For many shoppers, sales are all about getting the lowest possible price. But this year, one brand has put a psychological twist on clearance shopping that may make you think twice.

Everlane, an online clothing company that prides itself on explaining why its simple, nicely made basics cost what they do, is currently running a five day sale to clear overstock. And instead of slashing prices, it’s letting customers choose which of three prices they want to pay.

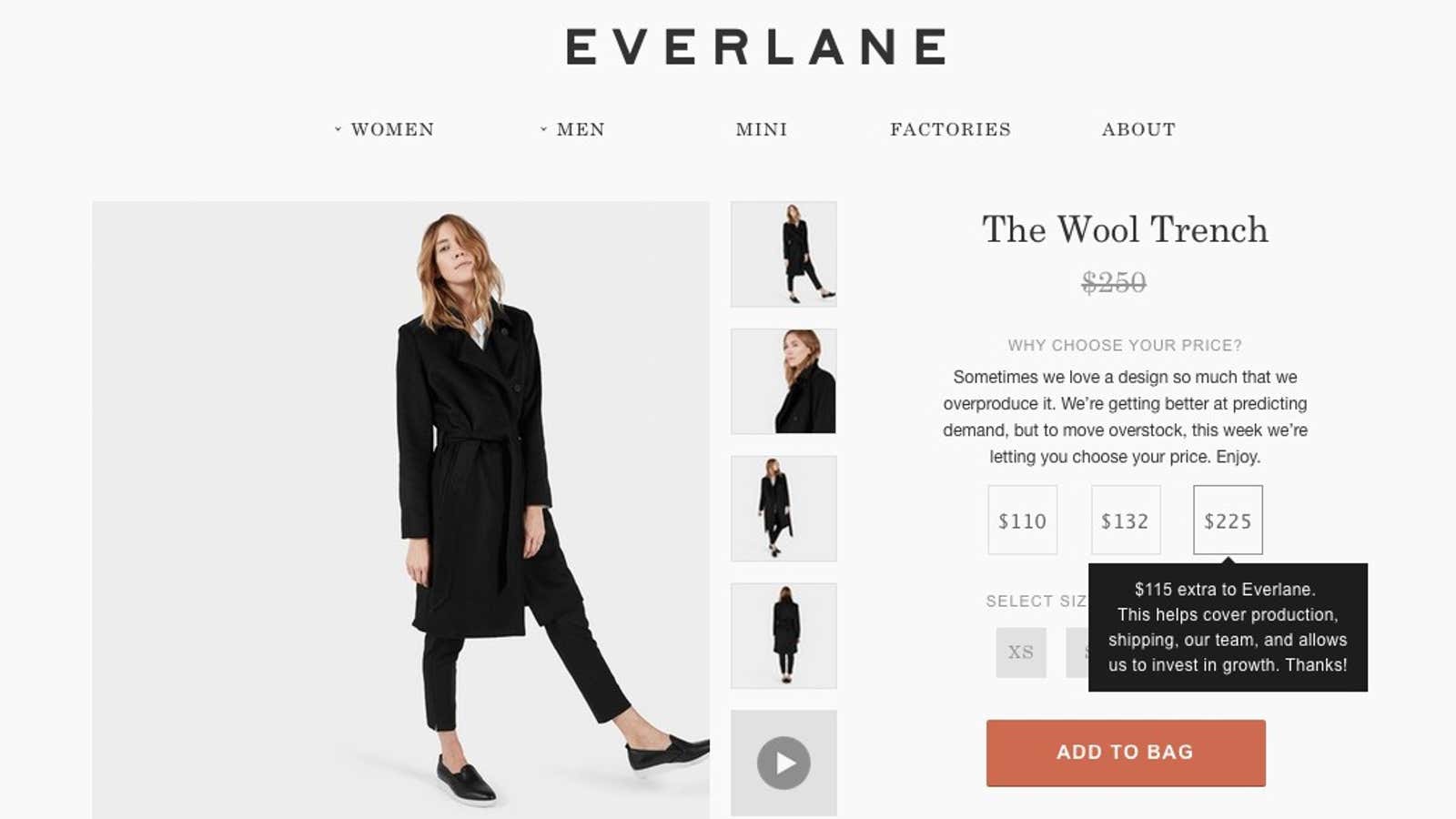

In each case, the cheapest price covers just the cost of producing the item and shipping it, and doesn’t factor in any of the overhead costs of Everlane’s 70-person staff. The middle price covers all costs, including staff, meaning Everlane breaks even. And the highest price covers all costs while giving Everlane a profit, which the company says allows it ”to invest in growth.” So here’s the moral dilemma: If Everlane has what you want, which price will you choose to pay?

A spokesperson for the company says it hasn’t yet pulled any data on which price most people are paying, and Everlane hasn’t decided whether it will share that information once it is compiled. But so far the three most popular items have been the Street Shoe, the women’s Slim Trouser, and the women’s Wool Trench. For a sense of the discounts on offer, the trench costs $250 retail. In the current sale, shoppers can choose to pay $110, $132, or $225.

The choose-your-own-price option is not just an intellectual exercise. Mass-market fashion is engaged in intense pricing competition that has increasingly pushed manufacturing into opaque, labyrinthine supply chains in Asian countries whose primary advantage is that their workers require the lowest pay. Brands that are faster at getting products to market, and cheaper than their rivals, tend to do well in this environment, but the paradigm is one Everlane professes to be against.

By asking customers to choose their price, Everlane is asking customers how much they support the company’s brand and growth. (It’s not exactly the same as asking consumers to choose to pay factory workers more, since Everlane is presumably eating the overhead costs, rather than recouping them by finding cheaper workers to make its goods.)

As website Fashionista noted, the brand isn’t normally known for discounting. Everlane, which launched in 2011, is apparently still perfecting its ability to predict demand, and just ordered too much stuff.