The numbers are in on 2012 and it was not the best of years for renewable energy, according to a report released today by market research firm Clean Edge.

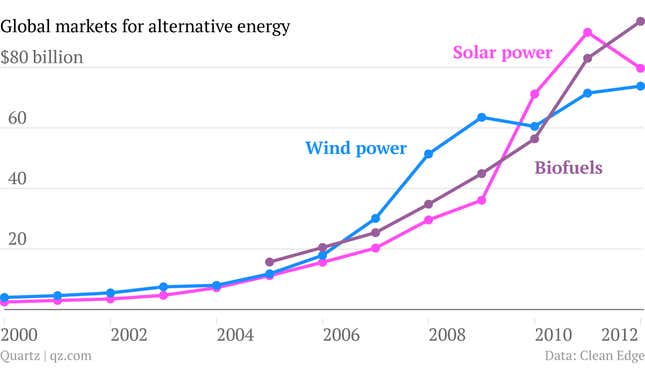

After years of breakneck growth, the value of global wind industry installations rose by just $2.3 billion from the previous year to $73.8 billion in 2012. Worldwide wind capacity jumped to a record 44,700 megawatts, but that was only about 8% up on the previous year.

The value of photovoltaic installations actually fell for the first time, from $91.6 billion in 2011 to $79.7 billion in 2012, as solar panel prices continued to plummet and Chinese manufacturers grappled with overcapacity. Total solar capacity hit a record 30,900 megawatts in 2012 but revenues fell for the first time in a dozen years.

Biofuels were the one bright spot, with the market growing to $95.2 billion in 2012 from $83 billion the previous year.

Last year “proved to be an unsettling and difficult year for clean energy,” the report’s authors wrote. “High-profile bankruptcies and layoffs plagued many clean-tech companies, overall venture investments retreated in the face of increasingly elusive returns, and the industry was begrudgingly transformed into a partisan wedge issue during the highly contentious US presidential campaign.”

So why does the green energy business seem to be in something of a funk? The shale gas boom is one reason, allowing investors and utilities to look forward to a cheaper, cleaner-burning fossil fuel that can provide power around the clock. The upheaval in the Chinese solar industry, home to 80% of the world’s photovoltaic manufacturing, and the failure of US startups developing next-generation solar technology to gain ground has also unnerved investors. And advanced biofuels have yet to make a commercial impact.

Still, Clean Edge estimates that the global wind, solar and biofuels market will grow from $248.7 billion in 2012 to $426.1 billion in 2022. And to put 2012 in perspective, the value of the worldwide wind market a decade ago was just $4 billion, the solar market was worth $2.5 billion, and the biofuels market was too small for Clean Edge to measure.

Venture capitalists’ enthusiasm for green technologies has waned as the market has grown and renewable-energy projects have reached the kind of size that needs more heavyweight funding. Total investment dropped from $5 billion in 2012 from $6 billion in the previous year.

Luckily, investors like Warren Buffett have stepped into the void. Buffett’s MidAmerican Energy Holdings, for instance, recently acquired two California solar power plants for $2 billion while Google has invested $200 million into a Texas wind farm. Google alone now has invested in renewable energy projects that generate 2,000 megawatts of electricity, enough to power 500,000 average American households at peak output—or a whole lot of server farms.