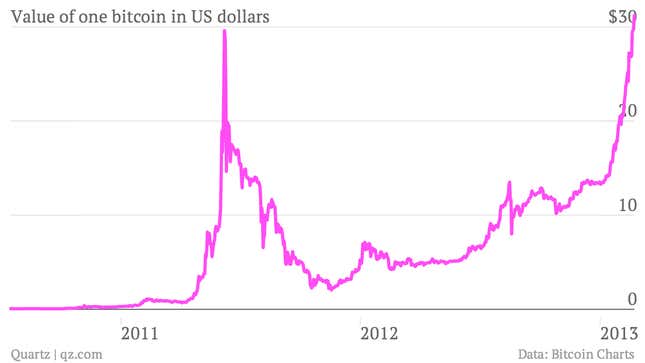

Bitcoin is back. The digital currency—which, unlike the cash in your wallet, is not issued by a central bank—has surged this year on bitcoin exchanges, hitting a new high today above $31.

Bitcoin hasn’t traded at this level since June 2011, which is an ominous observation since that peak was followed by the currency’s collapse, precipitated by an enormous sell order from a hacked account. But it recovered throughout 2012 and has begun to seem more more like a legitimate alternative to currencies issued by sovereign nations. Traders at large investment banks, including Morgan Stanley and Goldman Sachs, are said to be active on bitcoin exchanges.

The sudden surge in bitcoin’s value could be mere speculation by investors. It could also represent renewed confidence in bitcoin’s worth, following the 2011 collapse. More prominent businesses have begun accepting payments in bitcoin in recent months.

New bitcoins are generated through intensive computer processing, which is intended to control their release into the open market. Only 21 million bitcoins can ever be created. There are 10,814,125 right now, valued at a total of $341,942,633 or €280,085,838.