The new Trump International Hotel in Washington DC is a ticking time bomb for Donald Trump, and not just because foreign countries seeking to win his favor are already planning events there to line the US president-elect’s pockets.

Steven Schooner and Daniel Gordon, lawyers specializing in federal procurement rules, write in Government Executive that Trump’s inauguration will immediately place him in violation of the law because the hotel is in the Old Post Office Pavilion, a building just blocks from the White House that was leased to a Trump-led consortium by the federal government.

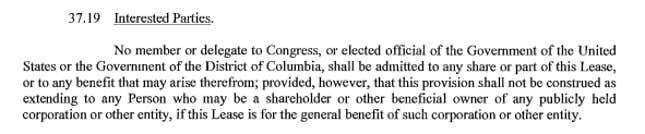

The lease, signed by Trump’s organization in 2013, includes a clause that says “no … elected official of the Government of the United States … shall be admitted to any share or part of this Lease, or to any benefit that may arise therefrom.”

The lease is managed by the government’s General Services Administration, and sure enough, the president is in charge of appointing the head of that agency. In other words, Trump will in effect become his own landlord, giving rise to immediate questions about whether the government’s handling of the $180 million lease is for the benefit of the public or the president.

Even if the business is passed on to Trump’s children, as the president-elect has occasionally suggested he might do, the conflicts would remain. Schooner and Gordon explain:

The Old Post Office lease is a particularly complicated and, for GSA, rather unusual, 60-year agreement that requires significant annual disclosure of detailed financial information. These extensive disclosures are followed by negotiations over escalation of the rent and any other payments that the Trump Organization must pay to the government. Just imagine GSA pressing the Trump organization for more detailed revenue and expense information, or the President’s children negotiating annual rent adjustments with a career civil servant who reports to the GSA administrator appointed by their father, who serves at his pleasure. Any reasonable person would worry about the undue pressures and the inherent risk of favoritism that the government might show to such a well-connected contractor.

Schooner and Gordon argue that Trump would be in breach of the contract, and that the GSA must take steps to terminate the contract if Trump will not divest himself and his family from the project. If there is no way to reach a negotiated outcome, they say that the GSA will need to terminate the lease and can expect to defend its decision in court from the typically litigious Trump.

A GSA spokesperson would not answer questions about the status of the contract now that Trump has been elected president, but says that the administration ”plans to coordinate with the president-elect’s team to address any issues that may be related to the Old Post Office building.”

On Nov. 29, a Trump transition spokesman told reporters he had no immediate information about how Trump would handle the GSA contract. More broadly, it’s not clear how Trump will deal with his business interests and the conflicts they will present to him as president. Already, concerns have been raised about whether Trump will violate the constitutional prohibition on the president receiving payments from foreign governments. Trump’s transition team said last week that they are examining ways to dispel such concerns, but have yet to reveal how.

Trump has suggested in the past that he would put his business into a so-called blind trust to be managed by his adult children. Yet his children have remained involved in the transition process, influencing decisions about personnel and policy that could benefit the business down the line. In any case, simply shifting the Trump Organization to different hands will not prevent the appearance of conflicts of interest, since Trump will clearly know what he owns, and who he owes. The best way to avoid conflicts, ethics experts say, is for him to liquidate his investments entirely.