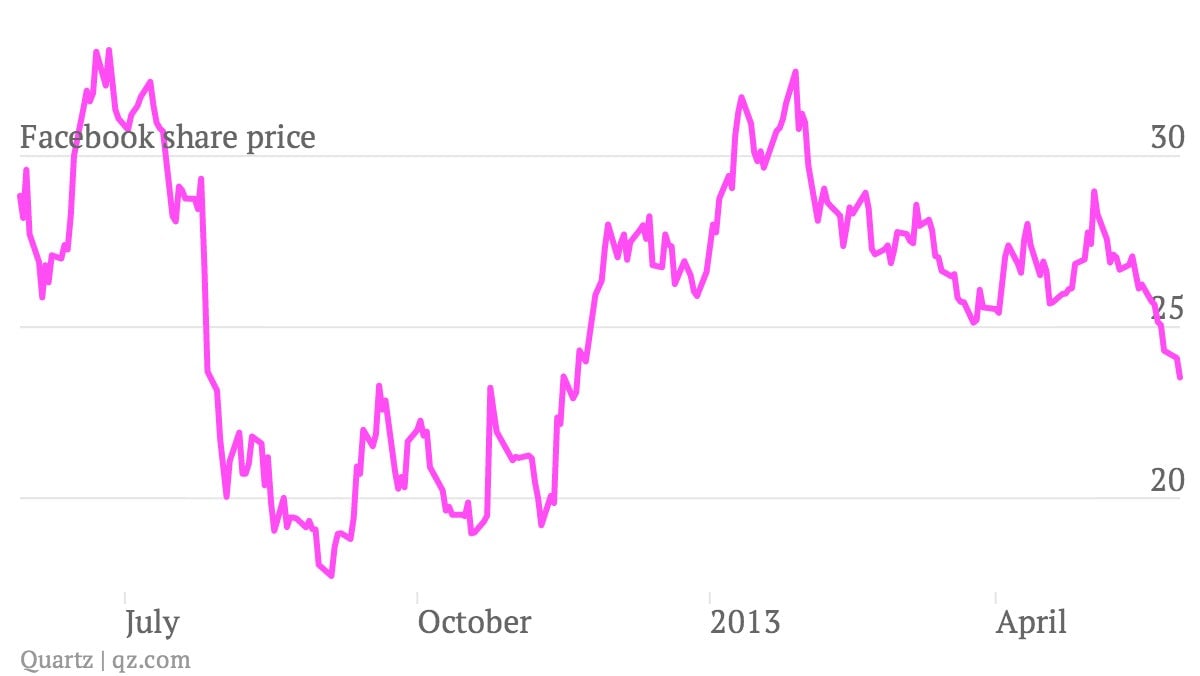

Facebook’s stock is dropping because Mark Zuckerberg doesn’t sound enough like Jeff Bezos

Facebook’s stock price is at a six month low, and it’s all Mark Zuckerberg’s fault—just not in the way you think. Let’s start with the usual sell signals: missed targets, bad management, dodgy acquisitions. For Facebook, none of those apply. And as for Facebook’s last quarter, the company managed to hugely expand both its user base and revenue, and especially its all-important revenue from mobile.

Facebook’s stock price is at a six month low, and it’s all Mark Zuckerberg’s fault—just not in the way you think. Let’s start with the usual sell signals: missed targets, bad management, dodgy acquisitions. For Facebook, none of those apply. And as for Facebook’s last quarter, the company managed to hugely expand both its user base and revenue, and especially its all-important revenue from mobile.

So why, when Yahoo and AOL are both up over the past six months, and the entire tech sector is seeing a comeback, is Facebook in a slump?

Messaging.

Let me explain: After writing a pretty dour take on Facebook’s last quarter, I took a second look at Facebook, and realized that the company is basically in growth-at-all-costs mode. Any dispassionate analysis of the company’s push into emerging markets bears this out. Facebook has been cunning about grabbing its next billion users—doing things like giving away free mobile internet access—that competitors like Google are only just catching up to.

Facebook’s meager profitability (the company has posted slim to negative profits over the past 6 quarters) can be explained by the company’s huge investment in engineers, which for a company like Facebook is almost a form of capital expenditure, even though it doesn’t show up on the balance sheet as such. Companies like Intel can spend billions creating factories to churn out their product and we call it innovation, but if a company like Facebook spends similar amounts on the humans who churn out code, conventional accounting makes it look like a liability and a drag on the bottom line.

Facebook should be compared to Amazon, not Google

Rather than comparing Facebook to peers like Google and Apple, a more appropriate way to evaluate Facebook is to treat it as if it were Amazon. Investors absolutely do not care that Amazon does not make money—the stock is currently trading at an eye-popping price to earnings ratio of 3,400—because they believe that in the long run Jeff Bezos is going to simply take over most of retail, at which point he can conjure profit at will.

So why don’t investors view Facebook as a long game like Amazon? Perhaps it’s the failure of MySpace and Friendster before it, the feeling that any given social network is just one disruptive startup away from becoming yesterday’s news.

But having followed the company for a while, I think the biggest factors in Facebook’s problematic image are the signals being sent by its leaders. Ever since its IPO, Facebook has been talking too much about money, and too little about long-term vision. For example, on an earnings call two quarters ago, in comments about Facebook’s new advertising program, Facebook Exchange, Zuckerberg talked only in terms of revenue growth: revenue is up, percentage of revenue from mobile is up, projections for future revenue growth are rosy. But the question of why Facebook doesn’t actually make a profit was never addressed.

That was a mistake, especially because advertising geeks were already hailing Facebook Exchange as game changing. Zuckerberg continues to imply that money (whether it’s profit or revenue) is something the company will naturally come into as its advertising efforts ramp up. Instead he should be explicitly repeating the Jeff Bezos mantra: his is a company “willing to be misunderstood for long periods of time.”

Perhaps Zuckerberg’s reluctance to follow Bezos in this way is an over-correction for Facebook’s over-hyped IPO. But at this point, the company needs to move past that event.

Facebook’s growth remains phenomenal

Take Facebook on the merits: There are more people using Facebook on a regular basis than any other site except Google. But unlike Google, which is losing market share in places like China, Facebook is continuing to rope in new users, despite the fact that it’s illegal in that country. In the US, 94% of teenagers are on Facebook. Reports about users deserting the site appear to have been based on bad metrics. The truth is, we couldn’t quit Facebook if we wanted to.

Facebook has network effects on its side. It’s the place where everyone is, and the site is more than adequate for the basic tasks of keeping up with friends, family and colleagues. The more people Facebook adds, the more indispensable it becomes, no matter what kind of advertising starts showing up there.

Does that mean that Facebook is going to start throwing off profit the way more mature and less growth-focused companies like Yahoo and AOL would? Of course not. But here’s the core bet a Facebook investor makes: a company that is on its way to 2 billion users will eventually figure out how to leverage them to make money. There’s always the possibility that non-search online advertising won’t expand dramatically over the next decade, that it won’t eat up larger and larger portions of ad budgets currently targeted at, for example, television. But if it does? No one will benefit more than Facebook.