Saudi Arabia is taking on more debt to finance its strategy of driving US shale and other high-priced producers out of business.

In August, the country announced plans to sell $27 billion in bonds to make up for its budget deficit, which the IMF said at the time could reach 20% of GDP because of the plunge in oil prices.

Now, the OPEC giant is reportedly prepared to run up its debt to 50% of annual GDP over several years of borrowing in order to cement its hold on the global oil market. In a report (paywall) by the Financial Times, unidentified Saudi officials gave no indication how much in total the country is prepared to borrow, but half of GDP could mean hundreds of billions of dollars in bond sales.

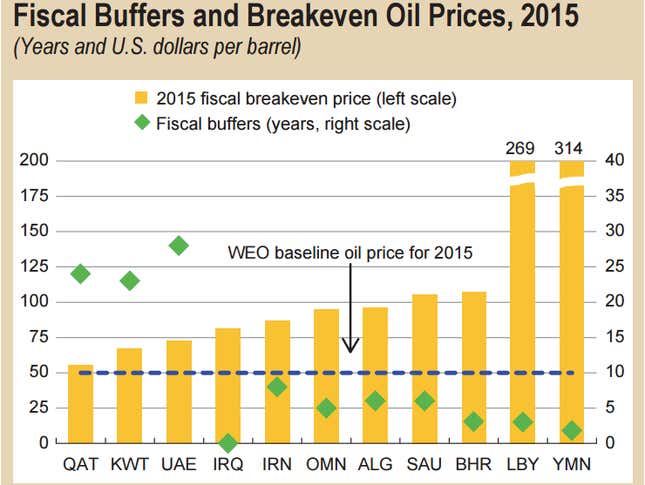

Borrowing would be necessary as long as the price of oil remains below what the Saudis need to balance a national budget that is swollen with social spending and subsidies. Saudi’s so-called “fiscal break-even point” is about $106 per barrel of oil, according to the International Monetary Fund (see chart below).

Globally traded Brent oil has sold in a band between $45 and $55 a barrel for months and, because shale is a resilient type of oil that can be brought to market with unusual speed, it could keep the price from rising much higher than $70 or $80 a barrel even in 2017 or 2018, many analysts say.

A year ago, Saudi Arabia persuaded its fellow members of the OPEC cartel to suspend their decades-long policy of influencing the price of oil through their control of about a third of the daily global petroleum supply. Spurring them on was a flood of US shale oil, which since 2011 had risen from nothing to 4 million barrels a day. At the time, oil prices topped $100 a barrel; while OPEC members expected a bit of a drop for a while, no one appears to have anticipated that the price would fall so low for so long.

The game of chicken has achieved a dent in US production, which has fallen from a peak of 9.6 million barrels a day to about 9.1 million last month. However, much more than that will need to be withdrawn from the market to restore paramount OPEC influence, and that does not even take into account the hundreds of thousands of barrels a day of Iranian crude poised to return to the market next year.

Today, Saudi Arabia continues all-out production of 10.1 million barrels of oil a day, in what analysts say is an attempt to both drive out higher-cost producers, and grab and retain market share. At the next OPEC meeting on Dec. 4 in Vienna, it is expected to insist that the assault on shale continue.