China’s Suntech Power, the world’s largest solar panel maker, has just failed to repay its $541 million of bonds.

Hedge fund Trondheim Capital Partners is on the warpath, threatening to sue Suntech if the company does not pay back what it owes. (Here is why Suntech is doing badly.)

Hong Kong based insolvency lawyers told Quartz winning such a case may be impossible. Not only do Suntech’s bondholders own a kind of debt that offers them scant legal rights. The Chinese courts often ignore the pleas of foreign investors that are owed money.

But their biggest problem is that they may only be able to sue an empty shell company that does not really own Suntech’s businesses.

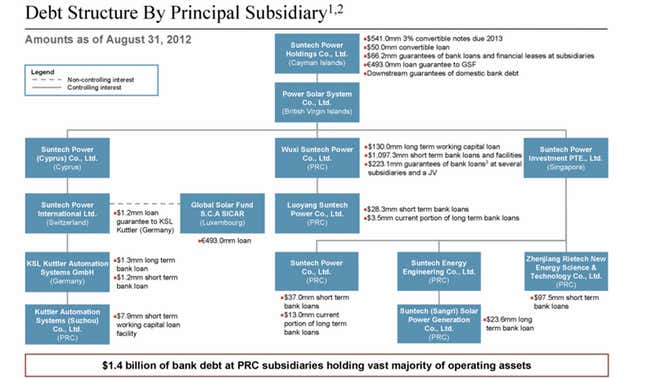

The bondholders lent cash to Suntech’s parent company, which is listed in the US but legally headquartered in the Cayman Islands. (Chinese companies often set up these offshore structures for tax reasons - pdf, p.17 – before listing overseas.)

The Caymans vehicle, Suntech Power Holdings, owns shares in the firm’s Chinese subsidiaries but no physical assets. And it is unlikely to have any cash.

This diagram from a Suntech presentation illustrates why. Suntech’s Chinese businesses owe $1.4 billion to Chinese banks. And the group’s legal structure includes a “downstream guarantee” from the Caymans vehicle which suggests the Chinese banks are able to grab funds that may be left in the Caymans shell. (Though someone familiar with Suntech said bondholders could sue the company to claim this downstream guarantee is not legally valid.)

Of course, the bondholders could sue Suntech Power Holdings. They would probably have to do this in the Caymans, as their agreement to lend money to the company was likely to have been struck under the Caribbean haven’s laws, lawyers said.

If they won their case, the Caymans ruling would not be automatically followed by Chinese courts. They could take their Caymans judgment to a Chinese judge and ask him or her to compel Suntech’s Chinese businesses to pay them back. But, sadly, Chinese courts mostly ignore foreign judgments, as solicitors from law firm King & Wood explain here.

Meanwhile, Suntech’s Chinese operations look set to be taken over by officials from its home city of Wuxi. That could save Chinese jobs, but Wuxi’s government is unlikely to feel obliged to pay anything to overseas bondholders, as American hedge fund manager Himanshu Shah told Reuters.

Such cashless government intervention is nothing unusual. In 2009, Chinese officials seized control of struggling Chinese yogurt maker Taizinai without paying the company’s foreign lenders anything. Municipal authorities in China also moved in (paywall) to run glassmaker Zhejiang Glass, whose shareholders included the World Bank.

Suntech’s bondholders are also hobbled because they own so-called “convertible notes” In debt restructurings, a legal principle called “structural subordination” means creditors must form a queue depending on the kind of debt they hold. Convertible bondholders are right at the back of the queue, just ahead of shareholders, who have the least rights. Banks tend to be at the front. For a longer explanation, see this primer. The upshot is that Suntech’s management is unlikely to be quaking with fear at the prospect of foreign bondholders taking the company to court.

As MIT Technology Review outlines here, China’s solar industry needs desperately to consolidate. It is oversupplied, and that hurts the entire industry. But the Chinese authorities probably will not allow Suntech to fail when the company employs over 20,000 staff. A Beijing bailout of Suntech’s more than $2 billion of debt would be the best result for the solar firm’s international investors. Then again, the Chinese state is unlikely to feel beholden to them.

A much worse scenario for overseas shareholders and bondholders is that Suntech’s US listing vehicle enters bankruptcy to escape its offshore debts, and delists. The company’s Chinese operations could then hobble on, with the Wuxi government strong arming the local branches of China’s famously forgiving state-owned banks to roll Suntech’s $1.4 billion of Chinese debt over for decades. But it is impossible to predict the future, and Suntech may have much more honorable intentions towards its overseas backers.