Jason Zweig, who writes the Intelligent Investor column in the Wall Street Journal, is a distinct voice in the US financial press.

Drawing inspiration from the value-investing principles developed by legendary American investor Benjamin Graham—and perfected by his pupil Warren Buffett—Zweig consistently urges investors to resist the temptations of chasing the latest market trends. (Zweig also wrote the commentary for the most recent edition of Graham’s value-investing bible, The Intelligent Investor.)

Instead, Zweig advises would-be Buffetts to do the math, think about an investment’s fundamental value, and buy low-cost, well-diversified funds for the long term.

Despite the admittedly repetitive, eat-your-vegetables nature of his advice, Zweig’s column is also thoroughly entertaining, lightly stitching together references from financial history, market lore and behavioral economics to gently nudge people toward their better investing selves.

His latest book, The Devil’s Financial Dictionary, is a typically wry look at some of most egregious financespeak Zweig has encountered during his decades as a financial journalist. Modeled on Ambrose Bierce’s 1906 satirical The Devil’s Dictionary, Zweig’s opus offers succinct and funny definitions that wink and warn about the true nature of Wall Street. Along the way, readers find they’ve actually absorbed important lessons needed to navigate the investment world. For example:

STRUCTURED PRODUCTS, n. Investment products structured to be profitable to the firms that sell them and incomprehensible to the clients who buy them.

Zweig swung by Quartz’s New York offices to discuss the book, the true nature of jargon, what Wall Street’s big lie is, and why Ben Franklin had a purse made out of a deadly, heat-resistant mineral.

Here are excerpts of our conversation, edited for clarity and concision.

Quartz: Why is Wall Street such a center for blabber, gibberish, and doublespeak?

Jason Zweig: Well I think every profession has its own jargon and lingo. But Wall Street jargon has a really—I think it’s a unique—quality.

If you think about when you go to your doctor. Something’s wrong. You get a diagnosis. Your doctor tells you that what you have wrong with you is this thing. And it’s like three words and each word has seven syllables and some are Greek and some are Latin and none of them you really understand. You just know it’s probably bad. So you stop your doctor and probably say, “Well, what does that mean?” You immediately want to know in plain English what the doctor just said.

But if you’re dealing with someone in the financial industry who throws jargon at you, there’s a very powerful temptation to pretend you understand what the person means, even when you don’t.

Because it gives you some comfort that you understand what’s happening. And it makes you feel like a little bit of an insider.

Even though you don’t understand.

Even though you don’t understand. So, Wall Street jargon has a double bad quality. First it obfuscates the situation and confuses you. But secondly it makes you want to pretend you understand it when you don’t.

How much is it deliberate? And how much is it the same as any shoptalk that takes on a life of its own?

Well, I think a lot of it is deliberate muddying of the waters. Where people are intentionally using euphemisms and code words and sort-of incomprehensible gibberish to make sure you can’t understand what’s happening.

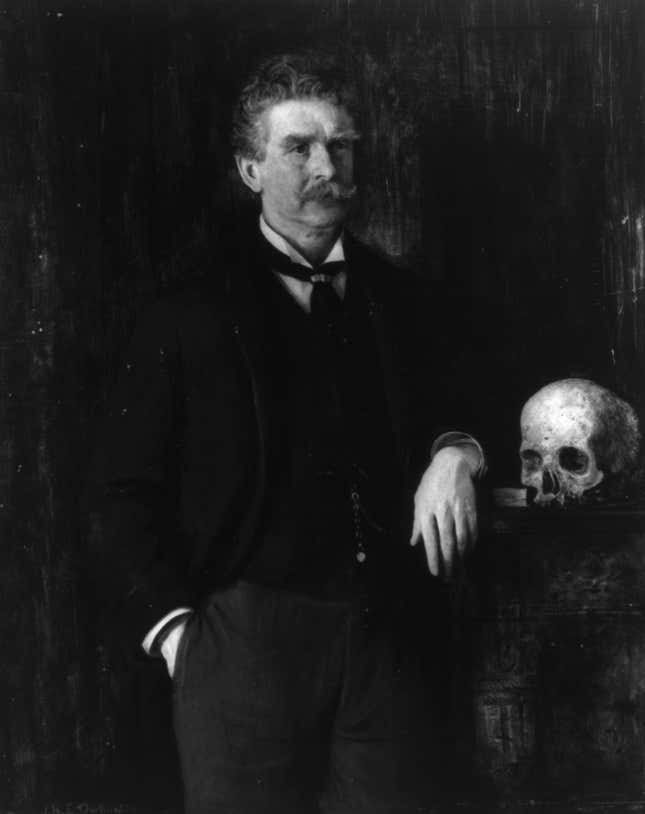

You modeled this book on American satirist Ambrose Bierce’s 1906 book, which came to be known as The Devil’s Dictionary. When did you first find that book?

Well, I’ve loved The Devil’s Dictionary ever since I was a college kid and stumbled across it in a book store on 88th and Broadway in New York. I turned two or three pages and I just immediately went to the counter and bought the book. Of course there was no internet then. The entire book…is online in numerous editions because it’s public domain at this point. But it’s probably the most brilliant work of satire written in America. And maybe one of the greatest in all of world literature.

Up there with Swift and Mark Twain?

A : Yup…And you know Bierce had this vicious sense of humor. He was a really mean guy….And he also didn’t really like people. I like people. But I recognize that they have foibles and I think one of the interesting things I learned working on this book is how well you have to understand something if you’re going to poke fun at it—without being unfair.

This book is interesting because it is really cynical…But it balances out. There’s also this kind of winking appreciation for some of chutzpah it takes to say some of these things. How cynical are you about the financial sector in general?

Yeah, you know I dedicated the book to my dad, who was a great man and certainly one of the wisest people I’ve ever known. And what I said about him in the dedication was that he knew everything, which I really believed is pretty much true, including when not to be cynical.

And I think that’s a really important perspective to bear in mind. You know, investors and people who participate in the financial system in any capacity have to remember—above all else—you have to be skeptical. If you’re not skeptical, you will not survive. People will turn you upside down and shake you until you have no more change in your pockets and no more money in your wallet.

And you should be cynical in the sense that you should always be asking yourself, “What is the motivation of the person on the other side of this transaction? What does this person stand to gain from the information I’m being delivered?”

But I don’t think you should become so cynical that you refuse to participate at all. I know one person in his 60s who owns no stocks, no mutual funds, no financial assets of any kind, because he says it’s all too risky. But his hobby is, every weekend he goes to the racetrack and bets on the horses.

So in other words, there is a component of investing, of Wall Street, that is a racetrack, that is a casino—a big component—but that doesn’t mean it doesn’t also work also for people, sometimes, over the long term.

Yeah, exactly, the biggest gamble you take in the Wall Street casino isn’t participating—it’s that you don’t know who you are.

Meaning, you don’t know if you’re the mark, or the gambler from Kenny Rogers.

Yes, exactly. So are you the shooter? Or are you the target? Or as Warren Buffett likes to say, if you’re playing poker and you look to your right and you look to your left, and you don’t know who that patsy is—it’s you.

But the fact that [Wall Street] has aspects of a casino does not mean you shouldn’t play. Because Wall Street resembles a casino in a lot of ways, but there’s one important way in which it doesn’t.

In the casino the single most important principle is what casino operators call TOD, “time-on-device.”

And from the minute you walk in the door in Las Vegas or Atlantic City or wherever you happen to be casino gambling, the people who run the casino have only one objective, which is to keep you glued to whatever game you’re playing. Because if you give one pull to the slot machine you might hit the jackpot. And if you just take your money and leave, you’ve just hurt the casino a lot. But almost nobody takes one pull, hits the jackpot…

…and leaves.

Nobody does that. And there’s a reason why. Because maximizing the time-on-device is terrible for you and it’s great for the casino.

Wall Street works the opposite way as long as you have a long-term perspective…If you’re a long-term investor, you should maximize your time-on-device. You should buy a diversified portfolio of low-cost funds and hold them your entire lifetime.

So you’ve participated in the casino but you’re not pulling any levers. You’re just watching.

How much of [the proliferation of financial jargon] is our fault as financial journalists? We’ve got to have a quote that explains why the market is up. Even though you and I both know the guys that we’re calling, they might be smart guys and gals, but they don’t know, really, any more than we know.

Well, a lot of it is the fault of the financial media. [But] to some extent we have to tell people what they’re looking to be told. You know, I think it’s a fundamental part of human nature to hate recognizing how random the universe really is, how important luck is in the course of human affairs and [how] difficult it is to predict what will happen before it happens.

Yeah, there’s this whole industry of Wall Street people making forecasts and revising their forecasts a couple weeks later. And it just seems like such a colossal waste of brain power.

I often call Wall Street the prediction industry. To a large extent, that’s what keeps Wall Street going. Can I just borrow this? [He grabs the copy of his book and begins to read.] You know the dictionary definition of forecasting is:

FORECASTING, n. The attempt to predict the unknowable by measuring the irrelevant; a task that in one way or another, employs most people on Wall Street.

And I think that’s really true.

So, you know the problem has two layers. The forecasters are part of the problem. But the consumers of forecasts are also part of the problem. And journalists are caught in the middle, because the reading, thinking, investing, viewing, listening public wants someone to say, “here’s what’s going to happen.”

My last question is about the US retirement system in general. The 401(k) system. What’s the average return for stocks—9%, more or less?

More or less.

But that’s over the entire lifetime and history of the stock market, right? In any given lifetime it could be less.

There are no guarantees. You know ever since the early 1990s, there’s been this sort of ideology of “stocks for the long run.” And the belief that a lot of people have is if you just own stocks long enough, the risk of owning them goes away.

And it isn’t true, the risk never goes away. You know there was a point in the financial crisis, where over the previous 40 years, stocks underperformed cash and bonds.

And if that happened to be the time when you needed to retire…

Exactly. If you’re somebody that needed to retire in 2007, so for roughly the 18 months of stock-market collapse, you would have been withdrawing money to live off in your retirement as stocks were collapsing. And when you take that money out when prices are falling, it’s gone forever—you can’t recover.

And if a stock market crashes right before you retire, it doesn’t matter what the long-term rate of return was. Your money is gone.

The only thing that’s within your control, really, is your saving rate. So you have to save more money. If you don’t save more money you cannot count on the stock market to bail you out.

And I think the big lie on Wall Street and in the financial-advisor community is a sentence that begins kind-of like this: “You’re going to need to earn higher returns so we’re going to buy you some of these…” Well, it doesn’t matter what you need. You could need a 20% return, you could need a 15% return, you could need a 10% return, but the stock market doesn’t know and doesn’t care what return you need.

You’re going to get the return that the stock market “needs” to provide you…which is why saving more is really the single most effective thing that people can do.

And “saving more,” do you mean just in the sense of socking money away into a bank?

In the dictionary [he grabs his book again] there’s this definition of thrift.

THRIFT n. the obsolete practice of spending less money than you earn. Once believed to be a virtue, now regarded as a disturbing form of deviant behavior.

Being thrifty used to be one of the cardinal American virtues. I often talk about this. If you think about—who’s the ultimate American? If a person from Mars came down and said, “Who’s the most American person in your history…”

Thomas Edison.

I would have said Benjamin Franklin or Abraham Lincoln. But it doesn’t matter. Because all three of these guys were really thrifty. They were savers.

In the book you mention this weird asbestos purse Ben Franklin had. Really, Ben Franklin had an asbestos purse?

Yes, he had an asbestos purse. It’s preserved in a museum in London somewhere, I forget where. [It’s at the Natural History Musem, and here’s a picture—Eds.] And there doesn’t appear to be a primary source saying it, but he apparently had it made with the idea in mind that it would prevent money from burning a hole in his pocket.