JC Penney CEO Ron Johnson was brought in to turn around the ailing retailer. Instead, he made the situation worse, and sales fell dramatically under his reign. Today the board’s patience finally ran out.

Johnson is out, and in a game of musical chairs, JC Penney is bringing back Johnson’s immediate predecessor, Mike Ullman. The move doesn’t instill confidence in JC Penney’s board or the retailer’s turnaround prospects.

Ullman was initially praised for his first few years at JC Penney, making it a bit more hip and nimble. But then the financial crisis hit, and though Ullman cut costs, he fell behind competitors like Macy’s and Kohls. Activist investor Bill Ackman got into JC Penney’s stock in 2010 and agitated for change, eventually bringing in Johnson.

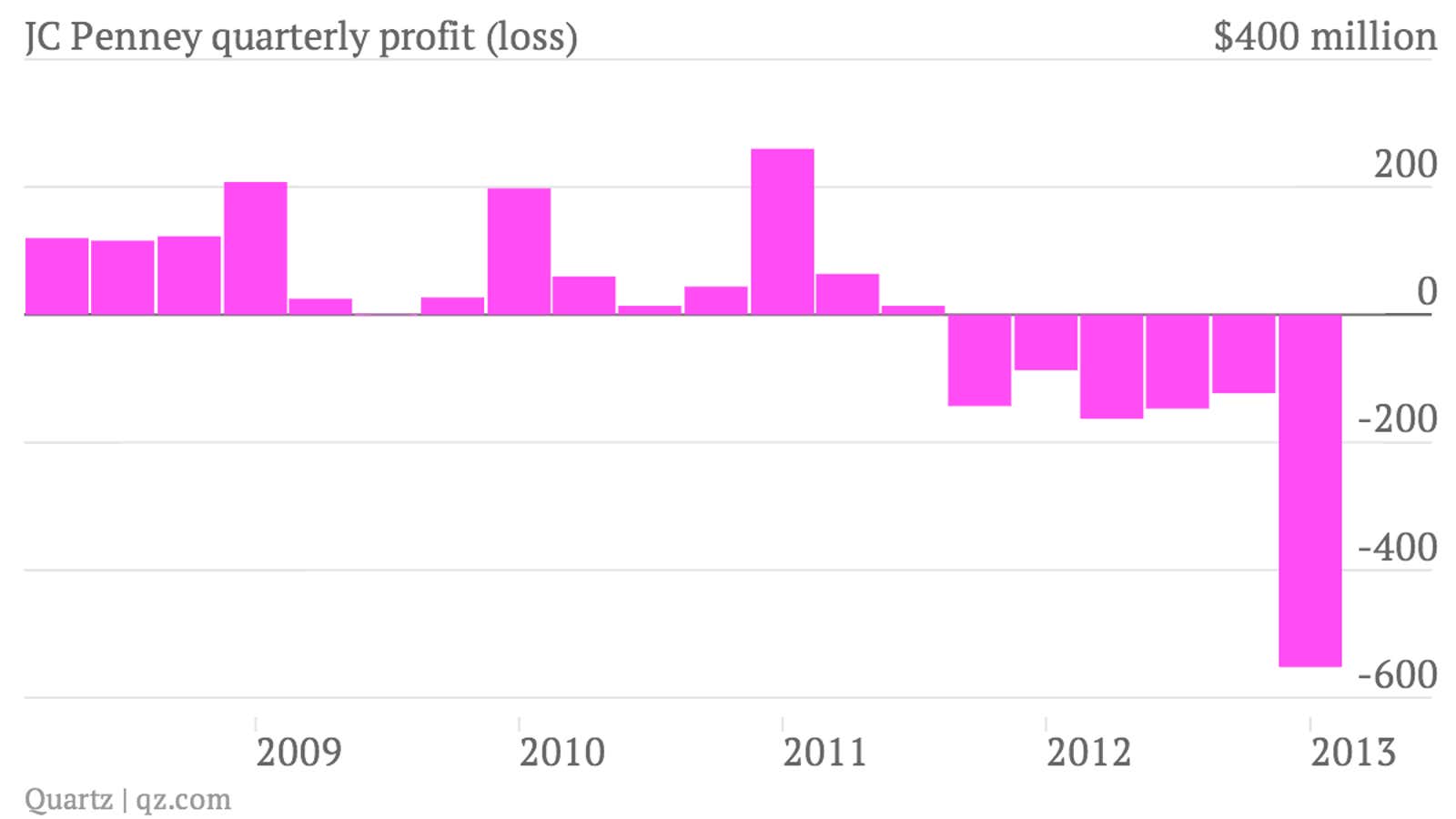

Johnson’s background as a retail guru at Apple and Target was initially cheered by JC Penney investors. But then he got rid of the retailer’s popular discounts and coupons, causing customers to flee. Sales fell off a cliff, and Johnson’s pay was cut by 96%.

He did bring back the price cuts, and JC Penney once again advertised sales. He also revamped JC Penney stores and launched boutiques selling home goods last week. But there was worry that a bulk of JC Penney’s old customers weren’t coming back. The redesign of stores was also a cash burn for the retailer.

Ackman initially said he would give Johnson three years to turn JC Penney around. On April 5, Ackman said Johnson had made big mistakes at the retailer. His criticism last week was the final indicator that Johnson’s time at JC Penney had run out.

Not surprisingly, the market reacted positively to the news of Johnson’s ouster, sending JC Penney’s stock up by about 4.6% in after market trading. But then the news hit that Ullman was his replacement, and the stock was down by more than 11%. Bringing back the guy who failed in a turnaround to replace the other guy who also didn’t succeed makes it seem like the retailer could be a lost cause.

As for Ackman, the JC Penney investment shows that he’s better off sticking to other sectors. His investments in Borders and Target were also busts.