Just a few years ago, the shadow banking system brought the world’s largest economy to its knees. Will it do the same to the world’s second largest?

Shadow banking—essentially when companies that aren’t regulated like banks start behaving like banks—is most definitely alive and well in China. And its growth is a key reason credit ratings firm Fitch cut its default rating on yuan-denominated debt today. The rationale is pretty plain. “Risks over China’s financial stability have grown. Credit has grown significantly faster than GDP since 2009. China experienced the second-fastest expansion of credit in real terms, behind only Qatar, between end-2009 and end-June 2012. The stock of bank credit to the private sector was worth 135.7% of GDP at end-2012, the third-highest of any Fitch-rated emerging market,” Fitch analysts wrote.

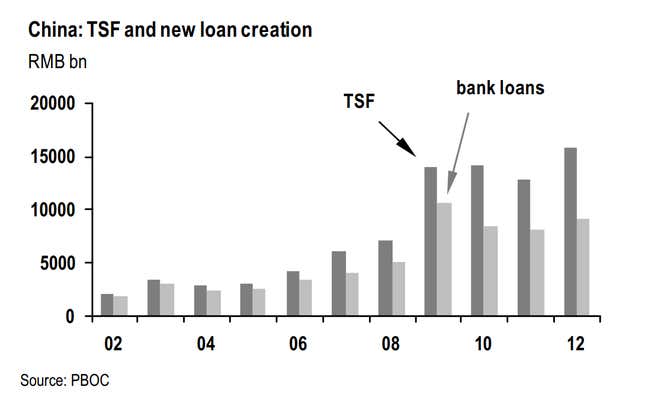

And that credit growth is increasingly coming outside the banking system. Here’s a chart that shows how growth in Chinese credit—tracked using a statistic called “total social financing,” or TSF—is outpacing bank lending, from JP Morgan researchers.

And the trend continues into 2013. Fitch says just 55% of the new credit created in 12 months ending in February came from banks, that’s down from 76% in 2009. “The proliferation of other forms of credit beyond bank lending is a source of growing risk from a financial stability perspective,” Fitch wrote.

The most worrisome source of credit growth outside the banking system is probably the wealth management products that have cropped up in China over the last few years. Essentially, Chinese folks have gotten fed up with low yields on bank deposits. And they’ve moved to “wealth management products,” that offer a much higher yield. Essentially, they make a deposit. The wealth management firm then turns around and lends these funds out, often to dubious land developers, for a much longer term. What could possible go wrong? Clearly, everything. And with some 7.1 trillion yuan wrapped up in wealth management—that’s about 7.5% of all Chinese bank deposits—a widespread run on wealth management funds would be disastrous.