JC Penney, epitome of the troubled retail industry, has attracted a big-name investor: George Soros reported a 7.9% stake in the company to the SEC, sending shares up 6% in after-hours trading.

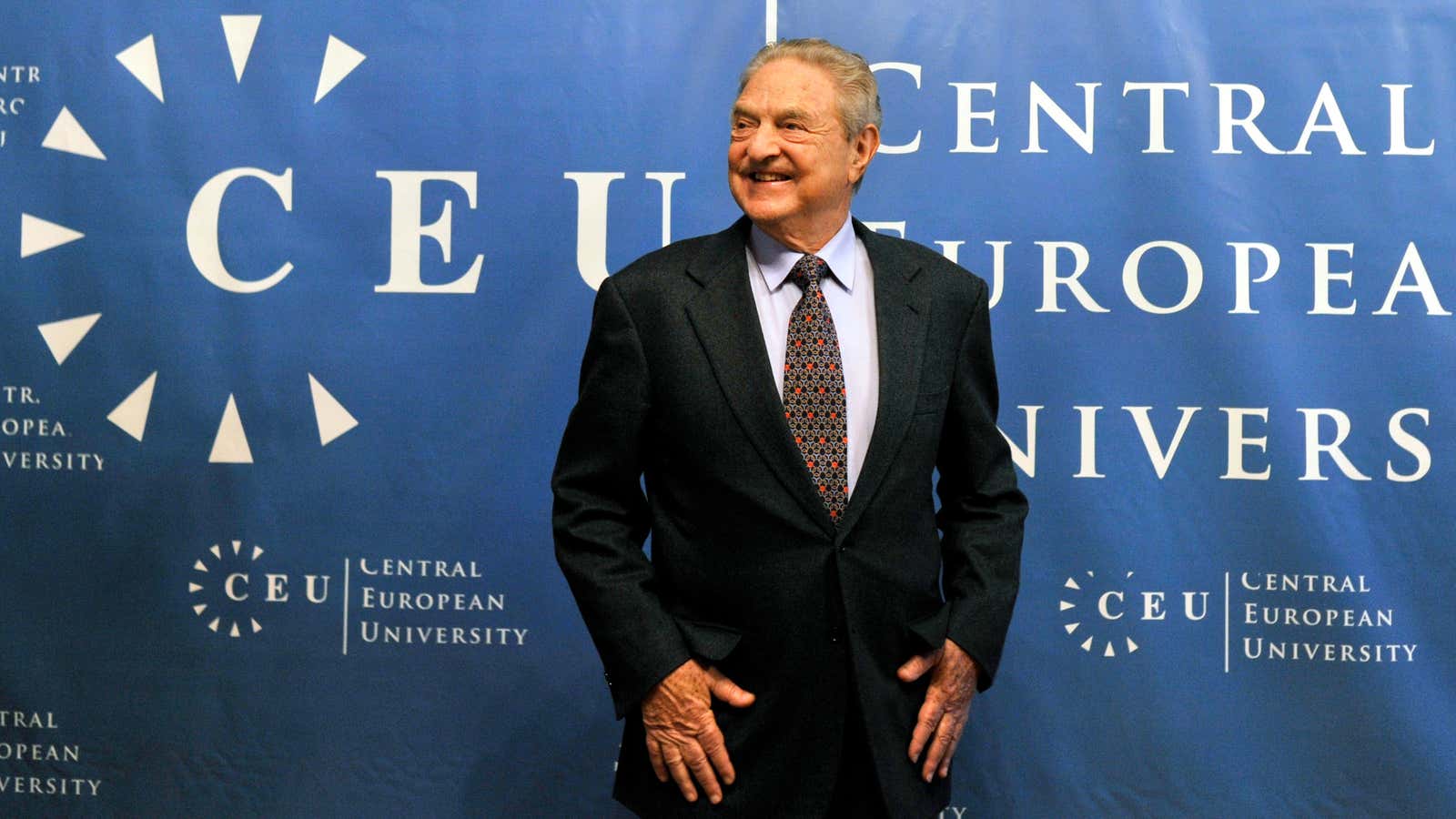

Take this as further proof that the legendary investor, whose obituary was prematurely published a week ago, is still very much alive.

Yes, this is the same JC Penney trying to raise $1 billion to reassure its vendors it won’t run out of cash. The same whose sales dropped by a third during the 2012 holiday season. The same one that recently ran its purported rescuer, Apple store creator Ron Johnson, out of the executive suite, replacing him with his predecessor, Myron Ullman.

So is Soros an optimist about JC Penney? The jump in its share price after his purchase might be due to other investors figuring that the man who broke the pound has some special insight into the company. But more likely they are on the same mission he is: speculation.

Unlike JC Penny board member and fellow hedge funder Bill Ackman, who owns 18% of the retailer and thinks the the company’s stock should be worth five times its current trading value, Soros probably doesn’t expect a big turn-around. While Ackman is known for riding investments through bankruptcy and into profitability, Soros’s strategy often takes advantage of short-term volatility and high leverage for profit.

In short, Soros is probably expecting to profit from a quick bounce, and then exit. Perhaps he expects Ullman, who is reversing many of the somewhat radical methods of the Johnson era, to restore sales enough to stave off what many analysts see as the company’s inevitable decline in the face of competition from online retailers.

But it’s still strange to see Soros mimicking Ackman’s position—if only because earlier this spring, a Soros investment fund asked to withdraw several hundred million dollars from Ackman’s Pershing Square Capital Management.