Match Group—owner of Tinder, Match.com, and OkCupid—announced today (Nov. 9) that it aims to raise about $430 million in an initial public offering.

The portfolio of online dating platforms is being spun off from IAC/InterActiveCorp. It plans to sell 33.3 million shares, representing a 14% stake, for $12 to $14 per share, it disclosed in a US regulatory filing.

IAC/InterActiveCorp will remain in control of the dating conglomerate, owning just over 86% of Match Group’s outstanding shares and about 98% of the combined voting power.

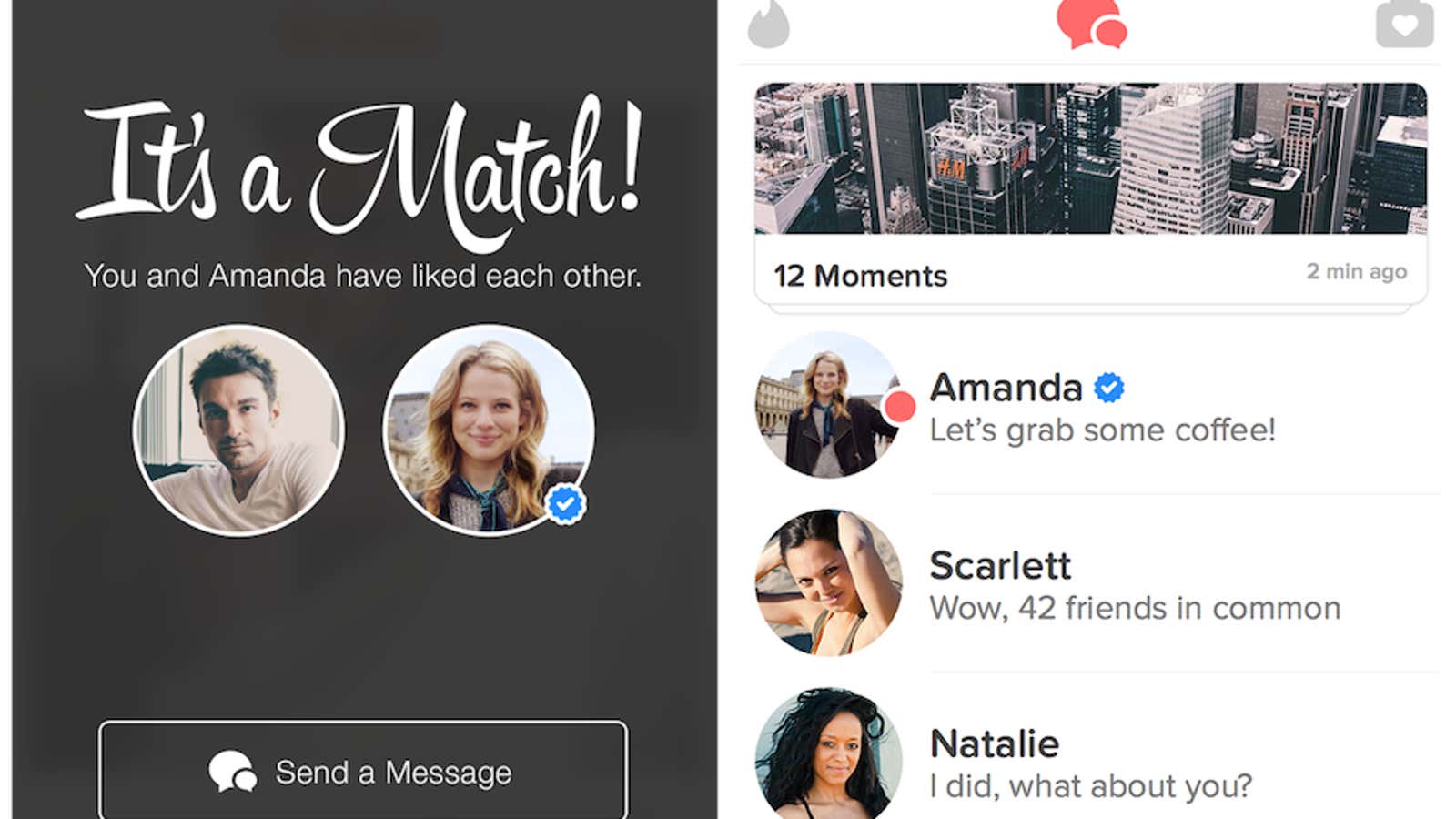

Match Group, based in Dallas, Texas, grew about 12% a year on average from 2012 to 2014. During the first nine months of 2015, its revenue rose 16% from the same period a year earlier to $753 million. The company said it had 59 million monthly active user in the third quarter and 4.7 million paid users.

Last spring, another online dating platform Zoosk sought to go public, but later withdrew its I.P.O plans because of “unfavorable market conditions” for subscription services, which were suffering at the time. As CNBC reported, the dating market can be difficult to monetize because users typically don’t want to pay for a service unless they’re seriously looking for a relationship. Online dating industry revenues have grown about 5% per year, the publication noted, citing research from IBISWorld.