Yes, American households are wealthy—incredibly wealthy.

And they’re getting wealthier, at least in the aggregate, according to the latest quarterly numbers from the Federal Reserve. A recovery in housing prices helped push US wealth up to a new record during the quarter.

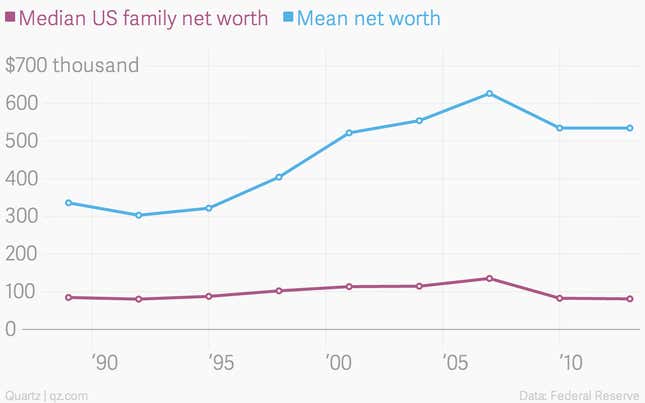

But no one lives in the aggregate. They live in their own individual household. And if we look at median, instead of average levels of wealth, the typical American household actually look a lot less wealthy.

What gives? Inequality gives. (Or takes.) The US is one of the most unequal rich countries, with roughly 80% of the wealth owned by the top 10%. The farther up the wealth scale you go, the more unequal it gets. The richest 1% of the country controls 37% of the wealth, according to the OECD.

These numbers from the OECD are from 2010, when the US economy was struggling mightily in the aftermath of the Great Recession. But there are some fresher numbers from the Federal Reserve for 2013. The Fed’s numbers showed that 90% of Americans saw there average net worth decline between 2010 and 2013. And the median net worth—a good gauge of how a typical family did between 2010 and 2013—shows that net worth fell 2% to $81,200. (The Fed only collects these numbers and publishes them every three years. An update isn’t due until 2017.)

In case you missed the point, it’s meaningless that headline US household wealth is hitting a record high. It doesn’t tell you much about the well-being of most of the country. The unequal distribution of wealth in the US means that the overwhelming majority of that wealth is going to a relatively small sliver of the population.

And wealth matters a lot to peoples’ lives.

While economists have long-noted a significant correlation between levels of income—essentially annual pay—and happiness, some studies have suggested that stored wealth has a greater impact on reported levels of happiness. “The association between household wealth and happiness seems unambiguously positive,” wrote Claudia Senik of the Paris School of Economics, in a 2014 paper on the topic. “Wealth plays the role of a buffer stock and a source of symbolic value.”

This is entirely logical. People don’t just want a paycheck, they want to build a cushion that will keep them secure as they age, and perhaps allow them to pass something along. And for many US households, that cushion remains far thinner than it was before the Great Recession.