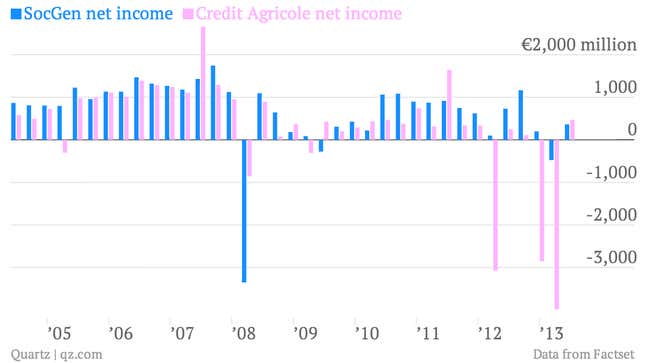

The numbers. Societe Generale: good. Credit Agricole: not so much. Both French megabanks reported positive net income for the first quarter of 2013—definitely a good sign, but not a great one.

Moreover, both showed that they’ll need to raise significant capital to satisfy their year-end goals for Basel III capital. Although those regulations won’t truly be phased in for a few more years, the world’s largest banks are already accumulating capital and beginning to evaluate themselves based on Basel III standards. Credit Agricole, which has raised €5.4 billion since January 1, has a common equity tier 1 capital ratio of 8.5%—sufficient for the transition period, but not by much. Societe Generale plans to hike capital from 8.7% in Q1 to 9.5% at the end of 2013, and it’s going to have to find that money somewhere.

The takeaway. It’s hard to say these banks are truly healthy and insulated from economic shocks, particularly in comparison to their US peers. Both banks are still in the midst of dramatic cost cutting measures, mainly reducing their staffs and selling off businesses. Hefty capital targets mean that this is probably going to continue.

What’s interesting. Deposits in both French banks are booming. Credit Agricole reported an 11.6% year-over-year increase in deposits in its French retail banking group, and an increase of 3.4% in the first quarter alone. Deposits at SocGen rose by 9.2% from the year before, although that number did not appear to increase from the quarter before. Is the deposit influx driven by the perception that French banks are safer than they were a year ago—and perhaps safer than some of their euro area peers?