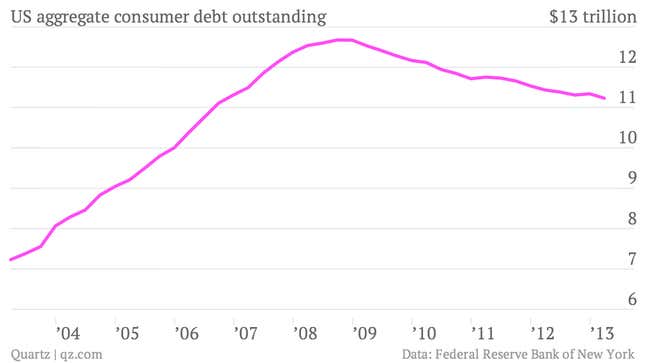

After a somewhat exciting uptick in US consumer borrowing at the end of 2012, Americans returned to their recent habits of shedding debt, according to fresh numbers from the Federal Reserve Bank of New York. That’s something they’ve been doing since the Great Recession hit.

- Overall debt declined, by $110 billion during the first quarter to $11.23 trillion. That’s after the $31 billion uptick in the fourth-quarter of 2012. That rise had people thinking that perhaps the “great de-leveraging” that followed the Great Recession might be dwindling.

- The debt decline was driven by mortgages, where the total outstanding balance of debt declined by $101 billion to $7.93 trillion. That’s the first time the outstanding balance of mortgage debt has been below $8 trillion since mid-2006.

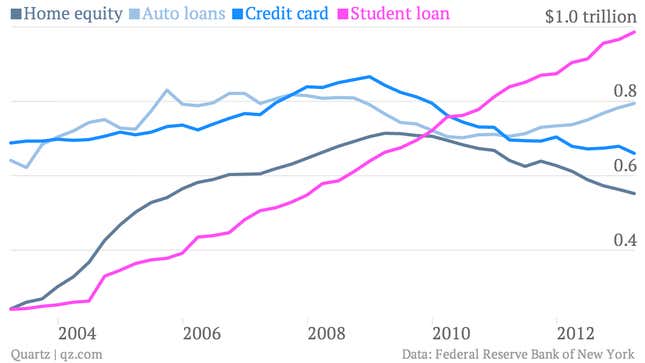

- But the urge to borrow lives on. Americans have been ramping up their borrowing for cars and college. The amount of auto and student debt outstanding rose by $11 billion and $20 billion, respectively, during the first quarter.