Carl Icahn popping up in Dell’s stock adds to the growing list of activist campaigns launched against large US companies this year to maximize value or gain board seats. So far, about 34% of targets have market capitalizations of over $1 billion, showing activists are going after bigger fish, according to FactSet data. Only about 24% of activist campaigns last year targeted companies with a $1 billion plus market value, FactSet data showed.

Activist campaigns based on shareholder value or board seats have risen every year in the last four years, according to FactSet. While some of the campaigns push for the usual options of breaking up or selling a company, many of them are increasingly focused on stopping a deal, like hedge fund manager John Paulson and P. Schoenfeld Asset Management opposing the proposed T-Mobile merger with Metro PCS.

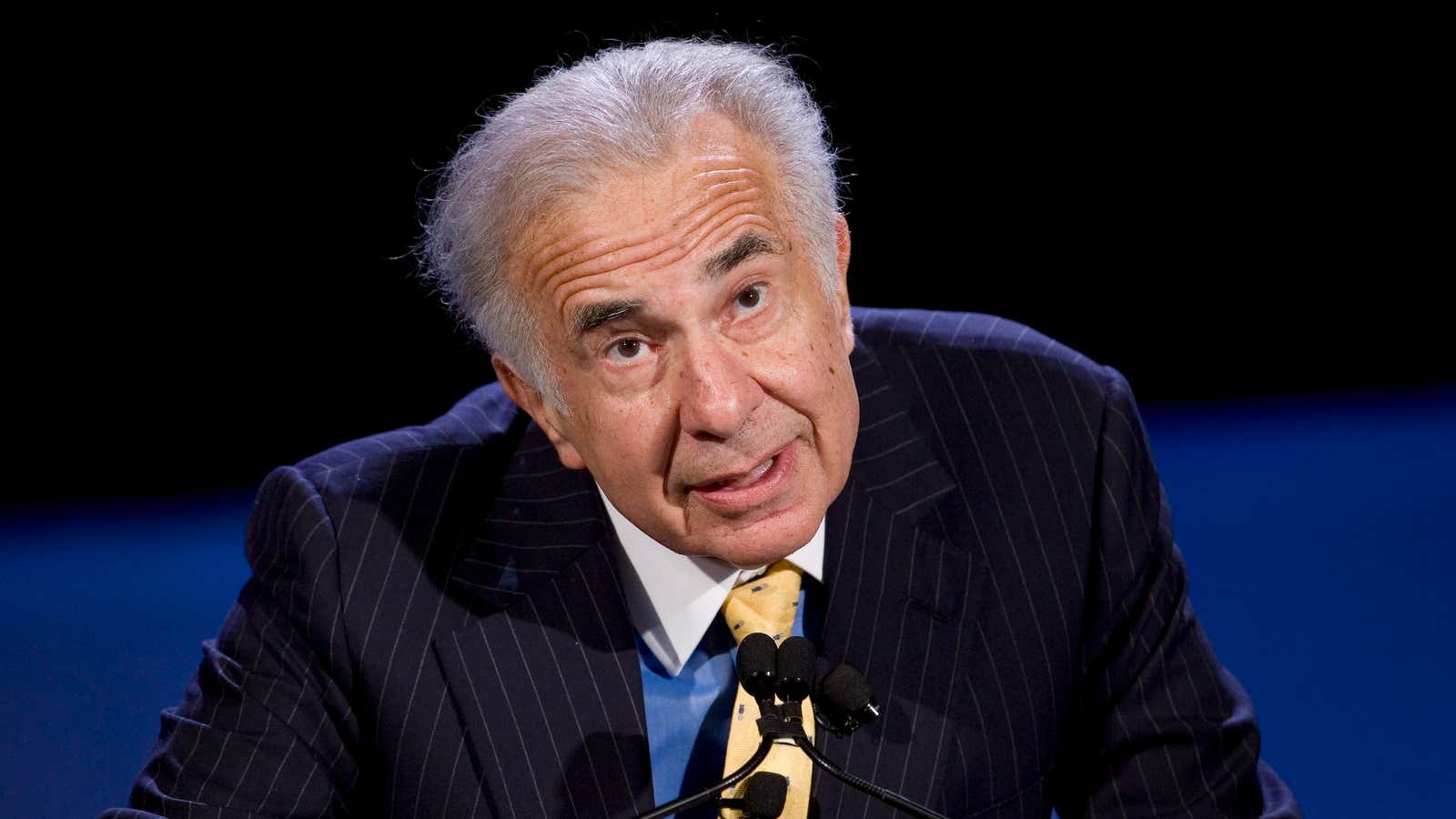

As for Dell, Icahn is the third known large Dell investor who opposes the $24 billion buyout of the PC maker by founder Michael Dell, private equity firm Silver Lake and Microsoft. The buyout group offered $13.65 a share for Dell, which Dell’s largest outside shareholder, Southeastern Asset Management, called “woefully inadequate.” Also against the deal are T. Rowe Price and now Icahn, who is seeking a $9 per share special dividend.

In light of this opposition, the Dell board special committee formed to assess a sale has said that it looked at all alternatives, including changing the dividend policy and selling only parts of the company. The committee is currently soliciting other offers to the current acquisition proposal, which is typical in a buyout deal. Although many firms end up taking a look during this process, called a “go shop,” it rarely results in another deal.

The fate of Dell and other proposed deals should be known later this spring, when many companies hold their annual shareholder meetings and investors will vote on the acquisitions. Until then, the companies and their activist investors will lobby for other shareholder votes through an array of meetings, PowerPoint presentations and letter campaigns.

Given the rise in activism, Michael Dell may end up ruing the day he decided to buy out his company. But, given the rise in activist campaigns against other big deals, he likely won’t be the only one with buyer’s remorse.