One way to clarify the kerfuffle over JP Morgan’s London Whale losses is by boiling it down to simple question: Were traders in the bank’s London-based chief investment office (CIO) hedging—trying to reduce JP Morgan’s risks? Or were they simply betting—using deposit money to try to make profitable financial trades?

We all know that in the end the so-called synthetic credit portfolio (SCP), the set of troublesome derivative trades that lost the bank at least $6.2 billion, turned out to be a bet—a very bad losing bet. But it took a while for the bank to admit it.

JP Morgan first said the purpose of this portfolio at the CIO was to make financial bets aimed at offsetting risks the bank took elsewhere, such as by loaning money to businesses or homebuyers or trading with other banks that could possibly fail. Way back in April 2012, after a series of great stories broke about the potential size of the losses, the bank’s then chief financial officer, Doug Braunstein—who was barbecued over the Senate grill earlier this week—took the mic on a conference call to explain what the CIO does.

We have put on positions to manage for a significant stress event in credit. We have had that position on for many years and the activities that have been reported in the paper are basically part of managing that stress loss position, which we moderate and change over time depending upon our views as to what the risks are for stress loss from credit. All of those decisions are made on a very long term basis. They are done to keep the company effectively balanced from a risk standpoint.

All this verbiage translates basically thus: “We were hedging.”

But JP now freely admits—including Braunstein under oath this afternoon—that the CIO’s problematic position didn’t act as a hedge. JP chief executive Jamie Dimon changed the bank’s tune on that a while ago. In testimony before the Senate Banking Committee last June he said of the CIO’s trades, “this portfolio morphed into something that rather than protect the firm, created new and potentially larger risks.”

Fine. But were the CIO’s traders merely being over-zealous? Or is the bank being less than transparent about their true role? In the Senate committee’s report on the Whale trades, investigators argue “Mr. Dimon has not acknowledged that what the SCP morphed into was a high risk proprietary trading operation.”

Or to put it another way: Did they “morph”, or were they pushed?

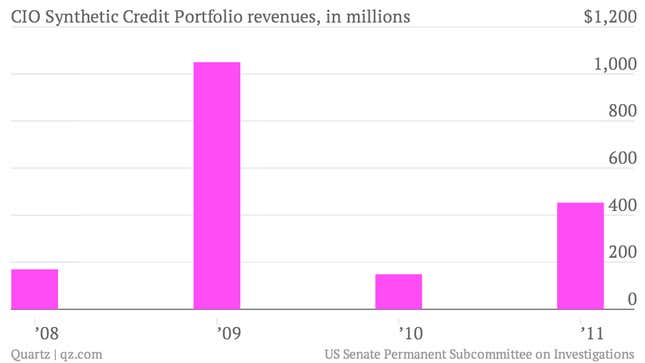

One thing is clear, the bank made a lot of money from the portfolio… At least, before it lost way more in 2012:

Defining the difference between a hedge and a proprietary trade is notoriously tricky. A hedge is supposed to offset losses or gains elsewhere, but it can end up making money and looking like a clever proprietary trade. And vice versa. ”I don’t think there’s a clear line of demarcation between hedging and speculating,” Charles Geisst, a finance professor at Manhattan College in New York told the Wall Street Journal. “There never really has been.”

So what makes the Senate think that these trades were proprietary trades and not just hedges? There are at least four things.

The traders weren’t being paid to hedge. If the point of making these bets was to offset other risks, it would make sense to pay traders for being especially good risk offsetters. But if the real goal was to make financially profitable bets, you’d design pay to reward profits. Here’s what the Senate report [PDF] says on that point:

Compensation that rewarded effective risk management would suggest that the SCP functioned as a hedge, while compensation that rewarded profitmaking would suggest that the SCP functioned more as a proprietary trading operation. The compensation history for key employees with responsibility for SCP trading suggests that the bank rewarded them for financial gain and risk-taking more than for effective risk management.

There was nothing specific the SCP was supposed to hedge. If something is a hedge, it has to offset something. But what? The Senate report says that unlike other “hedges” at JP Morgan’s CIO, the London Whale trades didn’t specifically outline what they were looking to offset.

In contrast, no line of business calculated the size of the credit risk to be offset by the CIO or provided a specific number or range to CIO to construct the SCP hedge, and the CIO did not provide routine information about the SCP “hedge” to either CIO managers or the Chief Financial Officer. According to JPMorgan Chase, the SCP’s “credit” hedge “did not have that level of discipline.”

The traders weren’t checking to see if the “hedge” was working. Ron Popeil would not have been good at financial hedging because you don’t just “set it and forget it.” Hedges are based on financial market correlations. And those correlations are always slightly changing. So if something is supposed to be an effective hedge, you’d want to check on it—often. The Senate report says:

A number of CIO hedges were recorded, tracked, and tested for hedge effectiveness, in part to qualify for favorable accounting treatment, but SCP hedges were not.

JP Morgan wasn’t documenting the hedges. The report again:

If the SCP had used credit derivatives as dedicated hedges, it should have triggered the bank’s standard hedging documentation procedures, at least in later years … Those procedures were used by the bank to qualify its hedges for favorable accounting treatment, but the annual report does not indicate that those procedures applied only to those types of hedges that received favorable accounting treatment. At the same time, despite this detailed description, JPMorgan Chase has not identified any CIO documentation indicating that credit derivatives in the SCP were subjected to any of the analysis or documentation described above.

Now, the banks have long argued that they sometimes do something called “economic” or “macro” hedging. Supposedly, this kind of hedging is designed to offset generalized economic risks that banks face, such as a slowdown in the economy. This is supposed to explain why traders couldn’t identify any specific risks they were offsetting.

Why does this matter? Well the still unfinished Volcker Rule—which is meant to prevent banks from making risky financial bets—permits bank trading only to facilitate legitimate banking business, such as market-making and hedging financial risks. So if the banks can get regulators to accept that “macro hedging” is actually legitimate under the Volcker Rule, that would blow a huge loophole through the rule and effectively allow banks a way to continue to do proprietary trading.

We’re glad, therefore, to see that the Senate investigators were skeptical of amorphously defined financial activities:

Without that type of specificity and a reasonable correlation between the hedge and the position being offset, the hedge could not be sized or tested for effectiveness. Rather than act as a hedge, it would simply function as an investment designed to take advantage of a negative credit environment.

It heartening to see such skepticism expressed by the Senate. But let’s hope that the Volcker Rule—whenever the final version of the rule is issued—is equally cautious about such bank “hedging.”