For those who fear that robots are coming for their job, here’s some heartening news: There’s reason to believe that humans still have a leg up on machines in at least one regard.

As it turns out, the fuzzy feelings that unwittingly guide our everyday decisions are a key component to being a successful trader, according to a study published this week in Scientific Reports.

Researchers from the universities of Cambridge and Sussex in England and Australia’s Queensland University of Technology found that the best traders are aware of their bodies’ signals, even if unconsciously, and use them to make more money.

The team of neuroscientists compared the interoceptive sense—an indicator of their self-awareness—of 18 London hedge fund traders working under high pressure with that of students in a control group. All were asked to assess their own heart rates in beats per minute at different points in the day under various conditions. Traders performed significantly better than the control group and were much more aware of their heart rates: The mean score for traders was 78.2, compared to 66.9 for the control group.

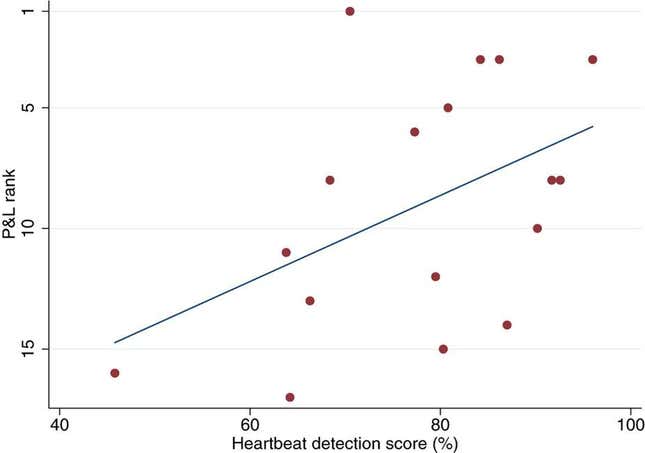

Among those traders, those with the strongest interoceptive sense were also more successful in their jobs. In other words, traders who read their bodies’ messages and acted accordingly, whether or not they were conscious of it, made more profitable trading decisions over the course of a year.

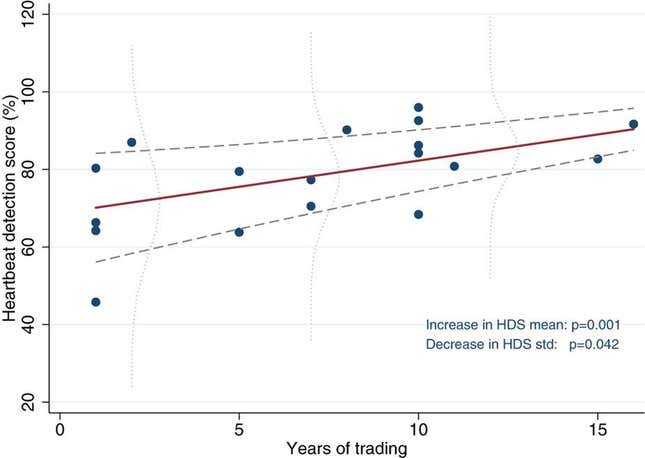

Traders with a strong interoceptive sense also tended to have longer careers in the business. Of course, making more money likely influences one’s decision about whether to stay in a particular line of work, especially in a highly stressful work environment.

Senior author, John Coates, told the Financial Times (paywall) that the findings suggest that the value of human traders shouldn’t be discounted, even as more computer algorithms take hold in finance. “If we focus on conscious mind and model it as a piece of software we will conclude that humans are doomed,” he said. “But if we recognize that body and brain act as a single functioning unit…then we will also recognize how exquisitely we are constructed for rapid pattern recognition. Humans can indeed compete against the machines.”

Coates, who used to run a trading desk on Wall Street, said the importance of gut feelings is something successful traders have long relied on instinctively. “Our findings suggest…they manage to read real and valuable physiological trading signals, even if they are unaware they are doing so.”

Past research has found that our gut instincts are powerfully linked to how our brain functions. Traders who aren’t good at reading their gut might want to check their finger length.