From the look of the financial markets, you’d think Ben Bernanke just told Congress he was washing his hands of the feeble US economy and letting markets fend for themselves.

But of course he didn’t.

Fedspeak is often a question of style more than content. Bernanke clearly stated that cutting off Fed support for markets too early would be damaging. But traders are fixating on another comment Bernanke made in response to a question in today’s congressional hearings. He said that the amount of bonds the Fed buys “could” begin to taper in the “next few meetings” if the economic conditions were right. Just released minutes of the last Fed meeting also contained this interesting tidbit: “A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome.” That’s essentially the same message.

And it stoked jitters in the markets about the strength of Fed support for the economy.

Stocks—which jumped on the official release of the Fed’s minutes—have staged a pretty sharp turnaround. The stock market is only down 0.5% at last glance, but after the run up in stocks so far this year on the back of the Fed’s super-easy policy—a roughly 17% rise—investors are trying to play it cool.

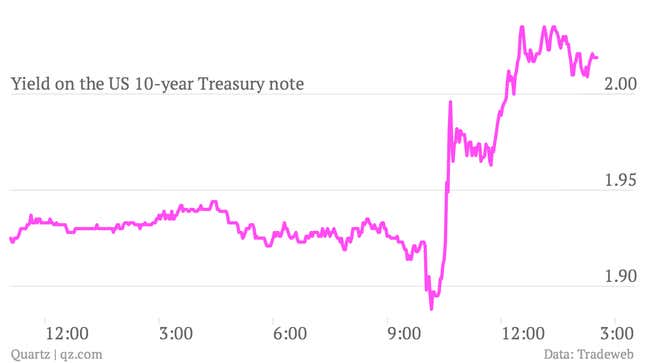

Also, prices of US government bonds, which the Fed buys as part of its economic support efforts, tumbled Tuesday pushing yields—which move in the opposite direction—sharply higher. In fact, the yield on the 10-year Treasury note is now above 2%, territory it hasn’t occupied since March. Of course, this is still quite low by historical standards, but it still suggests concern about a looming end to the Fed’s bottomless bond-buying power.

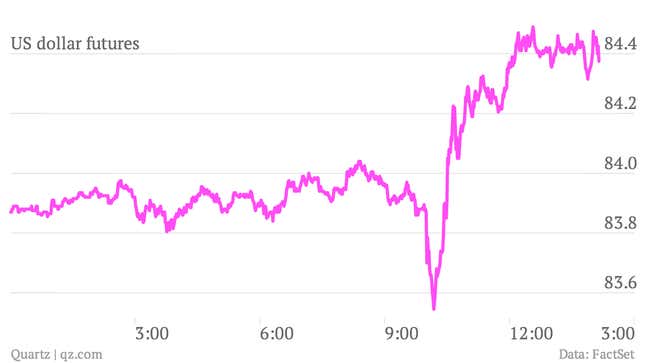

The dollar strengthened, a sign that investors are questioning the impact of less money printing. Meanwhile, the flight from both stocks and bonds represents investors moving to cash.

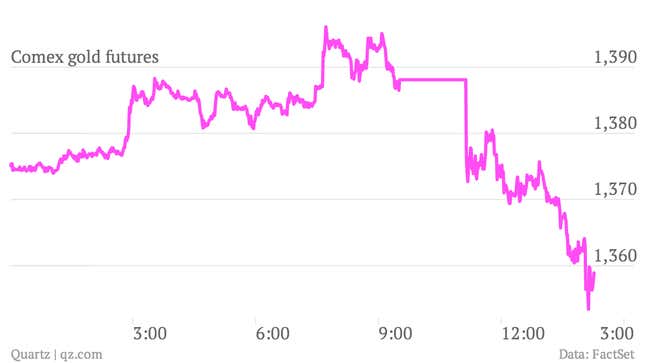

And gold, often seen as a hedge against a weakening dollar, continued its recent fall, which makes sense—again—if the Fed is going to be creating less money. Here’s a look at gold futures trading overnight and into this morning.

Of course, the market has been wrong about the Fed before. But if indeed Fed money printing is behind the recent run-up in stocks, and the Fed is about to take a breather on that policy, pulling some cash out of the game might be a good investing move.