Starbucks has been working tirelessly to expand its business in China with its promise to open 1,000 stores by the end of this year.

The Chinese consumer loves Starbucks and in return, the chain has broadened its offerings by adding a breakfast menu, serving red bean and black sesame green tea, and investing further in its efforts to produce coffee in China’s Yunnan province.

For its next trick, Starbucks plans on taking over the country’s grocery store shelves. Migrating away from a strictly store-based sales model will allow the company to tap into China’s seemingly bottomless reservoir of customers.

Starbucks is becoming more than an over-the-counter coffeehouse

Revenues from what the company calls consumer packaged goods (CPGs), which include food stuffs, packaged drinks and coffee beans, accounted for nearly 10% of its revenues last year, and that number is only slated to go up from here.

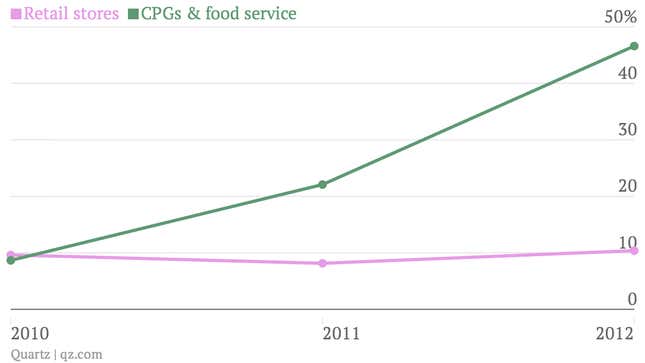

Since 2010, retail store sales growth across all markets has hovered around 10%, but revenue from its CPG business grew nearly 50% in 2012.

And that’s before unleashing its packaged goods on China.

More widely available, and cheaper, too

Since the bulk of Starbucks’s 750+ stores in China are located in the country’s largest cities, hordes of potential consumers currently lie outside of the company’s grasp. Placing its products on grocery shelves throughout the country would immediately change the Starbucks’s customer base and brand influence. Jeff Hansberry, the president of Starbucks in China and Asia-Pacific, told Quartz about the company’s plans for China: ”We are looking at grocery and will explore other channels as well. As we continue to grow our loyal customer base we want to be in the many places those customers expect us to be.”

Selling products like packaged drinks in grocery stores will allow the company to distribute them in bulk and sell them at a discount—a welcome option for consumers that are currently paying exorbitant prices for their in-store drinks.

Localization, localization, localization

Starbucks has invested much of its efforts in localizing products. Aside from seasonal, regional and asian-inspired offerings, the company has also moved to deepen its connection to China in other ways. Last year, the Starbucks opened a farmer support center with the primary goal of promoting coffee-bean farming in China’s Yunnan province. Down the road, it’s not out of the question that Starbucks might fill China’s grocery store shelves with locally grown coffee beans. The company’s investment in the Yunnan region dates back to 2009, when Starbucks introduced four different coffee bean varietals to its farmers.

Starbucks’s willingness to cater to local tastes and sensibilities has paid off in kind. Growth in the China and Asia-Pacific region has consistently outpaced the rest of Starbucks’s business, and China has been the driving force. Loyalty amongst Chinese customers has led to the highest per-store average, 2,000 members per store, of My Starbucks Rewards members, Starbucks’s benefits program, explained Hansberry. ”This is a powerful endorsement of the emotional attachment our Chinese customers have to the Starbucks brand,” he said.

It remains to be seen whether Chinese consumers will be as receptive to Starbucks outside of the retail space. But with plans to expand to grocery stores, Starbucks is addressing its restrictive price-points, geographic limitations, and the upswing in consumer packaged goods.

Bacon-gouda sandwiches and red bean frappuccinos could become shopping-list staples.