In 2008, the last year with complete data, US companies reported $938 billion in pre-tax profits abroad (pdf, fourth page). That same year, total pre-tax corporate profit by US companies was $1.36 trillion (see section 6.17D). In other words, a very large share of the profits that US companies earned, they earned outside the US. Is this a testament to their remarkable success in global marketes, or are they just very good at financial engineering?

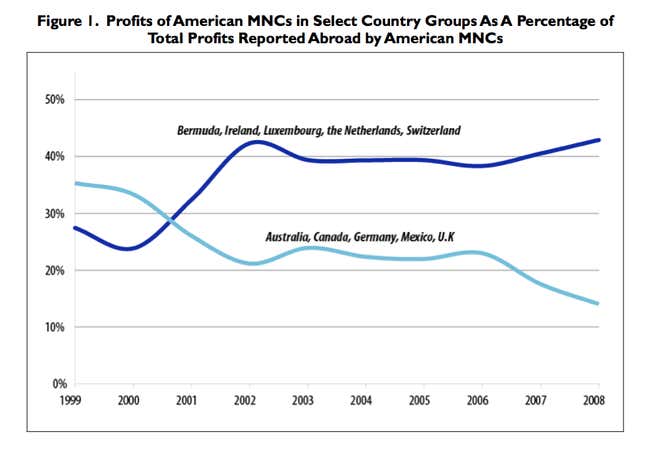

The Congressional Research Service released a report (pdf) in January that suggests the latter explanation. The author collected government data on non-bank American companies in two groups of countries: Five small countries with low taxes and tight bank secrecy laws, and five major US trading partners. First, you can see that most of the profits come from the secrecy jurisdictions:

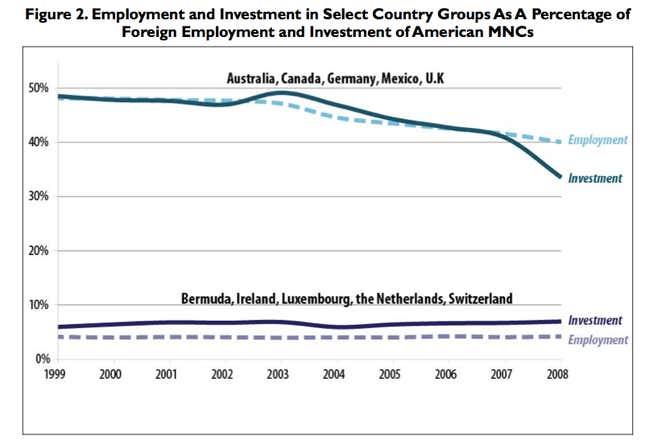

Perhaps, then, American multinationals just outsourced lots of their operations and investment to these small countries? That might explain why they represent such a large proportion of total profit. But that theory turns out to be false:

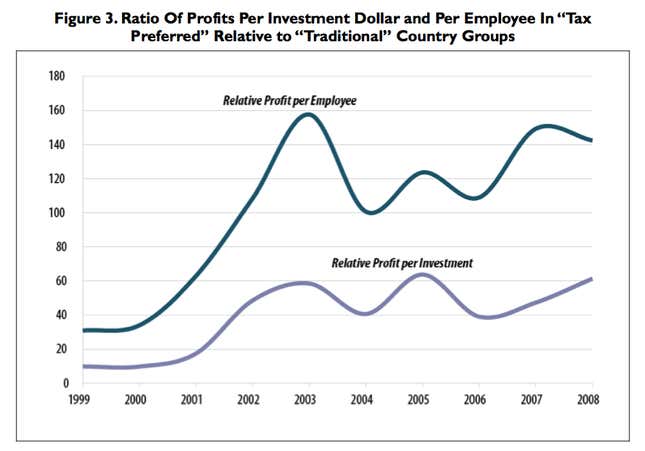

In fact, 43% of overseas corporate profits in 2008 came from those five small states, despite hosting only 7% of total investment and 4% of total employment. It turns out that there’s something going on that makes investments and employment in those tax havens incredibly productive. US companies have been making up to 160 times as much profit per employee and 60 times as much profit per dollar invested in these little countries as in the big markets where most of their customers are. Hmmm.

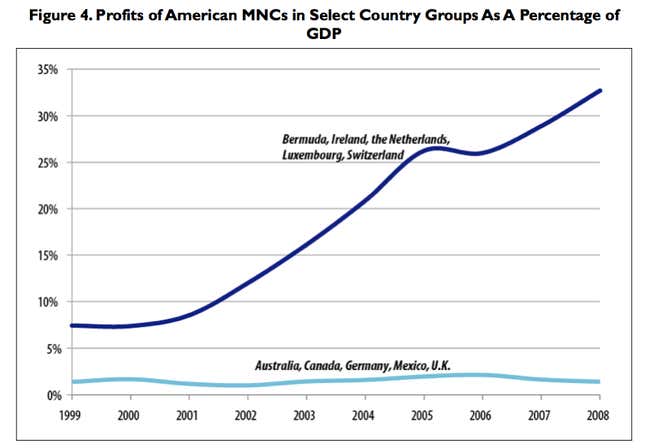

They’re so productive that US profits in those countries represent more than a third of those countries’ GDP, and rising rapidly:

It’s actually starker than that in some places: In 2008, US corporate profits in Bermuda were over 1000% of GDP, and in Luxembourg, they were 208% of GDP. It’s hard to imagine that US companies are making more money in those countries than their citizens produce each year.

What all this data implies is something we already know anecdotally: US corporations are using financial engineering to shift profits abroad, not out of business necessity, but to avoid US corporate income taxes. This is economically inefficient, and also hurts public coffers, but corporations insist they need to use these measures to stay competitive with global rivals. Estimates quoted in the CRS report suggests that the US lost out on $57 billion to $90 billion dollars in revenue in 2008 thanks to this kind of tax avoidance. To put that in perspective, the amount of money due to be cut from the budget next month in the “sequester”, for which President Obama and Congress can’t agree on a replacement, is $110 billion.