The Fed’s Beige Book is never really a stunner, as economic updates go. But reading the anecdotal round-ups from all of the Fed’s 12 district banks can really help you develop a sense of the prevailing economic winds.

One big signal is coming out of America’s natural gas patches, where new technologies are allowing drillers and producers to tap into previously unreachable reserves of gas trapped in shale formations. The ripple effects are huge: Fracking, and the money that comes with it, is reshaping behaviors among borrowers, automotive mechanics, utility companies and coal miners, among others. Here are some snapshots; highlights are ours.

Philadelphia Fed

- “In areas with Marcellus shale gas, several banks have described customers paying down loans with royalty money and avoiding further debt by paying cash. Beyond the gas fields, energy projects are attracting substantial investment interest and loan opportunities for larger banks.”

Cleveland Fed

- “A few [auto] dealers are considering increasing their sales staff if volume continues at the current pace. Dealers in the eastern part of the District are apprehensive about losing technicians to the shale gas industry, which may put upward pressure on wages … Shale gas producers expanded payrolls, while employment at conventional oil and gas firms was flat. We heard several reports of layoffs by coal operators.”

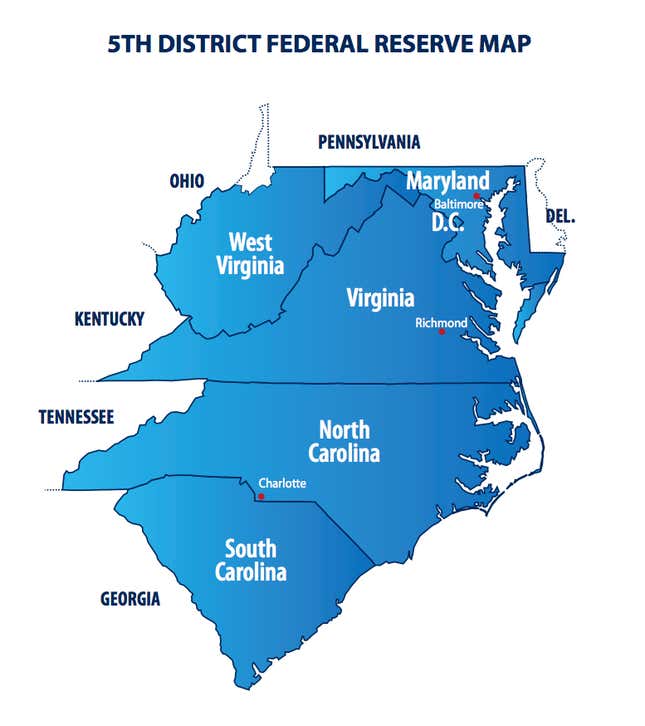

Richmond Fed

- “Coal production continued to fall, due to declining prices for natural gas and stricter environmental regulations. A manufacturer of equipment used in the coal extraction process pointed out that while the environment in the coal mining industry had been challenging, there is tremendous growth potential for coal producers in the global market, particularly in sales to China, India, and Germany. Another source stated that coal exports were up and that a coal operator who had never sold overseas before had thirty percent of sales in export markets for this year.”

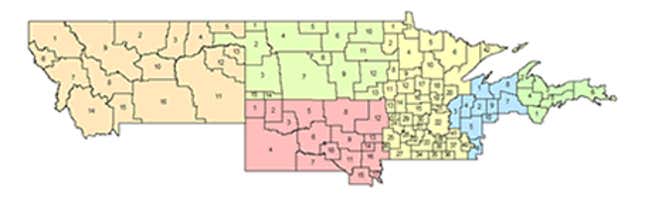

Minneapolis Fed

- ”A Minnesota electricity producer recently closed one coal-fired plant and converted another to natural gas to meet expected future pollution control rules.”

Kansas City Fed

- “Wyoming coal output continued to fall during January, which some contacts attributed to more demand shifting to natural gas, with gas prices remaining low.”

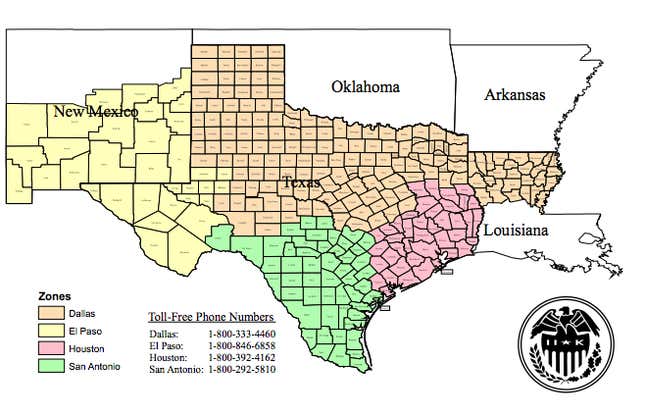

Dallas Fed

- “Energy activity in the Eagle Ford shale continued to drive lending activity in San Antonio, Houston and the surrounding areas.”