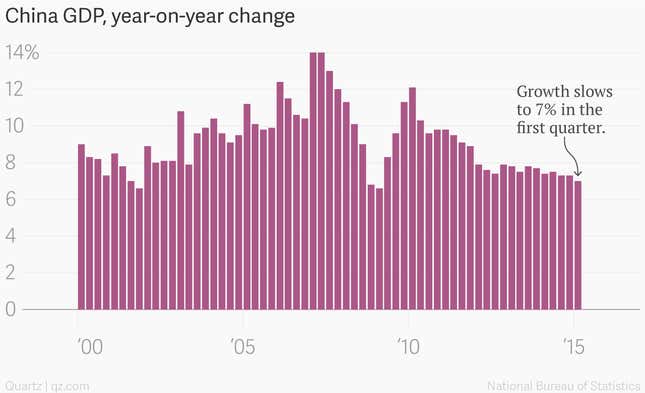

China has notoriously volatile markets. But, even by Chinese standards the recent behavior of equity markets has been head-spinning, underscoring widespread uncertainty about the country’s path forward amid an economic slowdown and reversal of what has been a decades long inflow of foreign capital into the country.