As market strategist Barry Ritholtz likes to say, Wall Street is littered with the bodies of economists who bet against the American consumer’s indefatigable urge to spend. If so, today’s update on US shopping in February likely left a few more corpses rotting in the shadow of Trinity Church.

Before their untimely demise, these economists had predicted a mere 0.5% increase in consumer spending for February, expecting that January’s payroll tax hike would leave people with less money to spend. That may have been logical, but it proved wrong. Consumer spending rose 1.1% last month, the fastest pace in five months. (That’s an important sign where personal consumption amounts to more than 70% of GDP.)

Now, a lot of that increase just came from higher gasoline prices. Gas station sales surged 5% in February. And Wall Street should have seen that coming: Gasoline futures traded in New York are up 14% so far this year. However, it wasn’t all gas. RBS economists note:

Even excluding gasoline stations and motor vehicle dealers, retail sales rose by 0.4%, firmer than expected. The control group (sales excluding autos, gas, and building materials) also rose by 0.4%. This is somewhat heartening, as consumers remained relatively resilient despite contending with higher payroll taxes and gas prices. Relative to its strength in November and December (0.68% average), retail spending excluding gasoline and autos has moderated rather than pulled back outright during January and February.

So what’s going on here?

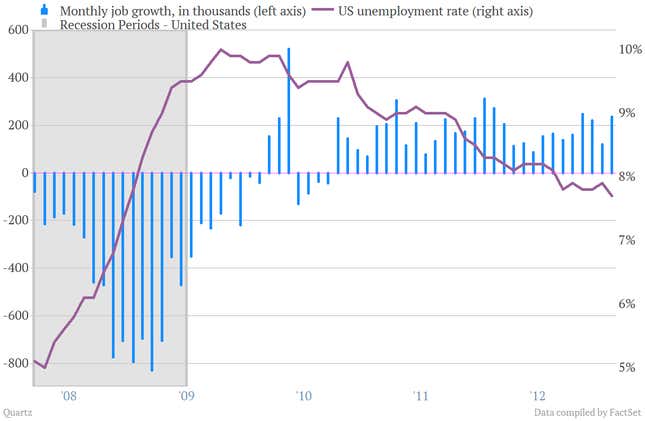

1. More jobs.

This is pretty straightforward. If more folks are pickup up paychecks that’s a good thing, even if those paychecks are getting pecked at by higher taxes to support Social Security and Medicare. Last month’s US jobs growth was unexpectedly strong.

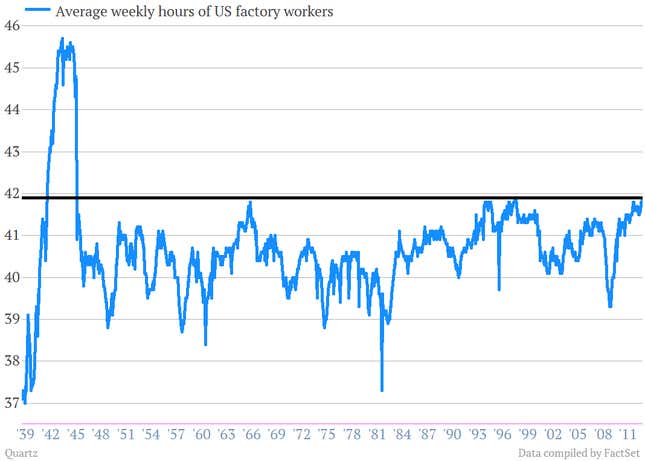

2. Workers are getting more hours.

Hours worked only move by small ticks. But they add up. At 33.8 hours a week in February, the average work week of private sector workers is matching its highest levels since the recession hit. In some sectors, such as manufacturing, it’s even higher. Bloomberg points out that the last time factory work weeks were longer, the US was churning out tanks to fight the Nazis.

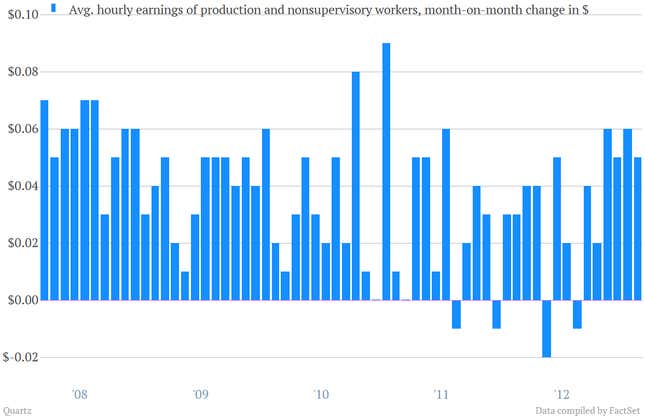

3. Pay is inching up, though really slowly.

They’re not enough to make anyone dance in the street, but over the last few months US production workers have seen the most solid string of wage increases since the recession hit.

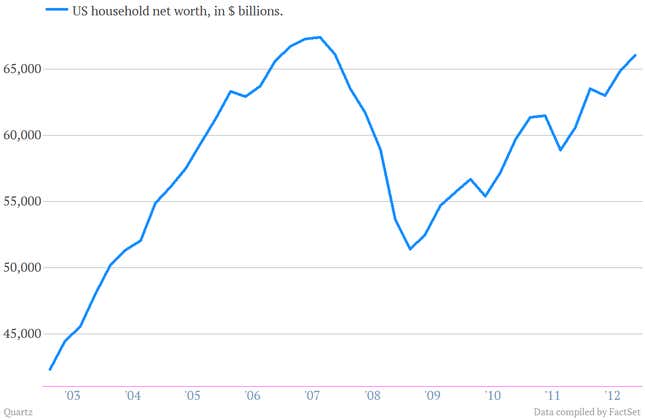

4. The “wealth effect” is in effect.

Along with the nascent recovery of the US housing market, the rise of the US stock market has done much to restore the $16-trillion decline in household wealth from the peak of the boom in 2007 to the trough of the crisis in 2008. The increase in prices of assets such as stocks and housing has long been linked to increased consumer spending, a phenomenon known as the wealth effect.

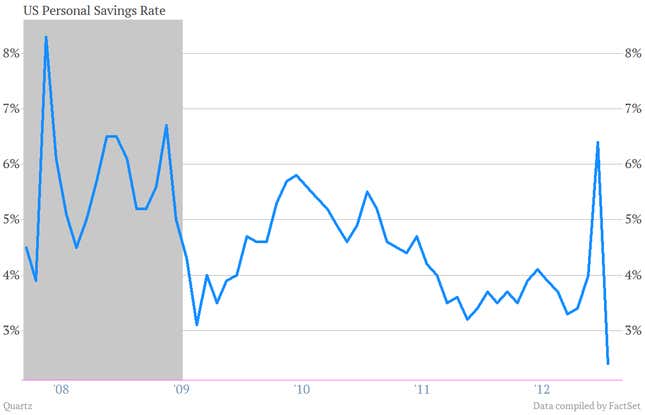

5. Americans might be returning to bad habits.

After a surge of special dividends and other payouts late last year—designed to sidestep tax increases—drove the US savings rate sharply higher, it collapsed in January to fresh post-crisis lows. This is not a good sign for those hoping that Americans might start squirreling away more pay in the wake of the crisis. But if it keeps consumer spending rolling, it could be a decent sign for the economy, at least for the short term.