Private equity firms, hedge funds, and other investment partnerships enjoy a perk called “carried interest,” which allows partners to pay the lower capital gains tax rate on compensation that many consider to be a salary that should be taxed as regular income. It’s the kind of thing that inspired Warren Buffet’s complaints about low taxes on the wealthy, and even the Rothschilds are against it.

The White House has been adamant over the years that it wants to eliminate this tax break, but it has gotten nowhere thanks to opposition from Republicans and the many Democratic lawmakers who receive financial support from financiers.

As the two parties approach another showdown, Capitol Hill newspaper Roll Call reports that House Republicans might consider supporting an end to the carried-interest tax break in an attempt to drive a wedge between the White House and Senate, where the third-ranking Democrat, New York Senator Chuck Schumer, is perhaps its biggest defender, (His spokesperson notes that he has twice voted to repeal the measure since defending it in 2007.)

The gamesmanship may be overwrought, and corporate lobbyists say they’d be surprised if House Republicans really brought such an offer to the table, since Democrats would likely take it. After all, this isn’t the first time that conditions for closing the break have appeared ripe. On the other hand, even private equity leaders seem convinced that their low-tax days are numbered, and are looking to venture capital-style corporate structures for new ways to avoid the government’s levy.

Regardless, eliminating the loophole would only raise about $13.5 billion over 10 years, a significant amount of money but only a small part of the goal to cut $1.2 trillion over the next decade. Sources familiar with legislators’ thinking expect that, if the carried-interest tax break is eliminated, it will happen during a comprehensive tax overhaul, not as part of the deal to avoid a government shutdown by the end of March.

There is one other pertinent reason to believe closing this loophole will take a back seat to plans to cut tax preferences for corporate jets, petroleum companies, and multinationals keeping profits abroad. It’s found in this dispatch from Politico (emphasis added):

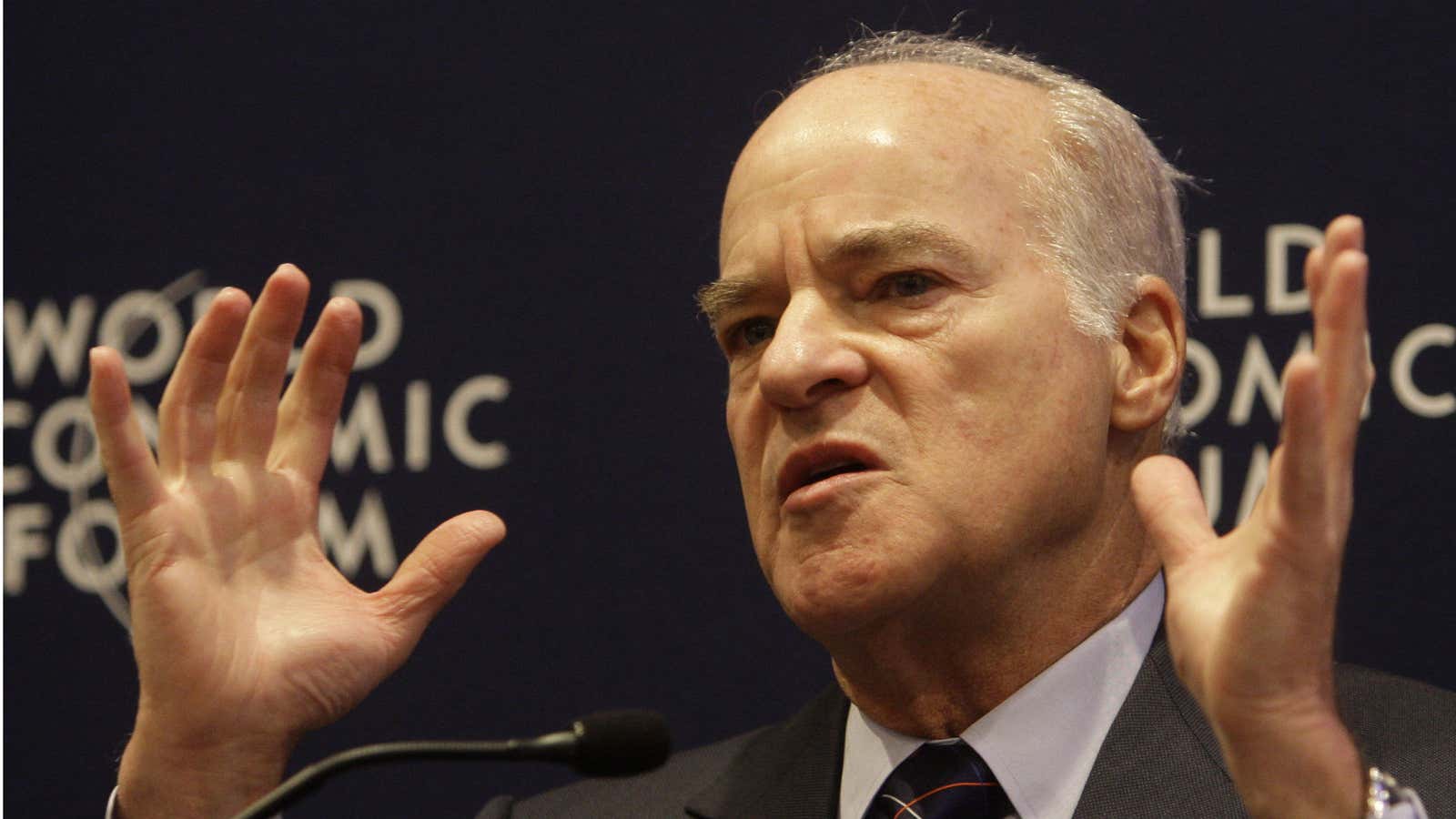

Florida Sen. Marco Rubio is moving swiftly behind the scenes to lock down some of Wall Street’s biggest donors ahead of the 2016 presidential race. In recent weeks, the rising GOP star and possible 2016 hopeful has quietly met with some of the most powerful GOP backers in the world of high finance. The roster includes Blackstone Chief Executive Stephen Schwarzman, KKR CEO Henry Kravis and senior executives at Goldman Sachs.

Which is to say: The financial sector’s influence on politics is still quite strong, indeed.