For Egypt’s economy, the small Gulf kingdom of Qatar has proven to be quite the veritable fairy godmother. Qatar has already provided Cairo with a whopping $5 billion since June to support its struggling economy, and pledged an additional $3 billion in aid last week as a cushion until the country is able to reach a loan deal with the International Monetary Fund (IMF).

The alternative is financial collapse.

Yet given such consequences, Egyptians hardly view the overtures as acts of kindness. Rather, Egyptians worry that each influx of capital chips away at its hard-won independence from dictatorship. Following news of Qatar’s latest financial aid, writer and blogger Bassem Sabry tweeted “Qatar has effectively annexed Egypt as of this morning.”

Popular television satirist Bassem Youseff, facing prison for his criticism of president Mohammed Morsi, recently mocked Qatar’s backing of the Muslim Brotherhood-tied government through a parody of an Arab nationalist song. His version: “Qatari, how your money fills my land…Qatari, give me more and I’ll be satisfied” and “Sell your Suez Canal, and take from their [Qatar’s] grace … Sell the pyramids and build another two.” The video went viral.

To be sure, nationalism is at stake and Egypt has a right to be fiercely protective of its sovereignty after the Arab Spring. But as the following financial charts demonstrate, until the country is able to come up with a sustainable economic solution, it may not work in its best interest to bite the hand that is literally feeding it.

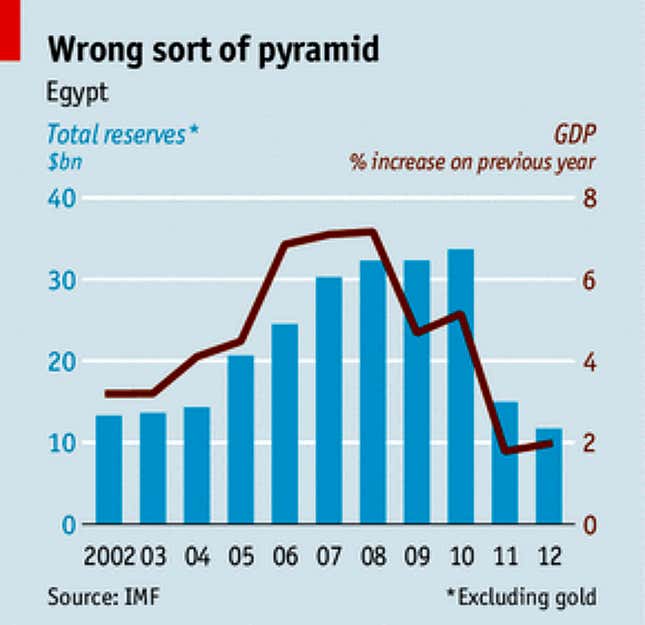

FOREIGN RESERVES ARE ON LIFE SUPPORT

This chart, compiled by the Economist using IMF data, shows Egypt’s total foreign reserves, excluding gold, in comparison with its GDP growth over the past 10 years. The decline is staggering on both fronts. GDP growth has tumbled from 5.1% in 2010 to around 2% in 2012. And foreign reserves, which stood at around $36 billion at the start of the Egyptian revolution, have slid to $13.4 billion in April – a critical level that would cover just three months’ imports. Keep that in mind when considering that Egypt’s import bill last year was $58.6 billion, according Central Bank figures. To tackle the decline, Egypt has aggressively sought to minimize the imports of non-essential items. Among the items deemed non-essential are some imported fuels, leading to power cuts throughout Egypt. Roughly 56% of Egypt’s natural gas consumption is used towards the electricity sector and the country has already declared rolling power cuts to save on resources. Qatar, as part of its most recent aid, has offered to provide Egypt with natural gas through the sweltering summer to alleviate some of the expected shortages.

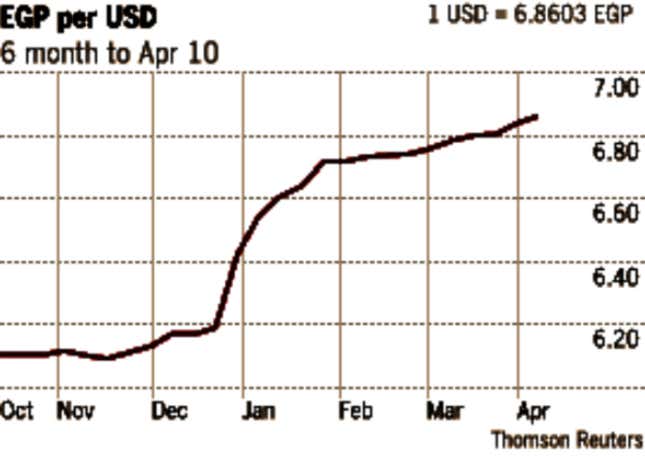

CRITICAL CURRENCY DEVALUATION

Tied in to the ongoing concerns over foreign reserves is Egypt’s steep currency depreciation. As evidenced by the above chart from the Financial Times, the Egyptian pound has taken a beating against the dollar, losing a tenth of its value since the end of last year. In December, Egypt’s central bank introduced foreign currency auctions to ration dollars in a bid to conserve foreign reserves. That’s led to a rise in black market currency trading. Qatar’s injection of funds this month, allowed the Egyptian government to hold a special auction of $600 million in order to pay for the import of basic foodstuffs, such as wheat, meat and cooking oil. Experts expect more such auctions will be needed to meet basic demands.

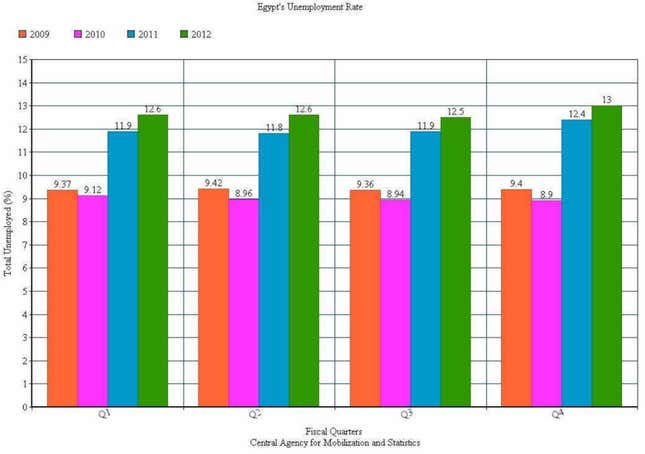

UNEMPLOYMENT ON THE RISE

As currency continues to decline, inflation is on the rise. Inflation held at 7.6% in March, a drop from 8.2% in February, but still a significant climb from less than 5% in December. For Egyptians, this rise in the cost of living couldn’t come at a worse time; unemployment is also steadily increasing. The chart above, based on data from the state-run Central Agency for Public Mobilization and Statistics (CAPMAS) and compiled by economics blog Rebel Economy, shows that unemployment stands at 13%, a historic high. To put it into context, there are now 3.5 million Egyptians out of work. According to a statement by CAPMAS: “Holders of intermediate, university and higher degrees—some eight out of ten of whom cannot find work—have been the most affected by skyrocketing unemployment.” The rise in unemployment is fueled by the decimation of some of Egypt’s key sectors. Tourism, for example, which once made up around 12% of Egypt’s GDP has been hammered due to political strife and safety concerns. A February report on tourism and travel by the World Economic Forum ranked Egypt below countries such as Pakistan and Yemen in its safety and security category. That’s a troubling development for a country that needs tourists to return. But Qatar has pledged, in addition to the $8 billion it will provide in aid, an additional $18 billion over the next five years within Egypt. Among its projects is a $10 billion tourist resort off of the Mediterranean coast. Such investment will inevitably lead to jobs.

There is no debate that after 30 years under the boot of former president Hosni Mubarak, Egyptians have a right to be the rulers of their own country. Qatar, for all of its apparent generosity, remains an unknown variable when it comes to its long-term agenda. But Egypt is at a tipping point economically. The country is nowhere closer to a deal with the IMF and aid from countries, such as the United States, number only in the millions of dollars, not the billions needed for survival. It is a country in economic and political disarray. Pushing away the Qataris at this crucial stage may result in some initial nationalistic fervor. But nationalism alone will not keep the lights on or allow for Egyptians to eat their daily bread. For that, in the short-term at least, Qatar is their best chance.