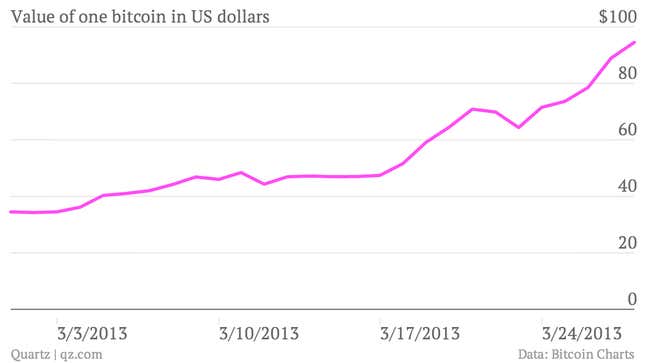

Digital currency bitcoin continues its remarkable and somewhat inexplicable run. It’s up 152% this month, and today the total value of all outstanding bitcoins—its market capitalization, if you will—topped $1 billion for the first time before settling back down.

That’s quite a milestone, considering bitcoin isn’t backed by any real asset or faith in any government. “A bitcoin’s not so much a thing as an understanding,” writes Paul Ford in a must-read essay about the currency in the new issue of Businessweek. His argument: Bitcoins are just as arbitrary as many financial instruments, like your average credit derivative packaged by a bank, but more interesting because they require trust in an idea rather than an institution.

Yes. What makes bitcoin so maddening to explain—no, there’s no central bank; yes, it really is just a bunch of people creating money out of thin air—is precisely what makes it so powerful. And to an increasing number of people, bitcoin is powerful enough an idea to create real value.

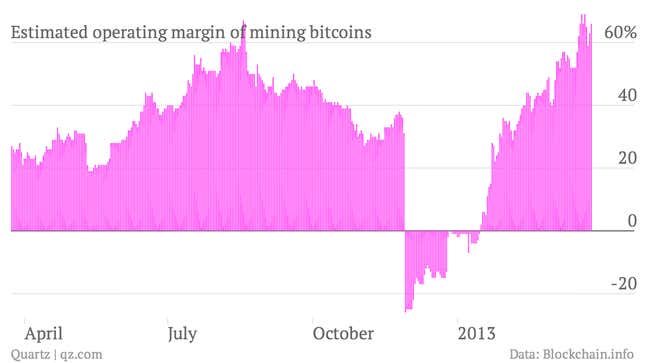

Look, the estimated margin on “mining,” or creating, new bitcoins has already recovered from December, when the rate at which new bitcoins could be minted was cut in half, part of the currency’s intentionally deflationary design. Anyone, from hobbyists to bankers to thieves, can mine bitcoins, which requires raw computing power dedicated to solving cryptographic puzzles.

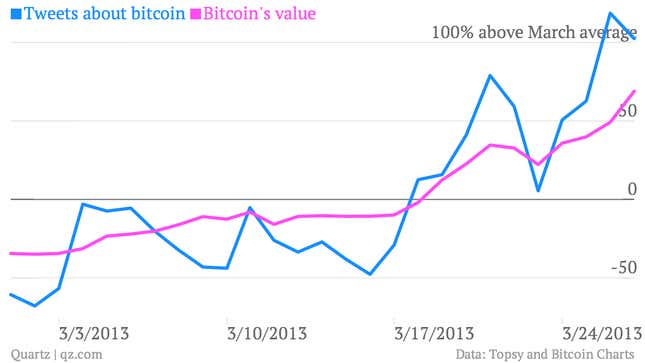

Last time I wrote about bitcoin’s surge, I cast doubt on the popular theory that it’s due to the crisis in Cyprus and asked for better ideas. (Here’s my email address.) The best explanations I received were the simplest: Bitcoin is going through a “demand crisis,” as Quartz reader Rees Sloan put it. That’s as obvious as it sounds—increasing demand for the currency is pushing its value higher—but framing it as a crisis emphasizes some other truths: As bitcoin’s value rises, so does interest in it, which drives the price up even further, leading people who own bitcoins to expect even more gain, making them reluctant to sell, reducing the available supply of bitcoins, driving the price still higher, leading to more interest, which…

Here’s a rough way of looking at interest in bitcoin explode this month, measured by the number of tweets mentioning the currency as compared to its value:

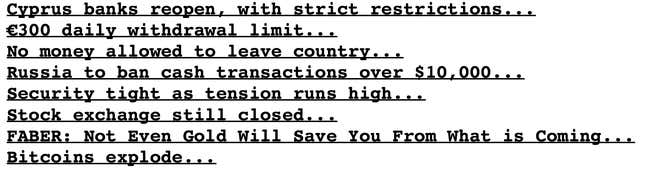

Here’s another way of seeing interest in bitcoin take off—this morning’s top stories on the Drudge Report, a favorite news site of American conservatives, where the world always appears to be on the verge of collapse:

That’s great publicity if you’re a bitcoin speculator, riding this surge to $100 before dumping the currency on a very eager market. It’s less encouraging if you believe in the idea of bitcoin as a truly alternative currency, unencumbered by sovereign governments, a refuge from the turbulence of monetary unions and fiat money. If that’s the bet you’re making on bitcoin, brace yourself: Just today, the value of a single bitcoin swung between $75.00 and $95.70.

Market forces tend to ruin good ideas.