Markets are betting that new Japanese prime minister Shinzo Abe’s plan to kickstart the economy by aggressively printing and spending new money will succeed. News that Haruhiko Kuroda—a former academic and diplomat who favors money-printing and reflation—is Abe’s top choice for governor of the Bank of Japan, has sent Japanese stocks rising and spurred another fall in the value of the yen, which has plunged almost 20% against the US dollar since last October.

Abe’s nomination still needs to be approved by Japan’s parliament, the Diet. Such approval is not guaranteed. But an unconfirmed report from Japanese news agency Jiji Press has claimed Japan’s main opposition party will support Kuroda.

After Japanese companies and politicians spent much of last year complaining that the highly valued yen was choking the economy, Abe pledged upon winning Japan’s parliamentary election last December to print more cash to drive down the yen, combat deflation and make Japan’s exports cheaper. He also wants to invest in infrastructure projects to create jobs and GDP growth.

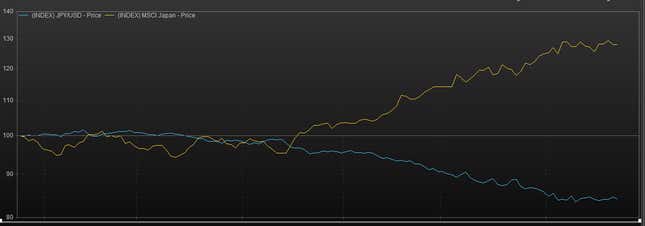

Here is how yen weakness (blue line) has caused Japanese stocks (yellow line) to soar over the last few months (six month chart).

The BoJ’s current chief, Masaaki Shirakawa, is stepping down early after he argued against the idea of monetary pump-priming to save the economy. By contrast, the 68-year-old Kuroda, who currently leads the Asian Development Bank and was formerly Japan’s top currency diplomat, has long promoted the idea of intervening (paywall) to weaken the yen. He has also argued that Abe’s 2% inflation target for Japan is achievable within two years.

Neither Abe nor Kuroda have confirmed the ADB leader’s nomination for BoJ head.

Detractors of so-called “Abenomics” claim Japan has too many problems—such as its ageing population, lack of entrepreneurs, inefficient corporations and crony capitalism—that increasing the money supply will not solve.