Heads of state, policymakers, and experts have gathered in New Delhi for the third India African Forum Summit from Oct. 26 to 29.

Key issues on which participants will focus include public health, UN Security Council reforms, terrorism, and climate change. Another major area of focus will undoubtedly be the growing trade and investment relationship between India and Africa. As the summit begins, we have looked into the big picture dynamics of Afro-Indian trade and investment.

Indo-African trade is growing but still lags behind other big players

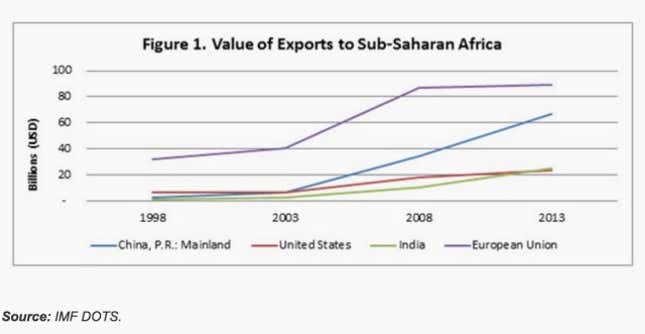

The International Monetary Fund (IMF) has determined that the value of India’s exports (now largely high-end consumer goods) to Africa has increased by over 100% from 2008 to 2013—meaning that India has now forged ahead of the US in African markets. However, although they benefited from Africa’s robust economic growth, India’s gains do not quite compare to China’s astronomical increase in exports to Africa (Figure 1).

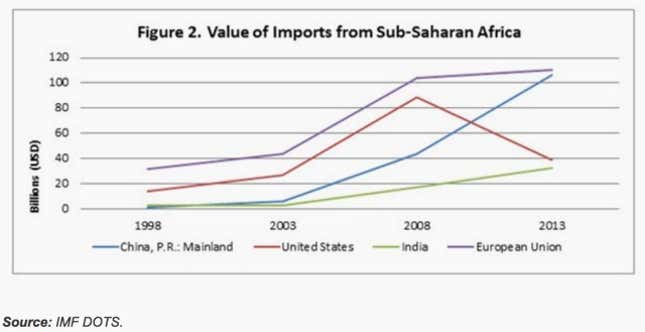

The value of India’s imports from Africa also grew dramatically from 2008 to 2013—by over 80%—compared to the sharp decline in the value of imports from sub-Saharan Africa to the US. The decrease in US imports from Africa was likely caused by the development of American hydraulic technology, which lessened US dependence on African oil and gas—its major import from the continent (Figure 2).

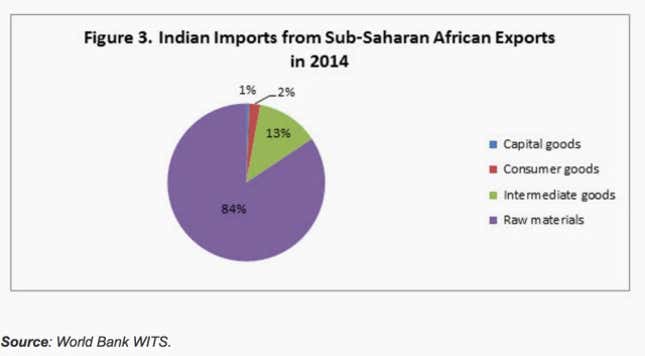

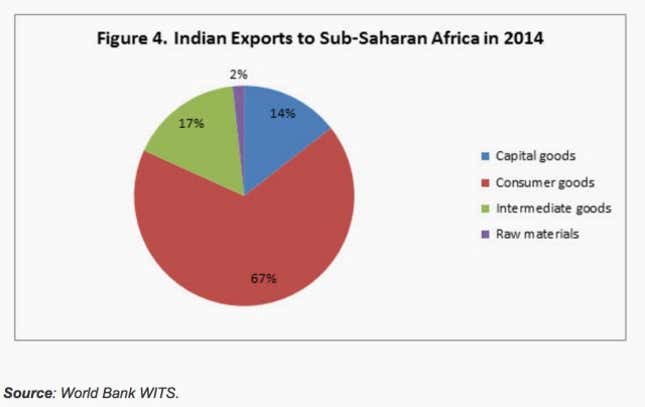

Raw materials still make up the lion’s share of African exports to India

Despite the impressive growth of increased trade relations between India and Africa, there is a substantial imbalance in the import-export relationship between the two countries. A vast majority of exports from Africa to India are raw materials such as crude oil, gold, raw cotton, and precious stones. Meanwhile, most exports from India to sub-Saharan Africa consist of high-end consumer goods such as automobiles, pharmaceuticals, and telecom equipment (Figures 3 and 4). This imbalance does not necessarily align with Africa’s goals to diversify away from natural resource dependence, which is a common issue in Africa’s trade relationships with China, the US, and the European Union.

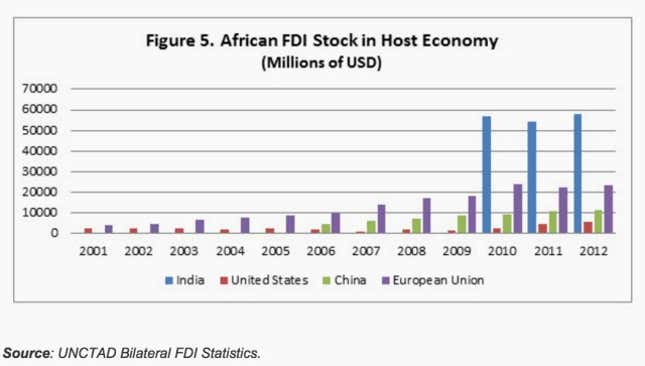

African foreign direct investment from and in India has recently skyrocketed, but is mostly driven by one country—Mauritius

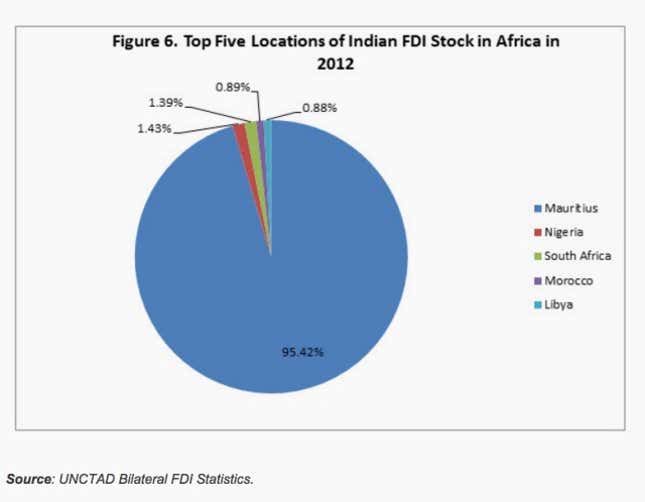

Another noteworthy trend is Africa’s growing foreign direct investment (FDI) in India. Since 2010, Africa’s FDI in India has proven consistently high compared to its FDI in countries such as China and the US. However, the primary reason is that Mauritius is the biggest source of FDI into India. (Figures 5 and 6).

Although India’s FDI in Africa has also increased, with an 11% jump between 2010 and 2012, Indian investments are concentrated in just a few countries. Once again Mauritius attracts a high volume of investments from India due to its favourable tax treaty with India (Figure 6).

Overall, the Indo-African economic relationship has made substantial gains, but there is much more room for growth. Of many of our recommendations, we suggest that, in looking forward, African businesses should focus on diversifying their exports to India by increasing awareness of preference opportunities—a strategy that could also mitigate the effects of a recently shaky Chinese economy. India, in turn, should focus on expanding its preferred areas of investment beyond the few countries on which it currently focuses.

This post originally appeared on Brookings Institution.