Stress over the this year’s election has reached the level of an unhappy fever dream. An editorial in the Los Angeles Times warned that a Trump victory could prompt a coup. A New York Times bestseller compared Trump’s battle against Clinton to Armageddon. If there is one thing we know about panicky people, it’s that they generally don’t make great choices with their money. Observers such as Bill Maher and Mark Cuban have speculated that a Trump victory could spark a stock market crash. Cut to an image of millions of people stuffing cash into their mattresses.

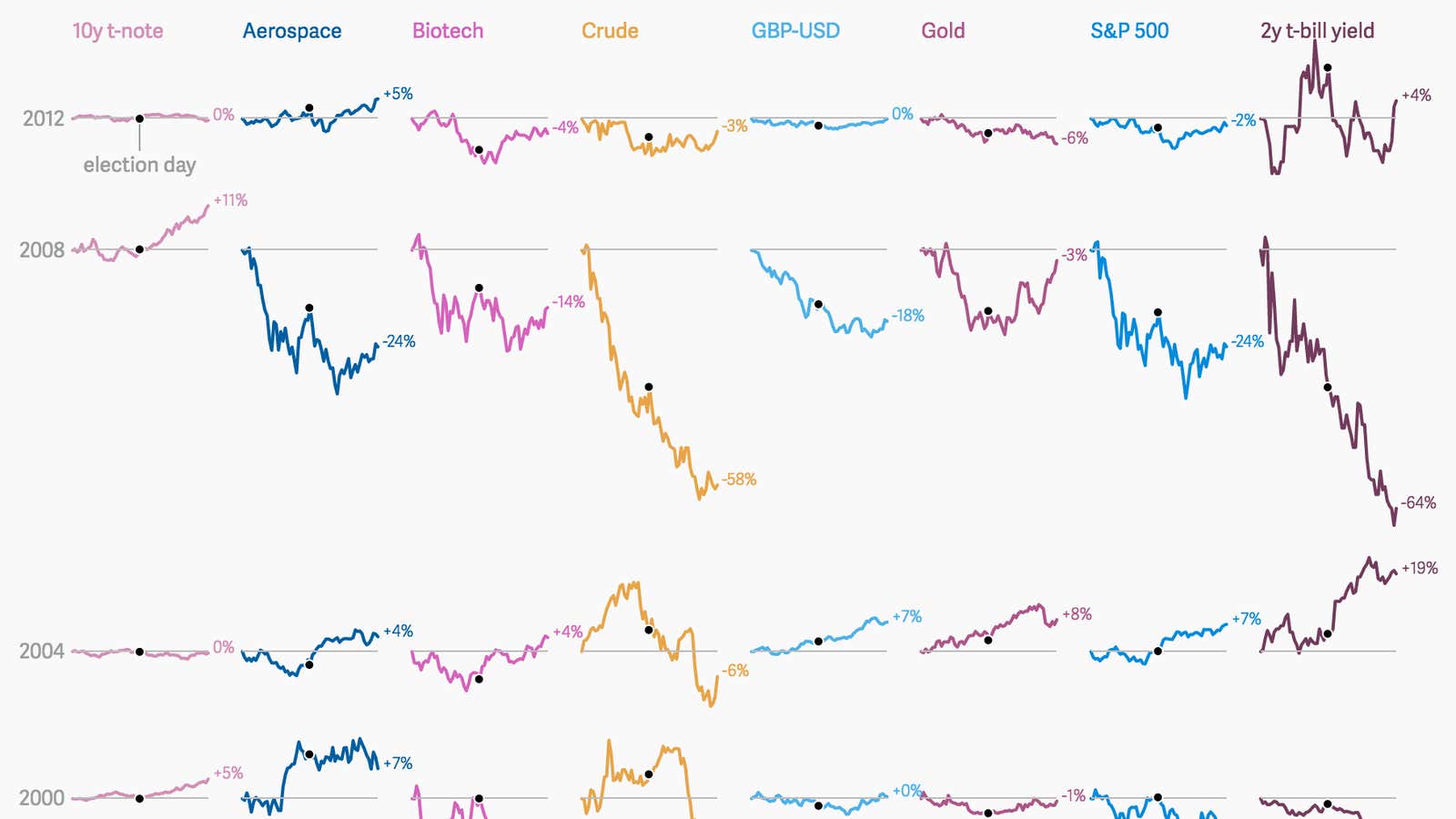

History suggests such a dramatic outcome is unlikely. In fact, there is little evidence that the markets react much at all to elections in the short-term. In the charts below we’ve plotted how major US markets, ranging from treasuries to gold, have been affected by the last six presidential elections.

The results are, for the most part, underwhelming. There is no obvious trend, nor are there are any clear outliers except for 2008, when the election took place in the middle of an ongoing economic meltdown.

It’s human nature to spot trends, especially in things as omnipresent as politics and financial markets. For example, some pundits made a big deal of a sharp market decline after President Obama was re-elected in 2012. However, such affects are usually transient. The market recovered from that downturn within 30 trading days.

Of course, none of these charts say that the election of a new president won’t affect markets at all. Over the long term, policy choices made by a new president will have a major impact on US businesses. Heavily regulated industries are the most likely to be affected. Clinton’s negative statements about drug pricing have already caused tumult in biotech stocks, a sector that is sensitive to changes in federal policy.

It’s crucial to remember that markets are fundamentally unpredictable. Panics and manias happen from time to time. Donald Trump is a new kind of candidate. It is not a cliche to report that anything is possible. However, that doesn’t mean that we should expect financial fireworks on election day. The data show that markets are more resistant than we tend to give them credit for.