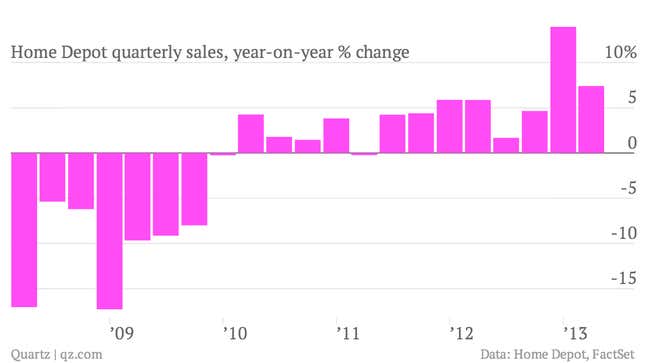

The numbers: Good. Sales rose 7.4%. Profits jumped 18%. Sales at stores open for a year increased 4.3% overall. In the US they were up 4.8%. The stock rose.

The takeaway: US housing continues to recover, buoying a range of companies with ties to residential real estate. For proof, look no further than the stock market. Even before this morning’s results, Home Depot shares were up 25% this year alone. Shares of rival home improvement retailer Lowe’s were up 20%. Appliance maker Whirlpool Corp. shares were up nearly 30%. For more proof, just listen to Home Depot chief Frank Blake’s canned quote from the company’s release: “We continue to see benefit from a recovering housing market that drove a stronger-than-expected start to the year for our business.”

What’s interesting: For the cleanest read on business tied to US housing, watch Home Depot’s sales to professional contractors, which are even more sensitive to housing’s recovery than those of consumers. In the post-earnings call with analysts today, Home Depot executives noted that sales to professional customers actually outpaced sales to consumers in the first quarter for the first time since the financial crisis hit. What’s more, sales to smaller contractors contributed more to earnings than Home Depot has seen since the crisis. Both indicate that the economic improvement of housing-related sectors is broad-based and not limited to the largest contractors. Very good news.