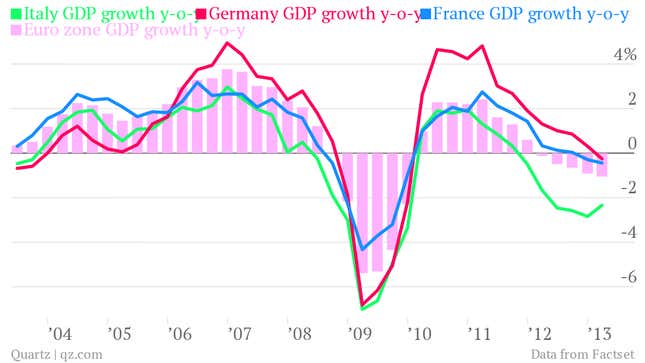

Euro zone economic growth in the the first quarter of 2013 fell 1.0% from the same period a year earlier, down from a 0.9% contraction in the fourth quarter of 2012—a sign that the monetary union’s recession is picking up speed.

Worse, cracks are forming in the euro area’s two largest economies. In what analysts expected to be a stronger quarter, Germany only narrowly eked out GDP growth on a quarterly basis, meaning that its economy increased 0.1% in the first quarter, compared with Q4 2012. But by year-on-year measures, its economy shrank 0.2%. Meanwhile, France’s GDP fell by 0.4% compared with the same quarter a year ago. Italy, the euro zone’s third-largest economy, managed to staunch the hemorrhaging somewhat, as its GDP contracted by only 2.3% year-on-year, compared with the 2.8% decline in the last quarter of 2012.

While euro zone officials say that the regional economy should recover in the second half of 2013, today’s data offer no signs of an imminent recovery. A slight silver lining is the evidence suggesting that, in its sixth year of recession, Greece might have stopped the bleeding; yesterday, Fitch upgraded the country’s credit rating to a still-fragile B-. But with growth in the euro zone’s largest three economies looking grim, it’s no surprise that most Wall Street economists predict that recession will last at least through 2013.