A surprising new estimate finds that only 24% of US corporate stock can be taxed by the US government because the rest is held in tax-free accounts.

The research from the Tax Policy Center has important implications for the debate over corporate tax reform in the US and how to tax capital in the new US gilded age.

While cries of double-taxation of corporate profits abound in arguments against steeper taxes on capital gains, many of America’s largest corporations use aggressive tax planning to shift profits overseas and reduce taxable revenue, shielding these earnings from the first step in taxation. And according to the Tax Policy Center, a centrist think tank operated jointly by Urban Institute and Brookings Institution, “relatively few shareholders pay the second level of tax on corporate earnings,” leaving a major stream of income out of the reach of public coffers.

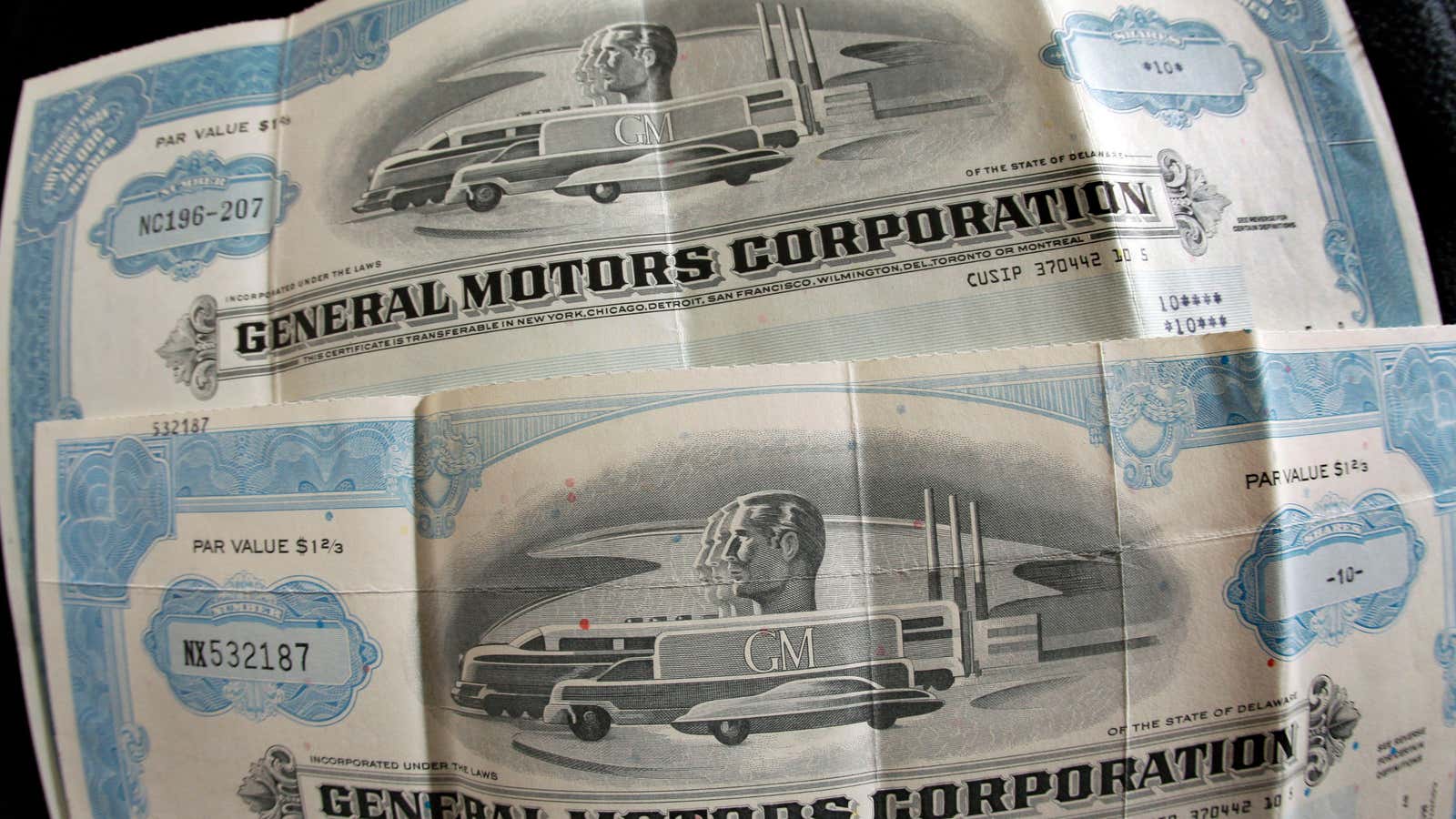

By law, owners of US corporate shares must pay a tax on their gains when they are realized; if the stock is held for a year or more, the tax rate is 15%, or 20% for individuals whose annual income is more than $415,050. But this doesn’t apply to stock owned in pass-through accounts or tax-preferred retirement and college-savings accounts.

Tax Policy Center researchers Steven Rosenthal and Lydia Austin stripped out the holdings in tax-preferred accounts and others that would avoid regular capital gains tax rates (like stocks held by nonprofits) and found that only $5.5 trillion of $22.8 trillion in US corporate stock, or 24.2%, is currently held by households in taxable accounts.

This is far lower than the Federal Reserve’s most recent estimates showing households own 50.3% of the value of US corporate stock. According to the researchers, the Fed estimate is based on overly broad definitions that include stock held in IRAs and stock held by nonprofits, among other categories of holdings that are exempt from regular capital gains tax.

The Tax Policy Center’s findings come at a time when effective capital gains taxes are lower than they have been in over 30 years. This chart shows average effective tax rates through 2009, the latest data available:

About 37% of the stock identified by the researchers was estimated to be in tax-preferred retirement accounts, like the 401(k) or IRA. On the one hand, this can be seen as a something of a victory for retirement planning, even at a time when most people aren’t saving enough money for retirement.

In 2015, tax breaks for defined-contribution plans like 401(k)s and IRAs amounted to $78 billion, per the Treasury Department. It’s no small amount—it equals roughly 18% of the $438 billion the US government borrowed last year. While the goal of supporting retirement is laudable, critics of these plans note that the benefits skew dramatically toward the richest Americans, who invest the most.

One 2013 estimate (pdf) by the Congressional Budget Office suggested that the lowest 20% of earners would see a benefit of 0.4% of their after-tax income thanks to retirement tax breaks, while the top 20% of earners would see a benefit of 2.0% of their after-tax income.

With this all may seem technical, businesses are pushing the next US president to take on corporate tax reform. It will be impossible to balance the need for revenue, retirement security, and a fair shake without figuring out not just when, but even if, capital will be taxed.