Need a reason to panic about the US government’s squabbling over the debt ceiling? Here’s one:

Unless the US invests an additional $1.57 billion per year in infrastructure—drinking water and waste water, electricity, airports, seaports and waterways, and surface transportation—between now and 2020, the nation will lose $3.1 trillion in GNP (gross national product), $1.1 trillion in trade, a $3,100 per year drop in personal disposable income, $2.4 trillion in lost consumer spending, and a little over 3.1 million jobs.

That sobering set of calculations, from the American Society of Civil Engineers’s new report (pdf), signal once again what the long-term costs of austerity are. More specifically, they include higher production costs due to less efficient supply chains, reduced consumer spending power, and the drag of more expensive transportation, water, and energy on business spending toward R&D and other high-return investments.

It’s a trend that, unlike the US government, has been building. The US spent just 2.4% of its GDP on infrastructure in 2007, while Europe spent around 5%. And though it once ranked fifth internationally in the World Economic Forum’s infrastructure evaluation, it has now slid to 25th (pdf). That’s hardly surprising considering that the rest of the developed world spends an average of 52.7% more of its GDP on transportation infrastructure then the US, according to the Council on Foreign Relations (pdf).

But wait—didn’t the 2009 stimulus bill attack that problem? It did, but $100 billion in infrastructure spending over several years is just a drop in the bucket toward what’s needed, as the Council on Foreign Relations points out. And the ASCE says that the US needs to spend $2 trillion more than planned between 2013 and 2020 in order to avoid the economic losses projected in its report.

Fareed Zakaria takes a stab at identifying why the government is falling down on the job:

Congress allocates money to infrastructure projects based on politics, not need or bang for the buck. The elegant solution to the problem would be to have a national infrastructure bank that is funded by a combination of government money and private capital. Such a bank would minimize waste and redundancy by having projects chosen by technocrats on merit rather than by politicians for pork. Naturally, this very idea is languishing in Congress, despite some support from prominent figures on both sides of the aisle.

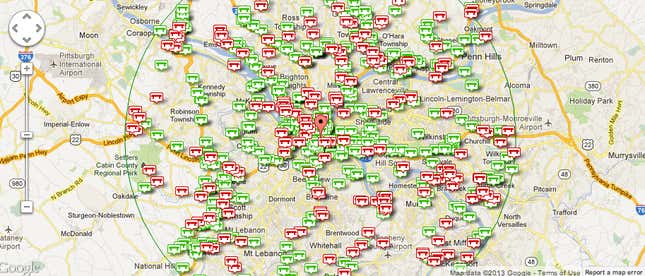

It’s sort of baffling that this is even controversial. Beyond the economic losses, there’s the potential human toll. Some 67,000 US bridges (pdf) are structurally deficient—around 11% of the total. And those bridges accomodate 283 million people each day. In Pennsylvania alone, more than a quarter of bridges are crumble-risks. For an example of what happens when bridges from the 1960s aren’t upgraded, recall the Minneapolis bridge that collapsed into the Mississippi River in 2007, killing 13 people. Avoiding another of those seems like a political winner.

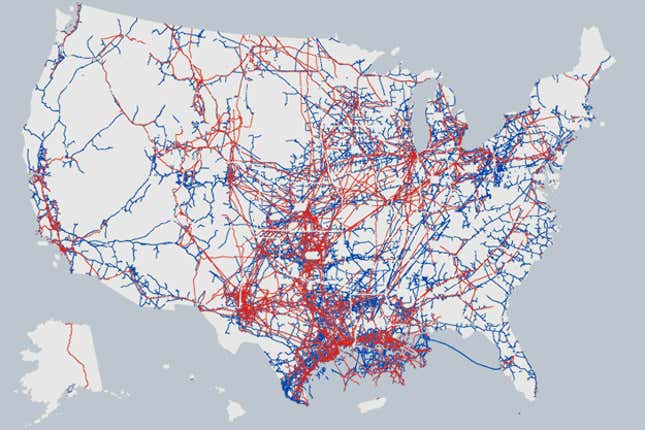

As does, for example, modernizing pipelines, which cause explosions and spills every year, claiming lives and costing hundreds of millions. Or overhauling the electrical grid, to avert another incident like the 2003 blackout, which caused $7 billion to $10 billion in economic losses.

Meanwhile, state and local governments, which can’t issue debt, increasingly must choose between accepting austerity or raising taxes on strapped citizens and businesses to make up the shortfall in federal spending. The ASCE calls for a national vision led by the federal government to address America’s infrastructure lag. But with the political debate instead focused on cutting spending, that hardly seems likely.