It seems like all systems are go.

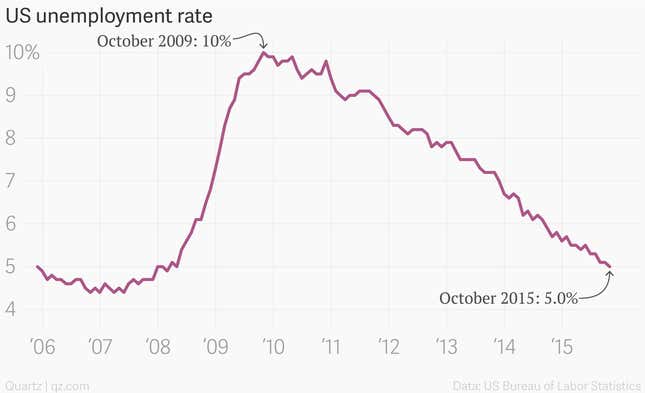

The latest jobs report showed the US economy produced a whopping 271,000 jobs in October, much better than expected. The unemployment rate fell to 5%.

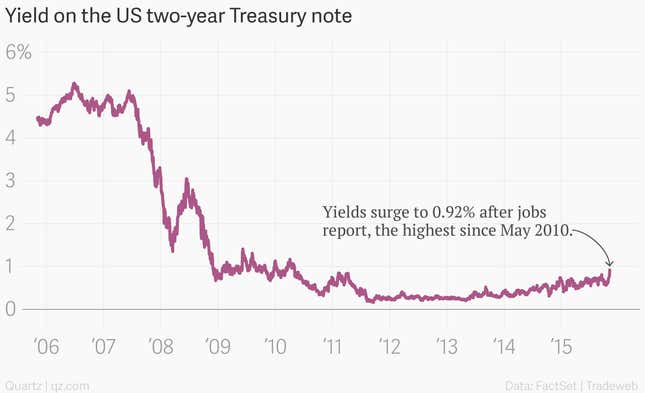

The numbers were enough to convince the bond market that the Fed would indeed lift interest rates at its next meeting in December. Yields on shorter-term Treasury notes rose sharply as the markets priced in the prospect for a hike. (Though rates remain quite low by historical standards.)

And indeed, the report does seem to show that the US labor market is firing on all cylinders, with the unemployment rate falling to the notable psychological level of 5% that resonates with the broad populace.

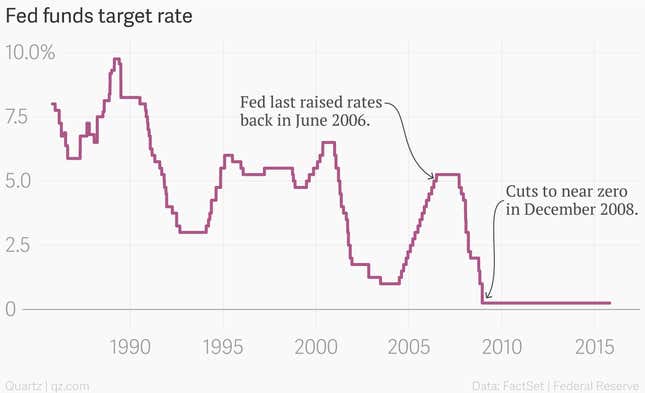

That should set the stage for the Fed’s first interest rate increase in more than nine years.

On the other hand, the Fed has two jobs.

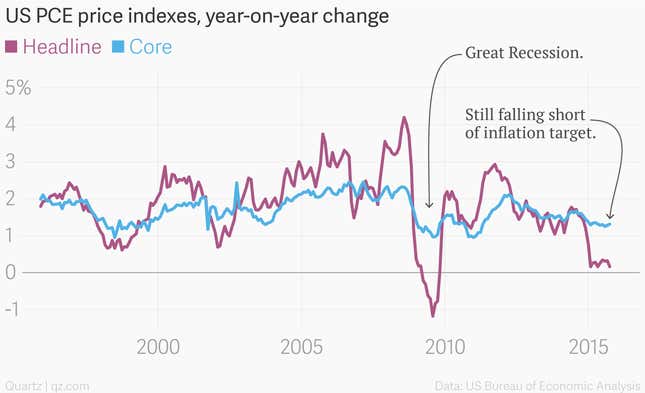

(That’s the “dual mandate” people are always talking about.) One is to foster employment, at which it seems to be doing alright. The other is to keep prices stable, which traditionally means keeping a little bit of inflation going at a steady pace, the Fed’s inflation target is about 2%. The Fed is falling short on that front.

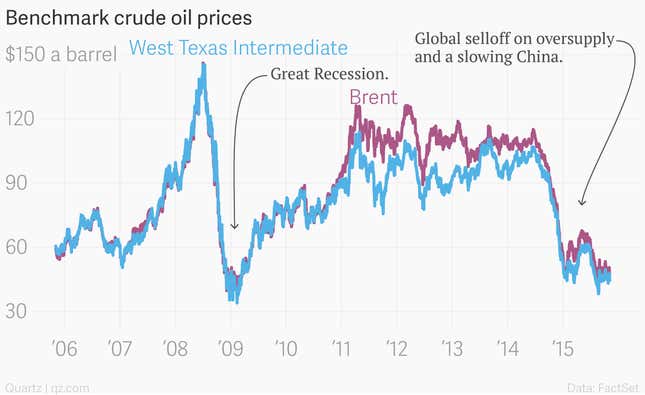

So far, the Fed’s position is that low oil prices is what is holding back inflation. And that is definitely part of it. Crude oil prices have collapsed since June 2014, when a barrel of Brent crude oil would have cost you $114. Today that same barrel costs $48.

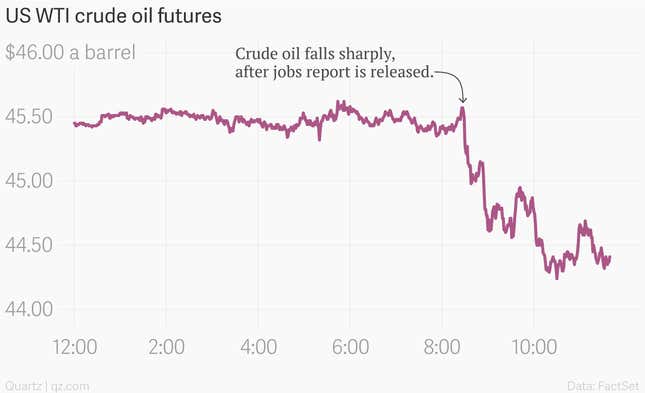

The Fed seems to believe that once the sharp decline of oil prices falls out of the year-over-year data, inflation will start to resume its normal climb. And that could be the case. But that will only happen if oil prices stop falling. And that didn’t happen today. In fact strong US jobs report caused a sharp decline in commodity prices, including oil.

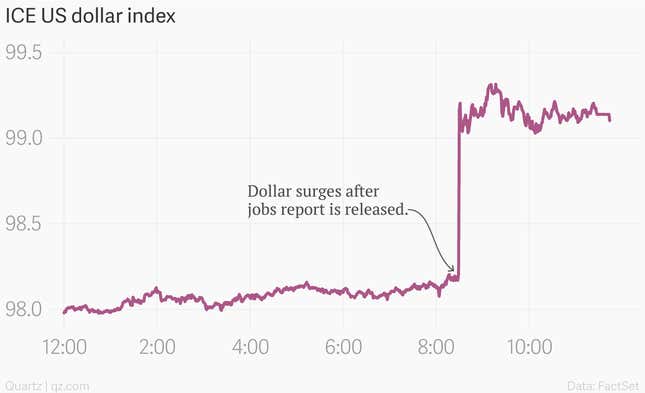

Why the selloff? It’s all about the dollar. Since crude prices are priced in dollars, as stronger dollar has the effect of making oil prices fall. (In other words, your dollar buys you more oil.) And the dollar soared today, after the jobs report gave people more confidence that the Fed would raise interest rates in December.

One way to think about interest rates is like the rate you earn on holding a currency. So, if the US is raising interest rates, it makes the currency a more attractive investment. As a result, the financial markets sell other currencies and buy the dollar, pushing the greenback higher. That’s what happened.

It’s worth noting that the strong dollar also puts downward pressure on all other US imports as well.

So what’s the upshot? Basically, the Fed is in a tough spot when it comes to getting inflation back to the level it would prefer. Since rising rates also tend to pull up the dollar, that will push down on inflation. The Fed doesn’t seem overly concerned about that now. But it does mean that the strength of the dollar might be the one thing that could derail everyone’s expectations that the Fed will start the long-awaited rate-raising cycle next month.