The end of the year is here. For many of us, it’s a time synonymous with holidays, cozy weather, anticipation and celebration. For others, it’s a time to think through how their income, deductions, contributions and investments are adding up. It’s time to think about taxes.

There’s one thing that we can all agree on: No one loves paying taxes. At best, we appreciate the abstract benefits we get by paying them. But we all have ideas about where that money would be better spent. And we’d all love to pay less.

Still, taxes aren’t all the same. When it comes to investing, being liable for some types of taxes is better than being on the hook for others.

“Good” taxes are those that confer a cash return on the investor. For instance, when you sell your fund shares at a profit, or earn income from your investments, you’ll need to pay taxes on your gains.

But there are also “bad” taxes, with no cash benefit to shareholders. These are incurred when the manager of a fund sells a security within the portfolio at a profit. For example, if a manager buys shares of a stock for a portfolio and later sells them at a higher price than originally paid, the difference must be distributed to shareholders as a capital gain. And, as a shareholder, you’ll owe taxes on that distribution, even if the fund itself has an overall loss.

“The whole idea is to keep as much money working in your portfolio as possible,” says Martin Small, head of U.S. iShares. “ETFs help do this by reducing ‘phantom’ taxes from balance sheet distributions, letting investors focus on taxes that come from beneficial sources such as dividends and preferred stocks.”

We know that ETFs are attractive because they’re accessible, flexible, and allow investors to easily tap diverse markets. But here’s another reason: ETFs tend to trigger fewer capital gains distributions, making them inherently tax-efficient. In other words, ETFs can help you to minimize the bad taxes, while letting you take advantage of the good, from potential earnings generated by the fund.

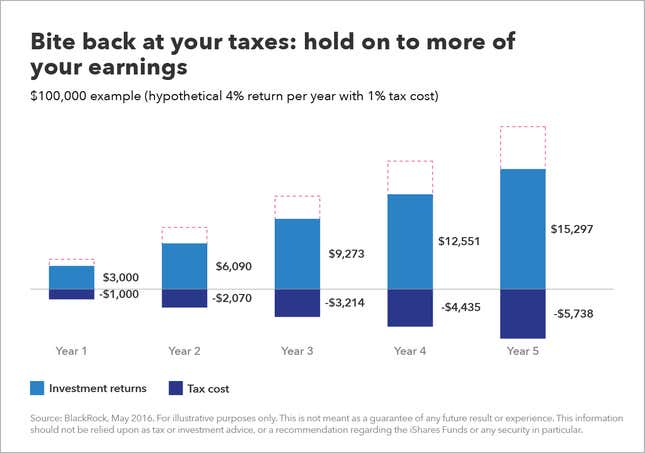

Over the long term, those savings add up and help you keep more of what your investments earn. In the example below, the combined effect of capital gains and dividend taxes take an increasingly big bite over time, which could cost a shareholder more than $5,000 by Year 5.

ETFs also tend to be more tax-efficient than actively managed mutual funds. Here’s why: Since active funds aim to beat a market index, they usually engage in a lot more buying and selling than ETFs, which are designed to track an index; as a result they will trigger more capital gains distributions and higher taxes. And unlike ETFs, which are traded directly between investors on an exchange, individual stakes in a mutual fund are tied to other investors. When your peers redeem their holdings, you might unexpectedly end up footing the tax bill too.

Are all ETFs equally effective at reducing investor tax exposure? As you can see in the numbers above, over the last 5 years, 50% of mutual funds paid out a capital gain distribution, versus 9% of non-iShares ETFs. That’s a notable distinction. But by comparison, just 3% of iShares ETFs made capital gains payouts.

At year’s end, there may be nothing better than relaxing by a warm fire. Unless it’s paying less in taxes. To learn more about using ETFs to help build a tax-efficient portfolio, answer these 5 quick questions.

This article was produced on behalf of iShares by Quartz creative services and not by the Quartz editorial staff.

Visit www.iShares.com or www.BlackRock.com to view a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing.

For more information on the differences between ETFs and mutual funds, click here.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations.

Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Certain traditional mutual funds can also be tax efficient.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2016 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners. iS-19774-1216