Warren Buffett’s steely-eyed decision to pour $5 billion into Goldman Sachs during some of the darkest hours of the financial crisis has generated a return—both in cash and on paper—of roughly $3.1 billion. Goldman announced today that it has inked a deal to convert Buffett’s valuable warrants (paywall), or rights to buy Goldman shares, into a large ownership stake in the bank for the billionaire investor’s Berkshire Hathaway.

As a quick reminder, Buffett placed his bets on Goldman soon after the collapse of Lehman Brothers, when Goldman’s stock was falling sharply. It was seen as a tremendous vote of confidence by the country’s savviest investor. And with Buffett’s imprimatur, Goldman Sachs was able to go to the market and raise fresh capital by selling some $2.5 billion in stock. But Goldman paid dearly for the public-relations power of a Buffett investment.

Here’s how the deal was structured. Buffett’s Berkshire Hathaway invested $5 billion in Goldman. In exchange, Goldman gave Buffett:

1) $5 billion worth of “perpetual” preferred shares. While technically a share of stock, preferred shares are a bit more like a bond. They’re slightly safer than “common” shares, because—should anything like a bankruptcy happen—preferred shareholders stand in front of common shareholders in the line to get their share of the proceeds from the garage sale of the liquidated company. They also typically pay a dividend. Goldman agreed to pay a 10% dividend on those preferred shares to Buffett, which cost Goldman about $500 million a year.

2) Warrants for 43.5 million additional shares. Warrants are similar to options. In this case they were the legal right to buy a stock at a particular price, which for Buffett was $115 per share. The deadline for exercising these warrants was Oct. 1, 2013.

How much did Buffett make on the deal?

1) On the preferred shares, Goldman had the right to buy them back, and did so in March 2011, paying Buffett $5.64 billion. That included the original $5 billion in principal, as well as a $500 million bonus for early repayment, and $140 million in dividends Buffett was due. So Buffett made $640 million on his $5 billion investment, or about 13% over two-and-a-half years. Not too bad. But Buffett was also collecting dividends while he held the shares, amounting to roughly $1.1 billion. So all in, Buffett made about $1.75 billion, a 35% return.

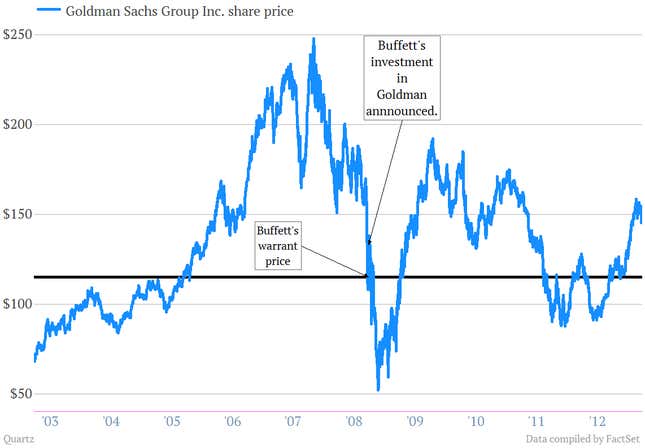

2) The warrants are a different story. They derive their value from the difference between the price at which Buffett was entitled to buy—$115—and the actual price at which Goldman shares are trading when he buys. At the time he got the warrants, Goldman was trading at around $125. Since then Goldman shares have see-sawed up and down, spending quite a bit of that time “underwater”—i.e., below the $115 level, which would have made the warrants a losing proposition for Buffett:

At one point, Goldman’s share price reached around $190. Had Buffett exercised the warrants at that point, and sold his shares at that price, he could have cleaned up. Instead, he waited some more, and the stock sank back underwater. In fact, it was only last year when the stock recovered above $115, and after breaching the $150 mark recently, it closed at $146.11 yesterday (March 25).

All of which goes to show that the famed Warren Buffett also sometimes finds himself at the mercy of market swings. And he has now apparently decided that it’s too risky to wait and see if the price starts to rise again before the Oct. 1 deadline.

Still, he makes a tidy profit—$1.35 billion. Under a revised deal with Goldman, he will get this money in the form of Goldman shares rather than cash, making him one of Goldman’s largest shareholders. So it’s only a paper gain until Buffett sells the shares. But a $1.35 billion paper gain is still a gain. So, all in, Buffett made about $1.75 billion in cash and about $1.35 billion in stock, or roughly $3.1 billion on the Goldman investment. That’s about a 62% return on a five-year investment. Not too shabby.