General Electric, one of the fastest-growing US advertising spenders, is abandoning the prime-time TV market for one where commercials have a better chance of standing out: live TV.

Chief marketing officer Linda Boff told Business Insider that she is funneling the bulk of GE’s TV advertising dollars to live programming. “We still believe in TV, but we believe in an audience that is going to stay,” she said.

Last year, GE’s spending on US advertising jumped 42% to $393 million, by Advertising Age’s calculations. GE’s commercials run “almost exclusively” on live TV, Boff said, citing programs like football, “Saturday Night Live,” and “The Tonight Show With Jimmy Fallon.”

Changing viewer habits have made traditional TV advertising less effective. For example, people are watching more TV on DVRs—where viewers can fast-forward through commercials—and through paid, ad-free streaming platforms like Netflix, Hulu, and Amazon Prime Video.

The shift away from prime-time doesn’t bode well for networks, which command high prices for ad slots during those hours because they typically reach more viewers. But it isn’t entirely surprising either.

Advertisers have always been drawn to live TV—throwing millions at award shows like The Oscars and sporting events like the Super Bowl—and are even more so now. During the 2014-2015 programming season, sports brought in $8.5 billion in sales for the big four US broadcasters—CBS, NBC, ABC, and Fox—up 35% from five years ago, according to Kantar Media.

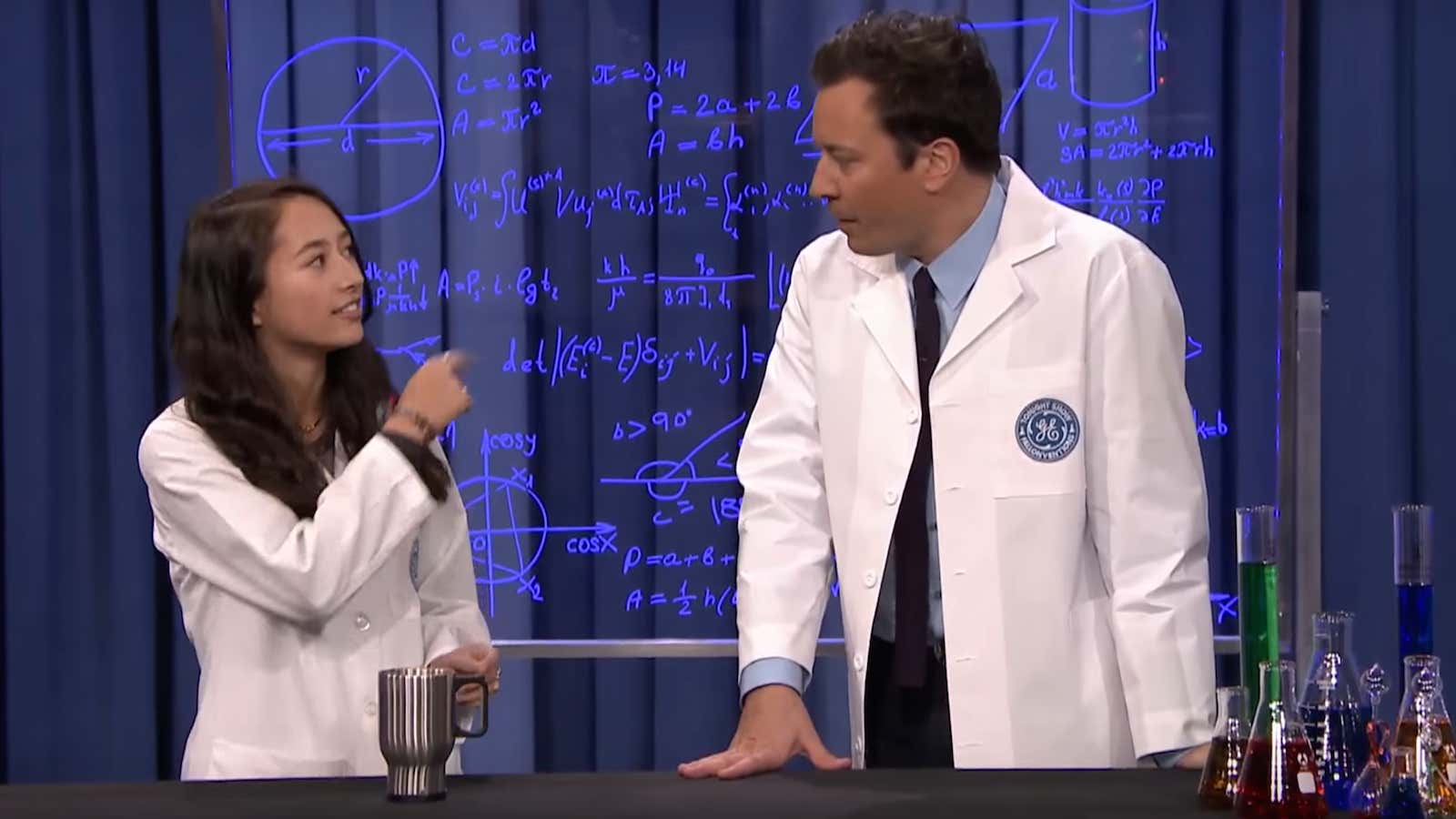

Live late-night programming is also appealing to advertisers because branded content is being increasingly integrated into shows. Fallon, for example, has a sponsored skit called “Fallonventions” on his show, where he sports a GE-branded lab coat and shows off kids’ inventions. Segments like these tend to draw more eyeballs than ads airing during commercial breaks, when viewers may step away from their screens or change the channel. And they’re more likely to be viewed and shared online by fans.

For GE, the media strategy may also be motivated by the business’s transition away from general consumers. Earlier this year, GE sold its appliances division—one of its last remaining consumer-driven revenue streams—centering the company around finance, through GE Capital (though it has been shrinking that division), as well as energy and industrial ventures.

Full disclosure: GE is a Quartz advertiser.