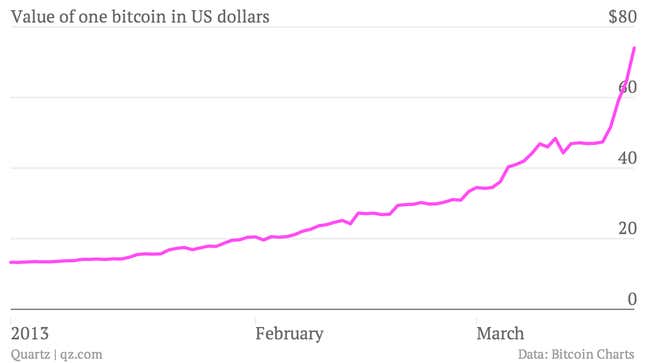

Bitcoin, the alternative currency hailed either as the future of money or speculative nonsense, has soared 57% this week, continuing its puzzling climb in 2013.

Analysts and people who help administer bitcoin have been at a loss to explain its newfound strength, beyond vague theories about increasing confidence in bitcoin’s viability as an accepted currency. This week’s surge is even harder to figure out.

Certainly, the crisis in Cyprus is undermining confidence in the euro and generally putting Europe on edge. Like gold, bitcoin usually rises in moments of uncertainty. Both assets are favored by critics of contemporary monetary policy; bitcoin has no central bank, a fixed supply, and is deflationary by design. And, indeed, bitcoin appears to be gaining popularity in Spain, where some nerves were rattled by the since-rejected plan to tax Cypriot bank deposits as part of the island nation’s bailout plan.

But none of that reasonably accounts for bitcoin’s stratospheric rise. It’s trading around $74 today, which is 145% above its value just a month ago, when the currency broke through an all-time high. Bitcoin’s market capitalization is now $819 million (€603 million).

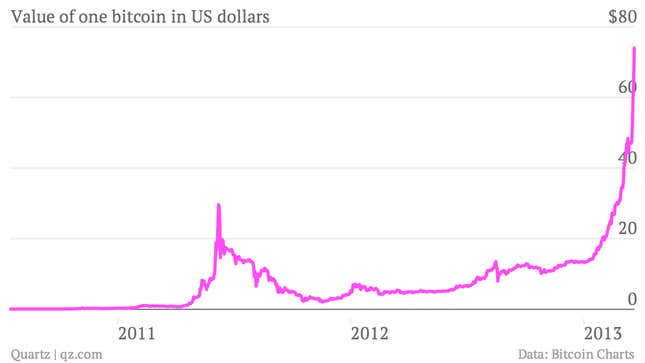

Instead, all signs point to a bubble. Here is bitcoin’s value over the course of its entire lifetime:

If you’ve got a decent theory for what’s going on with bitcoin these days, please feel free to get in touch by email or on Twitter.