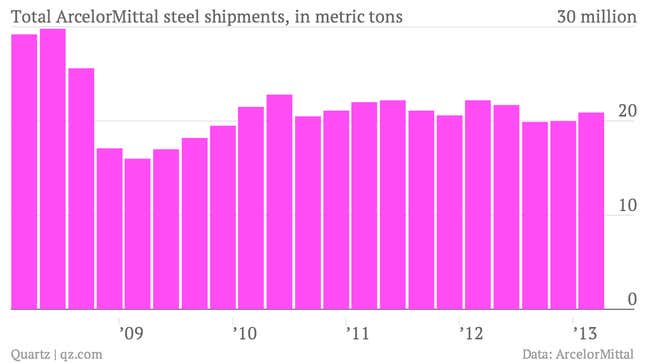

The numbers: Pretty bad. The world’s biggest steel maker lost $345 million during the first quarter of 2013. Last year, it made $92 million in the first quarter. Operating earnings—before the impact of interest, taxes, appreciation and amortization—were $1.57 billion, down 26% from the same period of 2012. Sales slipped 13% to $19.75 billion. The stock rose, however, after company officials said results in the second quarter would be better.

The takeaway: The global economy is still churning out far too much steel relative to demand, which has been hurt by weakness in China and the ongoing crisis in Europe. And it doesn’t look like demand is going to return to pre-financial crisis levels—at least from Asia—any time soon. One of the only bright spots for the steel business globally is the North American car market, which continues to bounce back from the worst of the recession.

What’s interesting: The demand picture for global steel has shifted pretty quickly in the aftermath of the recession. It’s worth remembering that Indian steel magnate Lakshmi Mittal took over Luxembourg’s Arcelor in 2006— in a deal worth more than $30 billion at the time. The new steel giant was born carrying a ton of debt, however. And last year ArcelorMittal saw its debt rating cut to junk by both S&P and Moody’s, prompting a round of asset sales and, more recently, an effort to raise cash by selling stock and bonds. Lucky for Mittal, even junk companies can borrow money at laughably low rates these days.