Mention “Lombard Street” to an economist, and they’ll likely assume you’re talking about Walter Bagehot’s 1873 ur-text of central banking.

But, for our purposes the more important Lombard Street is the serpentine San Francisco byway of that name.

Why? It’s the curves, stupid.

In economics, curves are a shorthand way of referring to widely accepted economic relationships. For example, the Beveridge Curve describes the relationship between unemployment and job openings.

The short version: When one is high, the other is low and vice versa. (Caveat: Economist William Beveridge’s curve didn’t do a great job of describing the recent experience of the US job market during the Great Recession, when job openings and unemployment were both plentiful.)

There was the Kuznets Curve, which for a long time was believed to reliably sketch out the relationship between inequality and economic development. Economist Simon Kuznets’ research argued that inequality spiked in the early days of industrialization and then subsided as the economy became more and more developed. (Caveat: Recent work on inequality by economists such as Thomas Piketty has cast doubt upon the durability of the Kuznets Curve.)

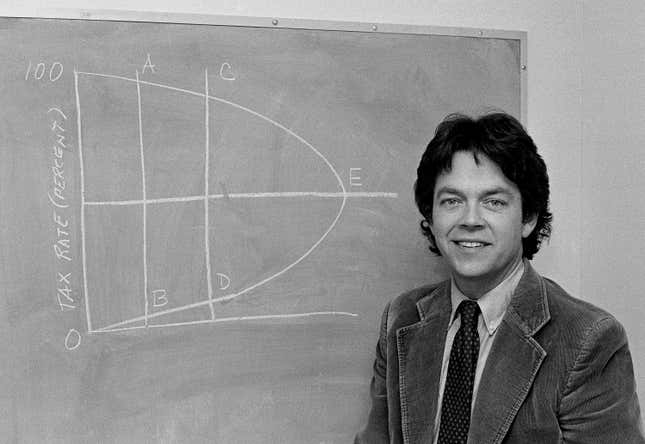

The Laffer Curve, named after conservative economist Art Laffer, was a cornerstone of supply-side economic theories that grew increasingly influential with the elections of Ronald Reagan and Margaret Thatcher.

Famously first scrawled on the back of a cocktail napkin at a Washington party, the Laffer Curve claimed to show that you could actually increase government revenues by cutting tax rates. (Caveat: It didn’t work, deficits exploded under Reagan.)

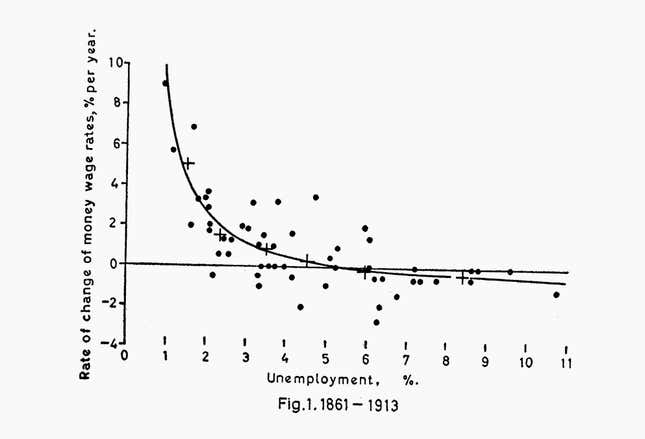

Perhaps the most influential curve in economics is the Phillips Curve, in which New Zealand-born economist A.W. Phillips described the relationship between inflation and unemployment that he observed in a long-term study of the British economy, back in 1958.

For decades, the Phillips Curve was the guiding light of the world’s central bankers. It was a framework they used to clarify their thinking and calibrate their adjustments of interest rates in order to keep both the economy humming and inflation under control. It fell under a cloud with the stagflation of the 1970s. (The Phillips curve seemed incompatible with a reality in which there was both high unemployment and high inflation.)

Anyway, economists didn’t want to throw out the Phillips curve altogether; after all, making policy based on the Phillips curve had worked for decades. Many key policy makers continue to believe there is some kind of tradeoff between unemployment and inflation, at least in the short term.

So what?

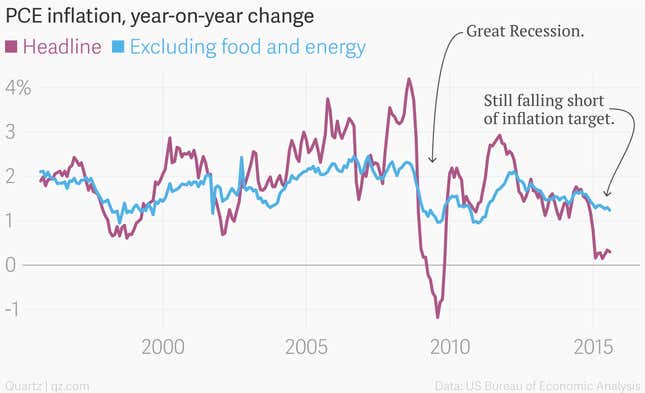

Well, this matters a lot for the US Federal Reserve. If the Fed still believes that low unemployment almost always translates into higher inflation—as the Phillips Curve suggests—that augurs for the Fed raising interest rates sooner rather than later. But, as the Wall Street Journal’s Justin Lahart points out, several high profile Fed speakers have recently been questioning whether the Phillips Curve is a helpful tool for understanding the current economic situation. And well they should.

As a Phillips, I take little pleasure in saying this. But all curves—Phillips included—are economic models. And economic models, as we’ve written before, are always wrong.

Don’t take it from me. Take it from Nobel Prize-winning economist Lars Hansen, who said this in a discussion on the terrific Econtalk podcast.

Models are always wrong. It seems kind of strange to hear that initially, but there is a sense in which models are simplifications; they are abstractions. And they are wrong.

Let’s just look at Switzerland, for example. The country has been in outright deflation for four years now. According to the Phillips curve such price declines should be accompanied by sky-high unemployment. Instead the Swiss jobless rate is a low-low 3.4%.

So does that mean the Phillips Curve is useless? No, it doesn’t. (Look at Greece where deflation has been correlated with unemployment rates of more than 20%.)

But it does mean that context matters. Switzerland has a unique role in the global economy. Not least because of its small, export-focused niche economy that doubles as a giant vortex sucking billions of dollars in tax-avoiding wealth into a financial black hole. An understanding of that context is crucial for anyone trying to understand how to make policy for the Swiss economy.

The same goes for the US. Inflation-phobic observers continue to look everywhere and see the shadow of the next great inflation. But it’s nowhere to be found in the actual inflation data.

What inflation-phobes need to understand is that the entire structure of the US economy is different now than it was in the 1970s, when inflation raged.

Case-in-point: The wage-price spiral that policy-makers fear was closely related to the cost-of-living adjustments baked into the contracts of unionized private sector industries. By the way, unionized private sector industries don’t really exist in the US anymore.

Here’s the upshot: Economic models are nice. And curves are cool as broad tools that help you understand general economic dynamics. But they belong to the realm of economic theory.

And in that domain it’s always worth heeding the advice of one of the century’s greatest economic thinkers: Yogi Berra. It was Berra who reportedly said, “In theory there is no difference between theory and practice; in practice there is.”

That’s worth keeping in mind, especially since Yogi knew far more about handling curves than any economist.