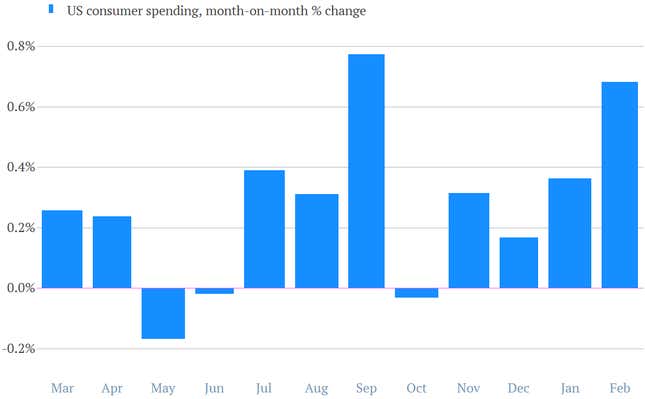

The US is a rare source of strength among the major world economies, and consumer spending is its cornerstone—worth about 70% of GDP. So it’s a clear positive to see that consumer spending posted a better-than-expected rise in February, increasing by a seasonally adjusted annualized rate of 0.7%, versus a 0.4% gain in January. Here’s a look at the gauge over the last year. You can see the consumer sector picking up the pace over the last few months:

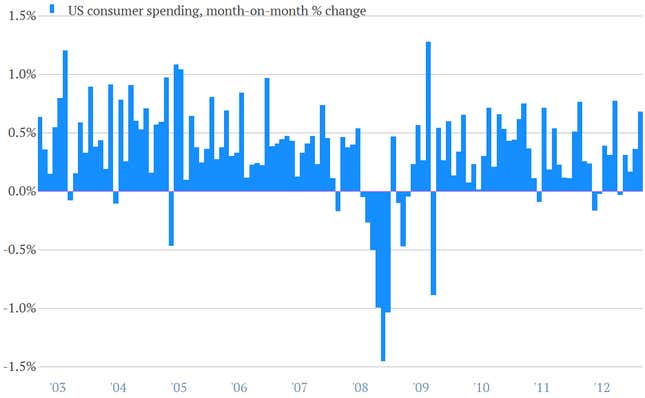

And here’s a look at the last 10 years. We’re clearly a far cry from the worst of the US recession. At the same time, we’re still not back to the superheated pre-crisis days.

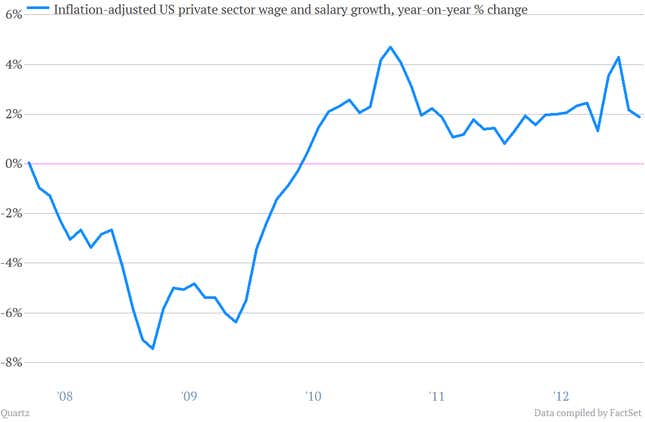

So why are Americans willing to spend? Well, it’s not because they all got a big raise recently. Inflation-adjusted private sector incomes ticked down during February to 1.9% from 2.2% in January.

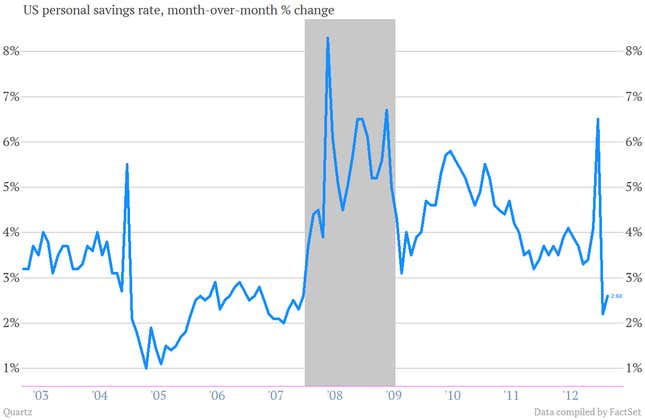

Part of the answer is that Americans are returning to the free-spending ways of the pre-crisis era. You can see that the personal savings rate, which ticked up modestly to 2.6%, from 2.2% in January, is near its lowest level since the Great Recession—the gray bar—hit.

In the short term that’s a good thing for the economy. But it also suggests that, as traumatic as the Great Recession was, it didn’t result in any fundamental change to the problematic way the US economy operates.