There’s an economic meme going around, and it’s a scary one: American firms aren’t innovating enough.

Hillary Clinton last month and BlackRock CEO Larry Fink earlier this year claimed that corporations are focusing too much on short-term stock prices and quarterly earnings; that they’re spending their profits on share buybacks and dividends instead of on research and development. This is really harmful to the US economy, Fink and Clinton say—so much so that there should be tax incentives to make people hold stocks for several years, so as to make companies think longer-term.

But even if it’s true that publicly-traded companies have become more short-termist, it’s far from clear that this is causing them to innovate less, or that it’s bad for the economy as a whole. And it’s certainly not clear that tax distortions for stockholders are the answer.

How much innovation? Depends how you measure

To start with, the evidence that big firms are innovating less is ambiguous at best. The Wall Street Journal calculated that companies in the S&P 500 are spending slightly less (paywall) of their operating cash flow on plants and equipment than they were a decade ago. The National Science Foundation, on the other hand, estimates that R&D intensity—that is, spending on R&D as a percentage of revenue—at large firms has been fairly stable, at around 3%, since 1995, and has even increased at smaller firms. And while a survey by PwC of the top 1,000 global companies found that R&D intensity has declined gradually for the past decade (pdf, p. 3), it’s hard to tell how much of that is due to fleeting economic conditions. More importantly, perhaps, PwC has consistently found that “spending more on R&D does not drive more innovation (or better financial performance).”

Josh Wolfe, founding partner of Lux Capital (a venture capital firm), reckons the overall pace of innovation in America hasn’t changed—just that where it happens is shifting. The new model is that small, private firms do the innovation and, if successful, are bought by big public firms. A similar argument is made by University of Florida professor Jay Ritter, who observes that startups these days increasingly aim to come up with a new technology and get bought, rather than grow big and public themselves.

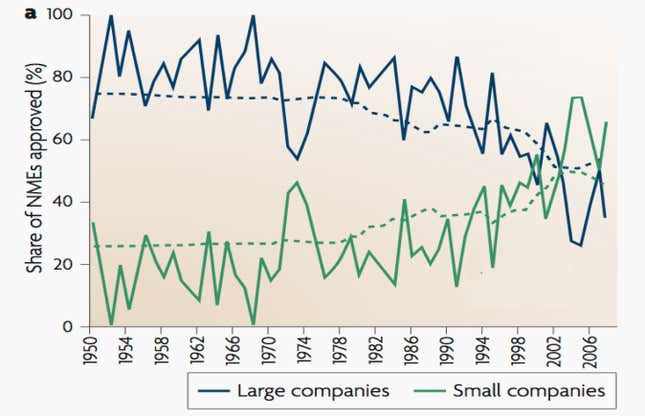

That has already happened in pharmaceuticals. Big pharma firms do less and less R&D in-house, relying instead on small biotech startups to come up with new potential drugs, and then buying them or licensing their technology. That’s visible in this chart from Jeff Kindler, also of Lux, which shows the growing share of new drugs that originated with small companies:

However, what’s going on in pharma has causes specific to pharma—the increasing cost and complexity of new drugs and therapies, more stringent regulation, and the spread of generics. The extent to which small firms are taking over innovation in other sectors is unclear. An uptick in acquisitions suggests large firms are indeed buying up smaller firms more often. But since the 1980s there’s also been a lower growth rate of new firms entering the market.

Are startups the new Bell Labs?

In some ways shifting more innovation to startups could be a good model. For decades the hotbeds of US innovation were big, well-funded firms: AT&T’s Bell Labs, IBM, Xerox’s PARC, General Electric, and Boeing, among others, attracted top scientists who won Nobel Prizes for their work and came up with innovations that made the digital age possible. But it’s hard to maintain an innovative culture at a large, old company mired in politics and vested interests.

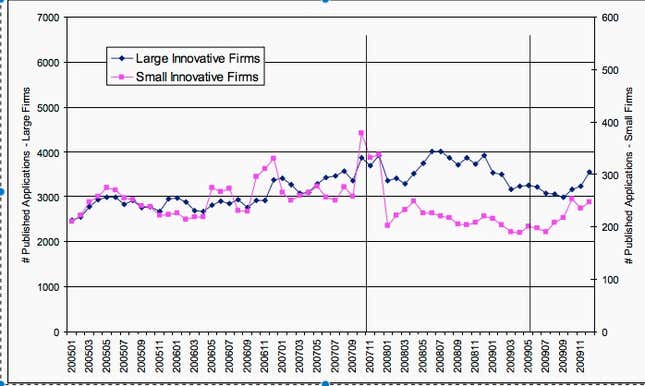

However, relying too heavily on startups for innovation can be risky too. Some kinds of innovation require lots of capital to get off the ground, and maturity and expertise to execute. Funding isn’t as stable, either: plentiful now (perhaps even too plentiful), but fickle. According to the Small Business Administration, the number of patent applications dropped at small firms much more sharply than big ones during the recession, when capital became scarce.

Large firms have deeper pockets and more reliable funding sources. And, as anyone whose innovation was bought by a larger firm can tell you, absorbing a start-up technology into a large bureaucratic environment can be an unpleasant process that can destroy the innovation itself.

Still, Wolfe thinks we could see more innovation in smaller firms. He argues that changing technology is lowering some of the large, upfront costs. He’s an investor, for instance, in Planet Labs, which makes satellites. “Before, satellite technology was hugely expensive,” he explains. “[It cost] $500 million to build a satellite and another $500 million to launch it into space. But using cell-phone parts the former NASA engineers at Planet Labs built a satellite for just $100,000 and launched it with Space X or Orbital Sciences [space start-ups] for $6 million.”

Wolfe also believes that so-called “adjacent technology,” where a new technology from one industry transforms another, is changing the innovative process in ways we are only starting to understand. Few would have anticipated cell-phone technology could be used to make cheap satellites, for example. However, this may not apply to all innovations the economy needs. Green energy still requires enormous amounts of capital and can take dozens of years to pay off.

Can startups can become America’s modern equivalent of Bell Labs? It’s risky to count on small firms with fickle sources of capital as engines of the economy. But their potential suggests that to restore America’s dynamism, instead of trying to make investors hold on to stock for longer, policymakers should make sure capital can flow to the most innovative companies, be they large or small.