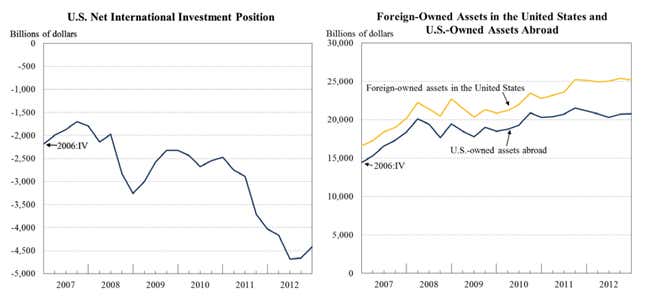

US companies and citizens had $20.7 trillion invested outside their home country at the end of 2012, according to government data released today. That’s a ton of money! But it’s not as much as the rest of the world has invested in the United States: $25.2 trillion, which is higher than ever before. The difference between the two numbers is called “net international investment position,” and for the US, it stands at -$4.4 trillion.

This tells us a few things:

- People love the American economy! Well, maybe not love it. But with other advanced economies in the doldrums (looking at you, Europe), sending your money to the US is a safe bet. About one-fifth of the foreign investment in the United States is from foreign governments, mostly other countries buying US government debt. (China’s stock of US Treasurys is about one-fifth of that.) Private citizens in foreign countries tend to prefer US stocks and bonds over public debt, another positive sign for the American economy.

- Could the investors who love the US economy destroy it? Probably not. Some worry that so much foreign investment means that the US is unusually dependent on foreign capital—in the 1990s, the net international investment position was around zero. More investment is generally a good thing—it creates jobs, new businesses, and allows the government to run deficits. But if those investors pulled their money out suddenly, say if Europe starts looking really bad, that could spread quickly to the US. Since the euro crisis began in 2009, however, foreign investment in the US has only increased.

- Foreign governments probably won’t screw up the US economy, either. China, America’s largest foreign debt holder, is frequently mentioned as a potential spoiler for America’s economic good times. What if it stops lending the government money in search of political leverage? This, however, misunderstands why China buys US assets; the purchases are part of their own export-driven trade strategy. Ending those purchases would mean painful adjustments in China. Incidentally, making those painful adjustments over time is the strategy US policymakers (and about some of China’s leaders) say the country needs to transition into the next stage of development.

- The US is the king of international investing abroad, but still not up to potential. The US is the world’s leading director investor abroad (PDF), while China is the leading recipient of foreign investment. But the US could do more with globalization: In 2011, US equities were worth about $15.6 trillion; that number is bigger today. But American investors only owned $5 trillion in corporate stocks abroad at the end of last year. Since the US economy is about a quarter of the world GDP—and a slower growing one, at that—there are likely missed opportunities abroad.

- Note the noise in the numbers. These valuations are market-based, so currency exchange and stock market fluctuations can significantly impact the final results.