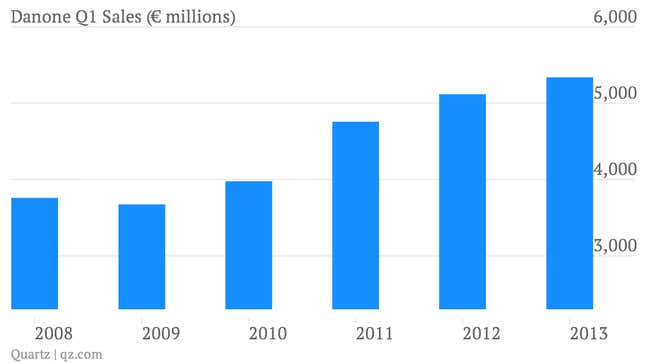

The numbers: France’s Danone reported revenue of €5.34 billion ($7 billion), up 4.3% and beating analyst expectations of €5.28 billion. Sales excluding factors such as currency fluctuations also exceeded analyst expectations, jumping 5.6%, compared with the projected 4%.

The takeaway: The food company—whose consumer brands include Danone dairy products and Evian water—is doing a solid job of offsetting the effects of the European downturn with a shift toward emerging markets. For instance, while sales were up 10% in emerging markets and North America, European sales fell 5.1%. The company highlighted during its earnings call that sales in Italy and Spain were particularly grim. And Danone will only be contributing to that sluggishness: as part of a cost-reduction plan, it will be slashing around 4% of its European workforce this year.

What’s interesting: Danone is making a killing off China’s ongoing struggle with tainted foods. Baby food sales rose a whopping 17%, buoyed by China’s infant formula-hoarding. Meanwhile, the company said that Chinese demand for bottled water was a top growth-driver, as well. Demand for those products is driven by concerns about extreme pollution and tainted food products.